Debitum Review 2026: a Safe & Licensed Platform with Good Returns

A comprehensive review of the Debitum P2P lending platform, covering returns, safety features, and my personal investment experience since 2018

Quick Verdict

Debitum is a solid, licensed P2P lending platform that stands out by focusing exclusively on business loans, offering more stability than consumer loan platforms. With returns around 9-10%, a 90-day buyback guarantee, and strong regulatory compliance, it's a reliable choice for passive income investors seeking safety over maximum yields.

Try DebitumWhat is Debitum?

As for all Peer-to-Peer lending platforms, Debitum is a financial platform that matches borrowers with investors, that will lend money on the platform in exchange of interests on loans. The Debitum platform launched in 2018, and they are based in Vilnius, Lithuania.

They currently have over 13,000 investors registered on the platform, and they already funded over 64M Euros worth of loans.

The platform really puts their focus on making it really easy for investors to generate passive income on their platform, while keeping their investments safe & secure, which is what we are going to check in this review.

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on Debitum are slightly lower than on some other platforms, with an average yield currently at 9.65%.

However, you can definitely get higher yields on the platforms, as I am currently around 10% on my own portfolio, which is in line with other Peer-to-Peer lending platforms in the field.

Most of the ABS (Asset Backed Securities) I saw when investing have yields in the 9 - 9.5% range, which is in line with what is announced by the platform. The slightly lower returns compared to consumer loan platforms are offset by the increased safety of business loans and lower default rates.

Asset Backed Securities (ABS)

One of Debitum's unique features is the ability to invest in ABS, which are pools of commercial loans grouped into single assets.

Instant Diversification

Each ABS contains multiple commercial loans, giving you automatic diversification with a single investment

Stable Returns

Pooled loans provide more stability in returns compared to individual loan investments

Easy Selection

Transparent credit scoring system makes it easy to select investments matching your risk/return preferences

ABS investments offer a more stable and diversified approach compared to traditional single-loan investments on other P2P platforms.

