Best European Real Estate Crowdfunding Platforms in Europe in 2026

My favorite real estate crowdfunding platforms for building a passive real estate portfolio

Quick Comparison

| Platform | Return | Rating | Min. | Best For |

|---|---|---|---|---|

1EstateGuru | 10-12% | 4.8 | €50 | Monthly repayments on loans |

2Reinvest24 | 7% + capital growth | 4.6 | €100 | Equity ownership in properties |

3Kirsan Invest | 11-15% | 4.7 | €100 | All projects done in-house |

4Crowdpear | 11% | 4.5 | €50 | Fully regulated platform |

5Indemo | 10-15% | 4.4 | €100 | Focus on Spanish real estate |

Objective Criteria

Advertised yield, track record of projects, automatic investment function availability, and investment license status

Personal Experience

Direct investment experience on each platform with real money to test performance and reliability

Real vs. Advertised Returns

Using TrackInvest software to compare actual yields against platform-advertised returns for transparency

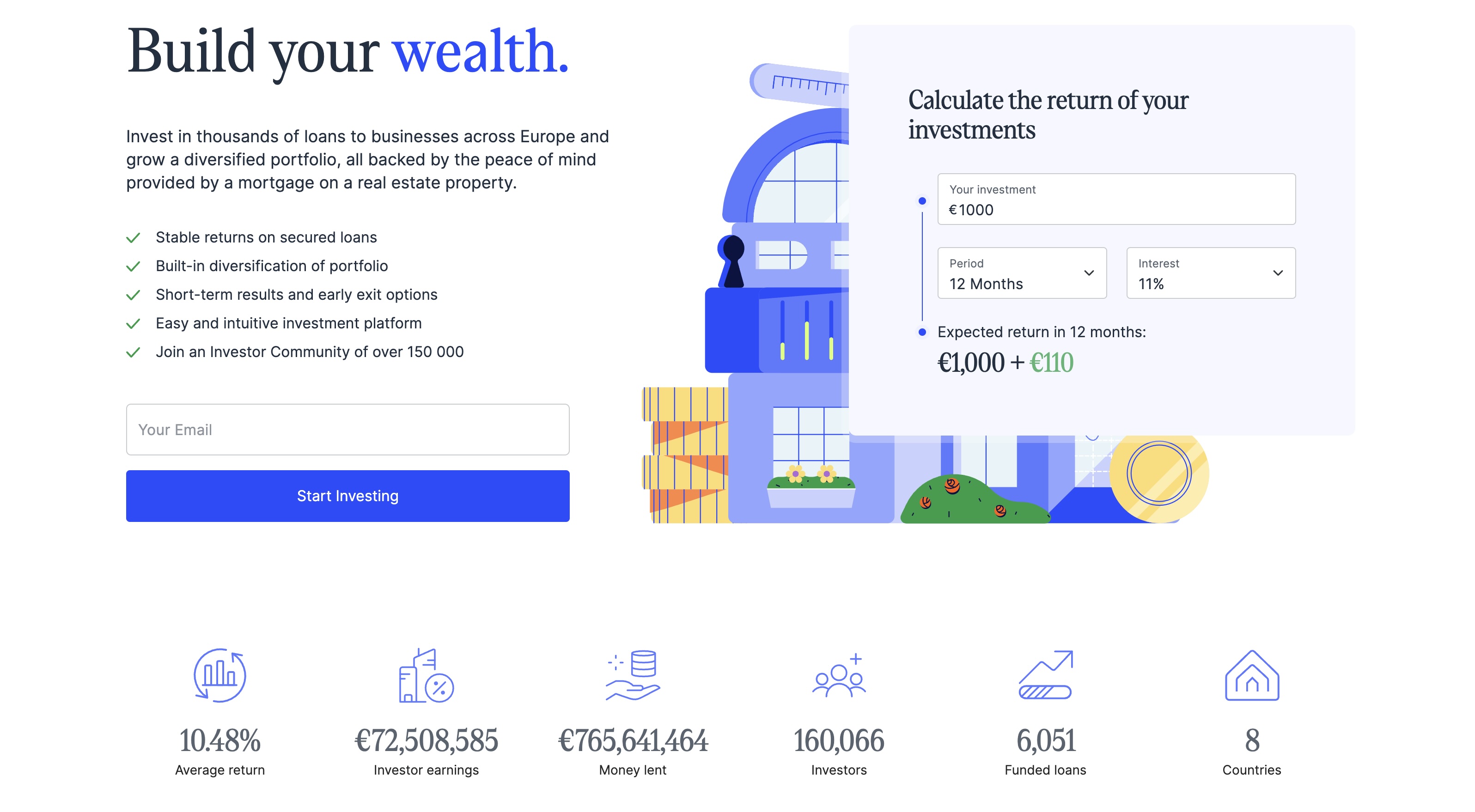

EstateGuru

Monthly repayments on development loans with easy diversification

The first platform I wanted to mention here is EstateGuru, which is a platform based in Estonia. It also mainly proposes to invest in real estate development loans, meaning you get a fixed-rate at the start (usually around 10 - 12%).

