Best European P2P Lending Platforms in 2026

A comprehensive guide to the top peer-to-peer lending platforms in Europe with detailed reviews and recommendations

Quick Comparison

| Platform | Return | Rating | Min. | Best For |

|---|---|---|---|---|

1Hive5 | 13-14.5% | 5 | €10 | Yields up to 14.5% - highest on the market |

2Lonvest | 12.5% | 4.5 | €10 | Controls own loan originators |

3Mintos | ~12% | 5 | €10 | Largest P2P platform in Europe |

4PeerBerry | 11.57% | 4.5 | €10 | 11.57% average return |

5Viainvest | ~11.8% | 4.5 | €10 | Investment brokerage firm (IBF) license |

6Debitum | ~10% | 4 | €100 | Specializes in commercial loans only |

7Income Marketplace | ~12% | 4.5 | €10 | Buyback guarantee on ALL loans |

8Profitus | Variable | 4 | €100 | Property-backed loans only |

9LANDE | Up to 14% | 4.5 | €50 | Focus on European agricultural sector |

10Swaper | 14% | 4.5 | €10 | Fixed 14% interest rate on all loans |

11Robocash | Up to 13% | 4 | €10 | Part of Robocash Group since 2013 |

Objective Criteria

Expected yield, buyback guarantee availability, auto-invest function, and investment license status

Real Performance

Actual yield compared to advertised returns using TrackInvest software to analyze real transaction data

Personal Experience

Direct investment experience on each platform, testing features, customer support, and overall reliability

Hive5

Highest yields on the market with full transparency and excellent TrustPilot score (4.7)