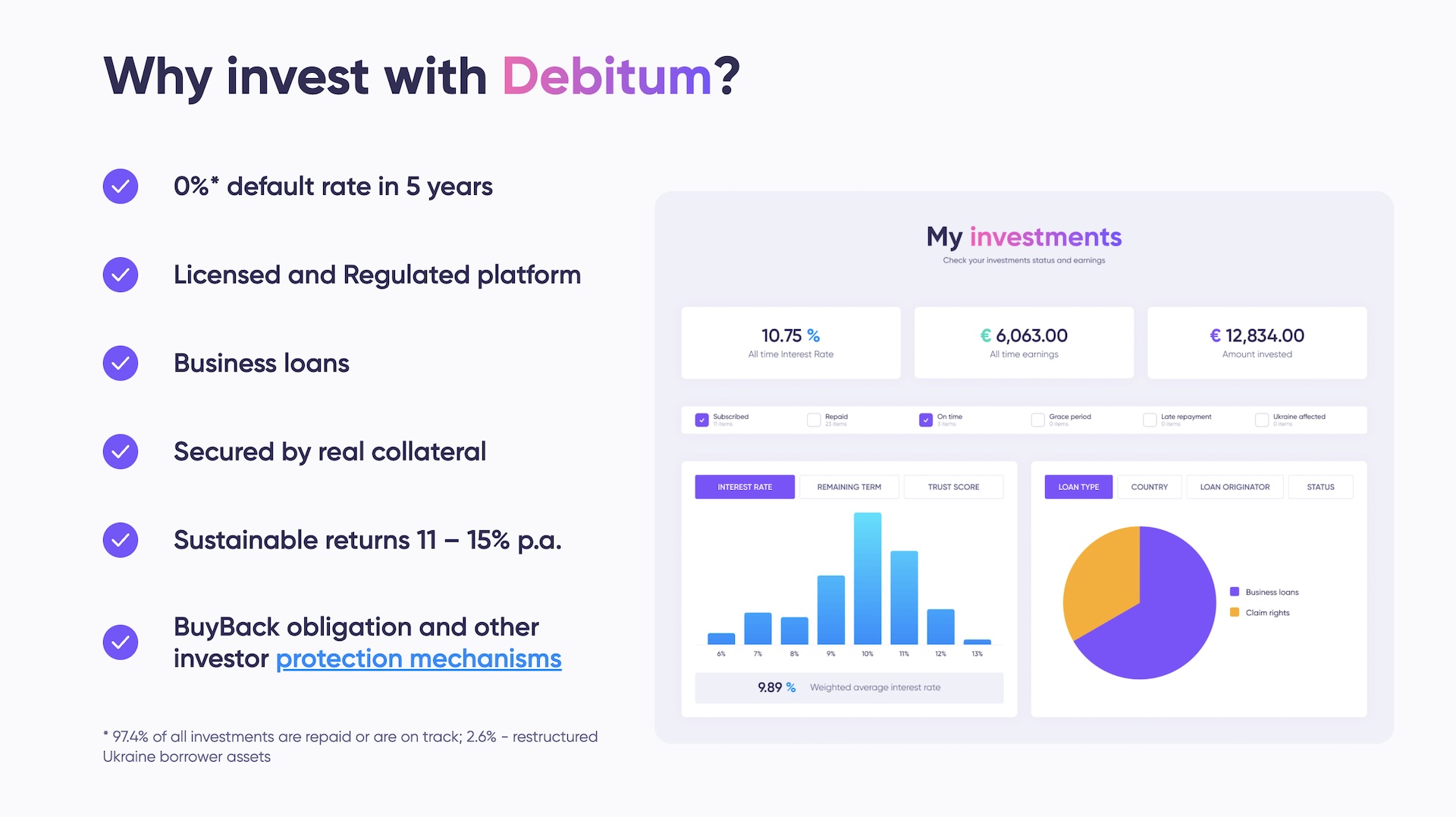

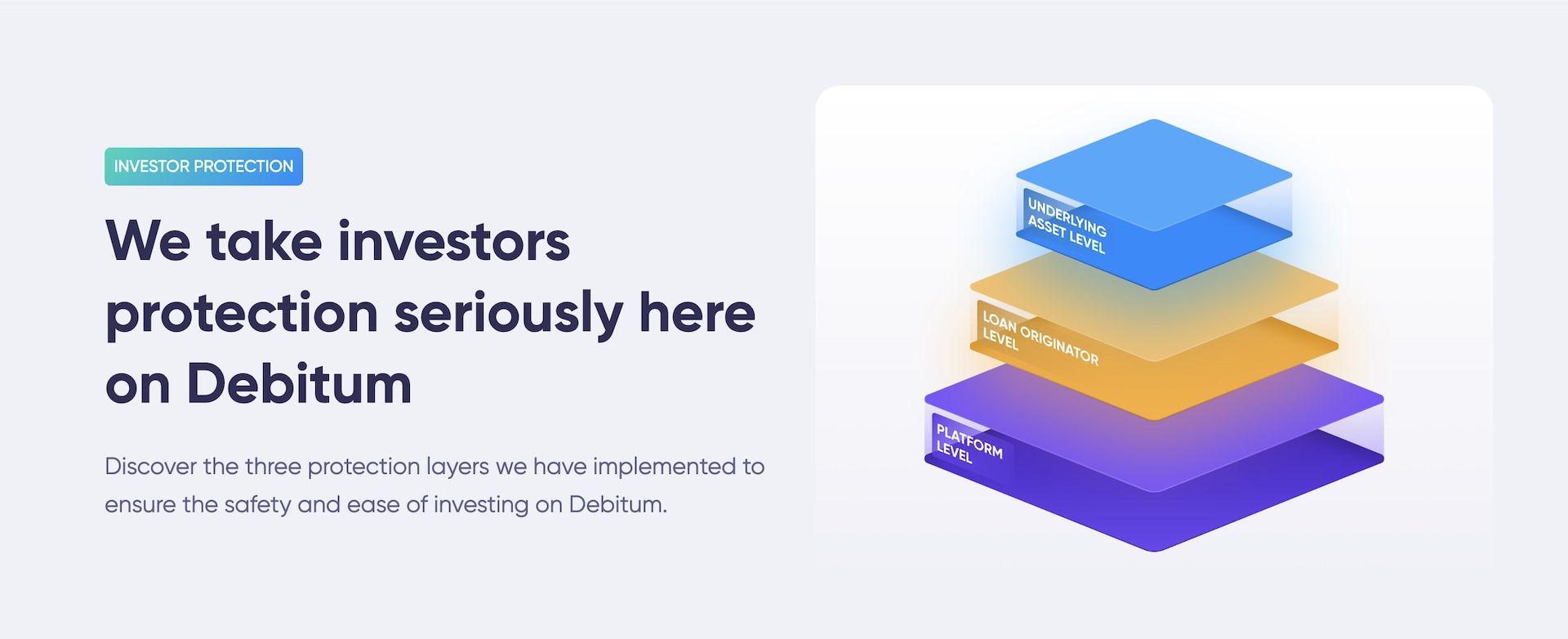

Is Debitum Safe?