What I really like about this platform is that they usually offer monthly repayments on the loans they offer, meaning that you will actually get passive income coming in every month when you invest in those development loans. On EstateGuru, the minimum investment in each real estate project is also lower than other similar platforms, at 50 Euros per project. This means that you can actually easily diversify your investments on the platform.

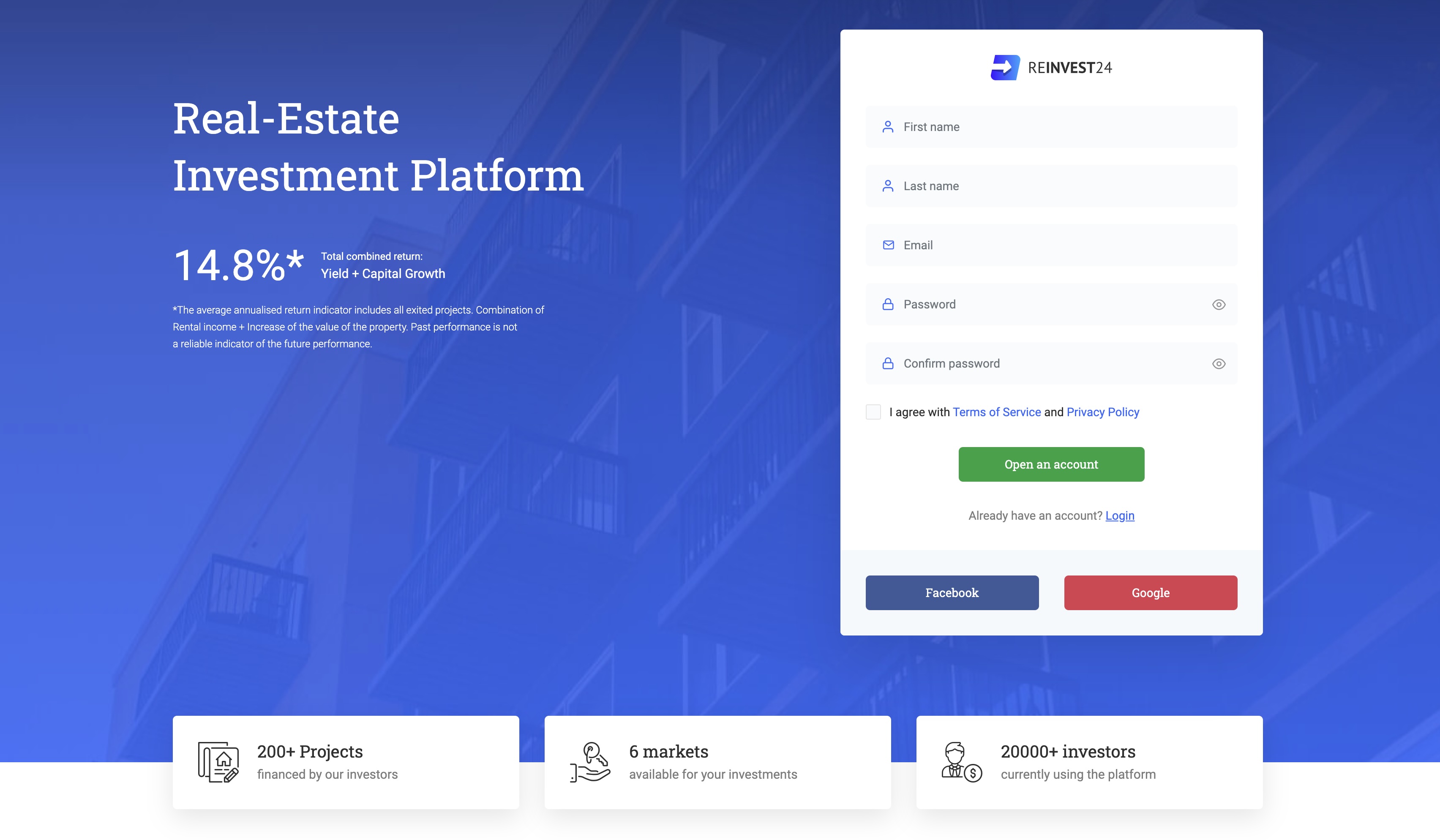

Reinvest24

Equity real estate crowdfunding with monthly rental income

The second platform that I wanted to mention in this article is Reinvest24. Based in Estonia, this platform allows investors to invest in equity real estate crowdfunding. This means that you will actually become the owner of a share of the properties you invest in and receive a monthly rent just like you would if you invested in 'classical' real estate. Plus a possible capital growth gain once the property is sold. This is really a form of real estate crowdfunding that I really like, as you get passive income coming in every month.