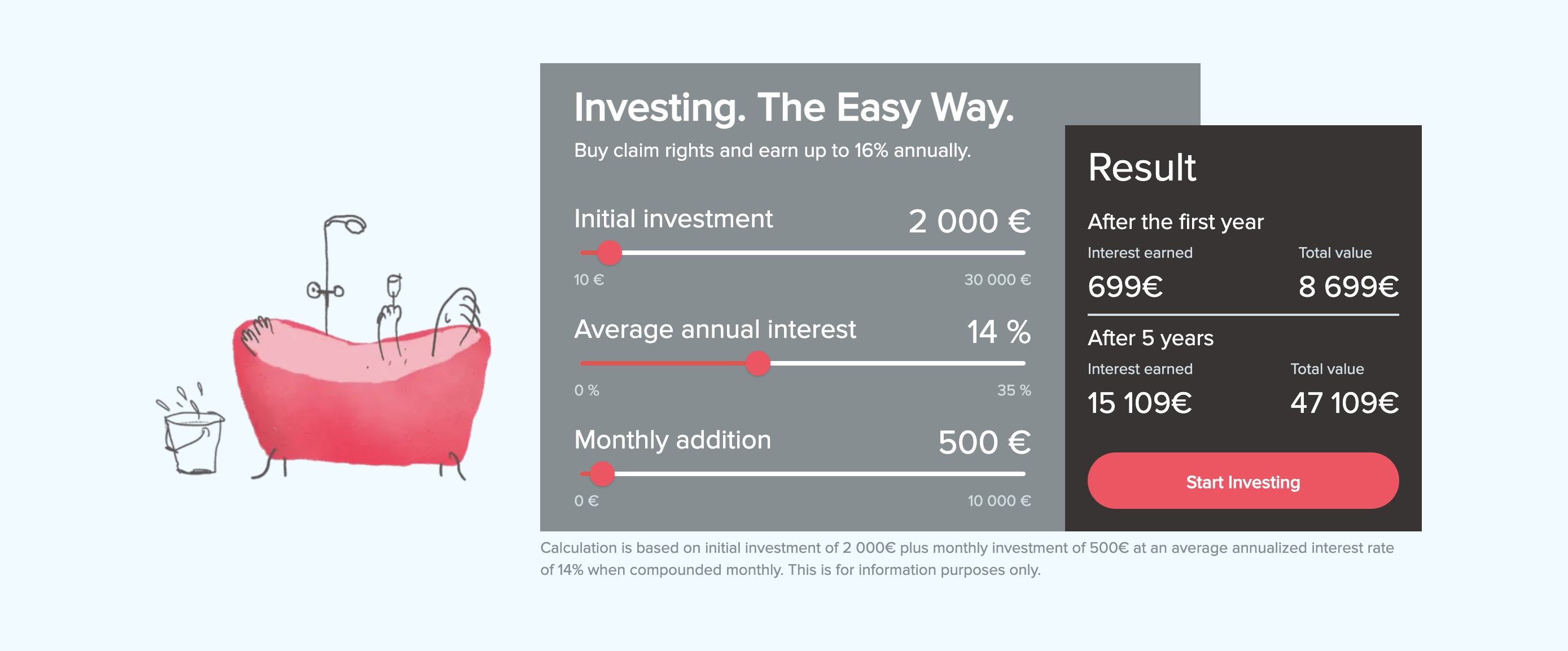

I wanted to start this article with hive5 - which is a relatively recent platform in the field, but has several advantages that makes it my favourite platform at the moment. They have excellent yields (above 13%, and up to 14.5% at the moment) which are the highest on the market, and put their focus on having full transparency on the platform.

The platform is also run by a team of highly-experience professionals, and I am regularly talking with them about the platform & how they can do better, which I really appreciate. They also have one the best TrustPilot score I've seen for such platforms (4.7 at the time of writing this article), meaning investors are really happy with the platform.

Lonvest

Controls its own loan originators for enhanced transparency and stability

Lonvest, a peer-to-peer lending platform launched in 2023 and based in Croatia, offers investors a promising opportunity to diversify their portfolios. The platform stands out by controlling its loan originators, ensuring enhanced transparency and stability.

Largest P2P lending platform in Europe with regulated status and Notes structure

The third platform that I wanted to mention in this article is Mintos. Mintos is currently the largest Peer-to-Peer lending platform in Europe, and offer a huge amount of loans to invest in. This makes it a really interesting platform to invest in, as it gives you exposure to several countries and several kinds of loans in each country. That's instant diversification on a single platform. The platform also offers solid returns to investors, around 12%.

PeerBerry

Solid platform with buyback guarantee and excellent customer support

I also wanted to mention PeerBerry, which is a solid Peer-to-Peer lending platform in which I started to invest in back in 2018. They also offer everything you need from a good Peer-to-Peer lending platform: buyback guarantee on most loans, a great diversity of loan originators & loan types, and an auto-invest function that is really easy to setup.

Viainvest

IBF licensed platform with buyback guarantee and excellent interface

The third platform I will mention here is Viainvest. As for other platforms in this review, Viainvest proposes a buyback guarantee on most of the loans present on the platform, which is something very nice to have as an investor. Their auto-invest function also works great, and is very easy to setup. Viainvest also has a very clear and easy to use interface, and excellent customer support that solved some issue that I had in a matter of minutes.

Specializes in commercial loans grouped into ABS for more stability

I also wanted to mention in this article the platform Debitum. Debitum is a more recent platform but which has all the qualities of the platforms present in this article - such as buyback guarantee on loans, as well as an auto-invest function. The platform also recently got an investment license, which is also a very good thing.

Buyback guarantee on all loans with complete transparency on loan originators

I could not write this article without including Income Marketplace in it. This is a relatively recent platform, having been created in early 2021. I have a bit of a special story to tell with this platform - as I had a few video calls with their team before they even launched, to discuss what would be great to have in the platform from an investors point of view.

Property-backed loans secured by first rank mortgage

Profitus is a different type of platform that the one I mentioned so far in this article, as they are offering loans that are backed by property. They basically list projects from investors that are looking for financing, and match those with investors that want to generate interests over time.

LANDE

Agricultural sector focus with very low LTV ratios (as low as 25%)

LANDE is another platform that is really different from all the platforms I have mentioned so far. Indeed, they are a platform focused on investing the European agricultural sector. This means that all projects present on the platform are backed by assets related to the agricultural field, like grain or real estate for example.

Swaper

Fixed 14% interest rate on all loans with easy investing strategy

Swaper is a platform that was funded back in 2019, and quickly established itself as one of the main player in the field of Peer-to-Peer lending in Europe. They really put their focus on making it easy for investors to generate interests on their platform.

Part of established Robocash Group operating since 2013

Like some other platforms of this article, Robocash is also a platform that is operating within a larger financial group, called the Robocash Group that has been operating since 2013. This means an additional layer of safety for investors on this platform, as the company is backed by a group with a good track record, compared to platforms that are more recent and just on their own.

My Recommendations

Best Overall Platform

Highest yields (13-14.5%), full transparency, excellent TrustPilot score, and strong auto-invest function. Perfect for both beginners and experienced investors.

Hive5 →Best for Diversification

Largest P2P platform in Europe with regulated status, Notes structure for stability, and exposure to multiple countries and loan types.

Mintos →Best for Beginners

Fixed 14% interest rate on all loans and easy investing strategy makes it simple to start generating returns immediately.

Swaper →