Key safety features and regulatory compliance

Licensed & Regulated

Investment brokerage license obtained in September 2021, ensuring compliance with all regulatory requirements for investor protection

Business Loans Focus

Exclusively invests in business loans which have lower default rates and more stability compared to consumer loans

90-Day Buyback Guarantee

All loans come with a 90-day buyback guarantee for additional investor security

Two-Factor Authentication

2FA available for enhanced account security and protection of investor funds

🔍 Risks & Guarantees on Debitum

Debitum is really different from the other Peer-to-Peer lending platform as they solely offer investments in business loans, which are way safer than loans to individuals, especially with lower default rates. This of course also explains why the returns on the platform are slightly lower than other platforms, as you invest in safer assets.

On Debitum, all loans come with a 90 days buyback guarantee, so this is already a good point for the platform. They also have a very transparent credit scoring system, which makes it easy to select investments you want in your portfolio & what level of yield/risk you are looking for.

They also follow a strict due diligence process to put loans on the platforms, and use this process for the scoring system I mentioned earlier. We'll see later how to select loans based on their credit score in the auto-invest function.

Note that two-factor authentication (2FA) is also available on Debitum, which is another good point for the security of the platform.

🏢 The Company & The Team

As for all Peer-to-Peer lending platforms I add to my portfolio, I also check the company itself and see what they are doing in terms of security & safety of the investors funds.

Also, compared to the first time I wrote about this platform, Debitum is now a regulated & licensed investment firm. They got their investment brokerage license in September 2021 - which will guarantee that are following all the required processes to protect investors funds. This is definitely a very good trend that a lot of platforms are following, and it is good to see the Debitum is also following this trend.

As for all platforms I review, I also check who is in their management team, and what activities they did before going to Debitum. For example, I checked the profile of the co-founder of Debitum.

By checking his LinkedIn page, I could see he was involved with other companies before Debitum (they are a few more below in the profile), which is a very good sign. I also checked other members of their management team with similar results.

🏦 Loan Originators

I also always have do a close examination of the loan originators a platform uses, as this is usually where a platform will encounter problems if anything bad happens like a financial crisis.

Here, I really liked the transparency on who their loan originators are, which you can find on a dedicated page directly accessible from the main page of the website.

They currently have loan originators from Estonia, Latvia, and the UK. I liked the fact that they give details about each of their loan originators, especially about the security of the investors funds.

Debitum also continuously adds new loan originators, which is great for the diversity of loans on the platform. They for example added in mid-2023 Sandbox Funding, a Latvian loan originator that offers up to 12% yields.

Getting Started on Debitum

Open an Account & Get Verified

Create your account and complete ID verification. This process is quick and easy, taking under 5 minutes to complete including the verification part.

Deposit Funds

Transfer money to your Debitum account via simple bank transfer. The process is straightforward and your funds will be ready to invest once received.

Choose Your Investments

Browse available ABS (Asset Backed Securities) on the investment page. Each ABS contains pools of commercial loans with yields typically in the 9-9.5% range. Minimum investment is €50 per ABS.

Set Up Auto-Invest (Optional)

Use the powerful auto-invest feature to automate your investments based on your preferences for credit score, yield, and diversification. This allows for hands-off portfolio management.

Pros & Cons

✅ Pros

- ✓Licensed and regulated investment firm since September 2021

- ✓Focus on business loans with lower default rates than consumer loans

- ✓90-day buyback guarantee on all loans

- ✓Transparent credit scoring system for easy risk assessment

- ✓Investment in ABS (Asset Backed Securities) for instant diversification

- ✓Two-factor authentication (2FA) available for security

- ✓Fast withdrawals (money back in 1 day)

- ✓Powerful auto-invest feature for hands-off investing

- ✓Transparent information about loan originators

- ✓Continuously adding new loan originators for diversity

❌ Cons

- ✗Slightly lower returns compared to some other P2P platforms (9-10% vs higher risk platforms)

- ✗Minimum investment of €50 per ABS

- ✗Limited to business loans only (less variety than mixed platforms)

My Personal Results with Debitum

As for all platforms I talk about on my website, I personally invested on the platform with my own money, for over 3 years now on Debitum. So far, I only had good returns with the platform, even during the COVID-19 crisis in 2020 & 2021, with an average annual yield of 9.78% over this whole period.

The platform has been stable and reliable throughout my investment journey, with consistent returns and no issues with withdrawals.