All projects in-house by Kirsan Group with 5000+ apartments built

A platform that I really wanted to mention here is Kirsan Invest. What is unique with this platform compared to others in the field is that they do all the projects in-house - as they are a part of the Kirsan Group, which is a large investment group that has been active in Europe since 2010.

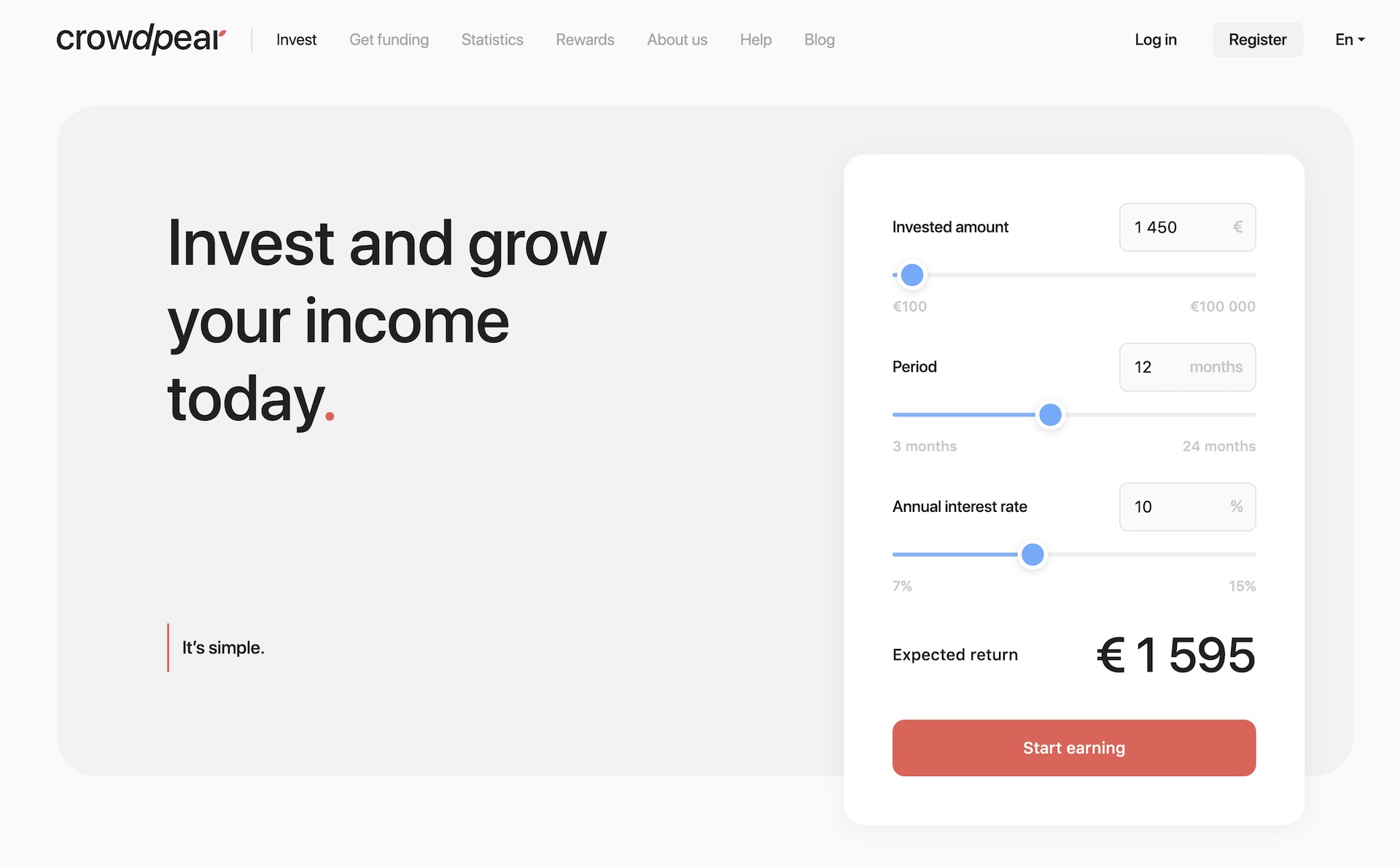

Crowdpear

Backed by PeerBerry with secondary market for quick portfolio building

One platform that I really like as well is Crowdpear. Similarly to EstateGuru that I already mentioned earlier in this article, Crowdpear allows you to invest in development projects.

Indemo

Unique discounted debt investments in Spanish real estate

I also wanted to mention in this article Indemo - an innovative platform that offers to invest in real estate in Spain.

My Recommendations

Best for Beginners

Start with EstateGuru as it's the largest platform and easiest to use with low minimum investment

EstateGuru →Best for Passive Income

Choose Reinvest24 if you want monthly rental income from equity real estate investments

Reinvest24 →Best for Safety

Kirsan Invest offers the most security with in-house projects and proven track record

Kirsan Invest →