EstateGuru Review 2026: Is it Safe to Invest?

A comprehensive review of the European real estate crowdfunding platform with property-backed loans

Quick Verdict

EstateGuru is an excellent real estate crowdfunding platform offering property-backed loans with strong returns around 11%. With ECSPR licensing, transparent operations, and an excellent track record of recovering defaulted loans with no capital loss for investors, it's a solid choice for diversifying your investment portfolio.

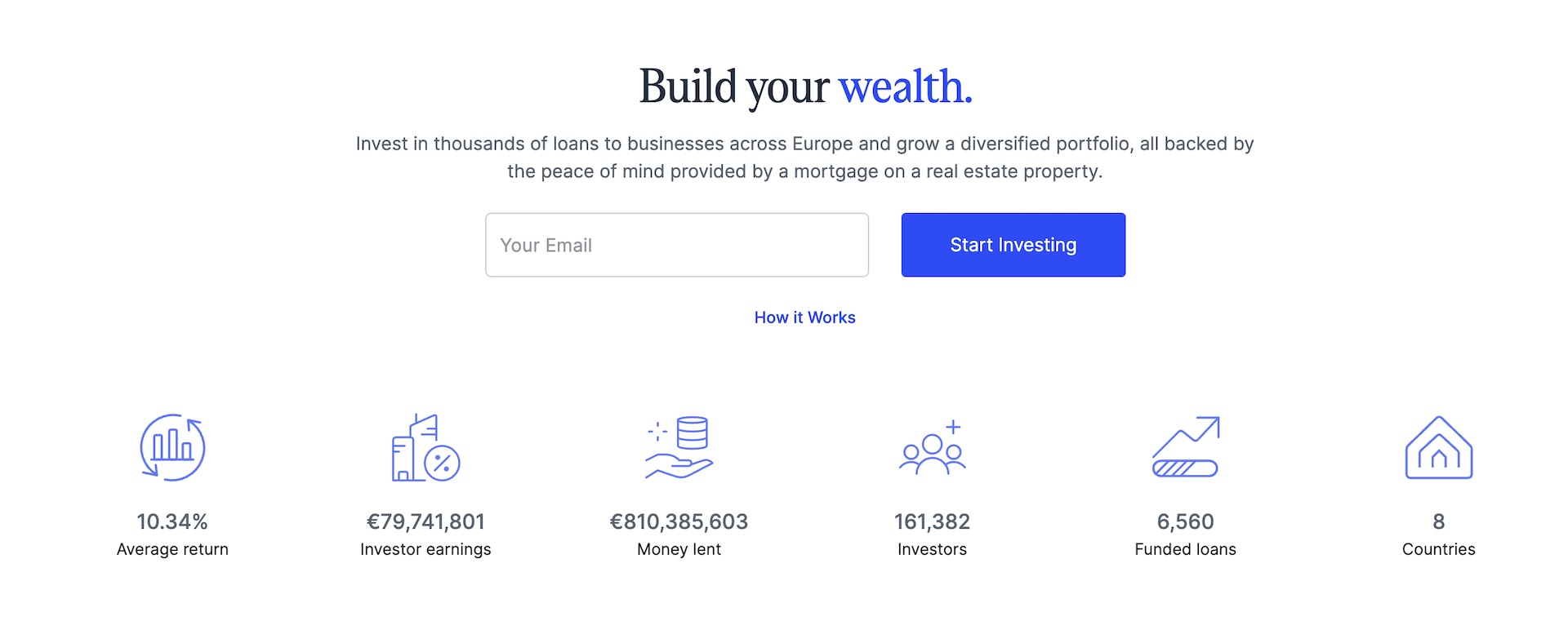

Try EstateGuruWhat is EstateGuru?

EstateGuru is a European Real Estate Crowdfunding platform based in Estonia, that mainly funds property loans for businesses. As such, all the loans on the platform always come with a property as a guarantee, which makes it very safe for the investors. Note that I usually prefer to invest in equity real estate crowdfunding (where you get a monthly rent from your properties), so I was at first a bit reluctant to invest in property loans. However, the fact that you can easily diversify into many loans will also provide a monthly income at the end and will add more diversification to my portfolio.

So far, they funded over 700 Millions worth of real estate loans of the years:

As you can see from the graph, they are continuously growing, and they recently expanded to several European countries like Spain and Portugal, making it a true European real estate crowdfunding platform.

What Returns Can You Expect?

Real returns based on my investing experience

The returns that you can expect on EstateGuru greatly depends on which projects you will invest in on the platform. Currently, they advertise an average return of 10.34% on the platform.

This is an excellent yield in the real estate crowdfunding space, as many platforms are more around 7%. If you compare that to classical real estate, this is also an excellent annual return, as you will usually only get a 5% annual yield on classical real estate in Europe. I will of course verify this yield in the rest of the review.

Auto-Invest Function

EstateGuru offers a powerful auto-invest feature that allows you to automatically diversify your capital across multiple loans based on your preferences.

Custom Strategy

Configure your investment strategy with specific parameters like loan duration, countries, and interest rates

Automatic Investing

Your funds are automatically invested in matching loans as they become available on the platform

Diversification

Spread your capital across many loans to minimize risk and ensure consistent returns

Loans on the platform are usually funded very rapidly, so using auto-invest is highly recommended to ensure your capital is deployed efficiently.

Is EstateGuru Safe?

Key safety features and regulatory compliance

Property Collateral

All loans are backed by real estate properties as collateral, providing a security layer in case of borrower default

Low LTV Ratios

Loan-to-value ratios typically around 50%, ensuring sufficient asset coverage to protect investor capital

ECSPR Licensed

Regulated under European Crowdfunding Service Provider framework since May 2023, adding regulatory oversight

100% Recovery Rate

Excellent track record of recovering defaulted loans with no capital loss for investors across the platform

🔒 Risks & Guarantees on EstateGuru

EstateGuru offers loans that are backed by real estate properties, which are there as a collateral in case something would go bad with the project. They also have low LTV (loan to value) on all the projects they offer on the platform, meaning there will be enough cash to cover the money due to investors in case a project would go to default.

EstateGuru is also a very transparent company, and they regularly publish reports that shows all the current statistics about the company and their activities, like the amount of loans funded, the current status of all projects on the platform, and much more.

They also got their European Crowdfunding license (ECSPR) in May 2023, which is an excellent news for the platform:

This means that the platform is now regulated under the European framework for crowdlending platforms, and adds an additional layer of safety for investors.

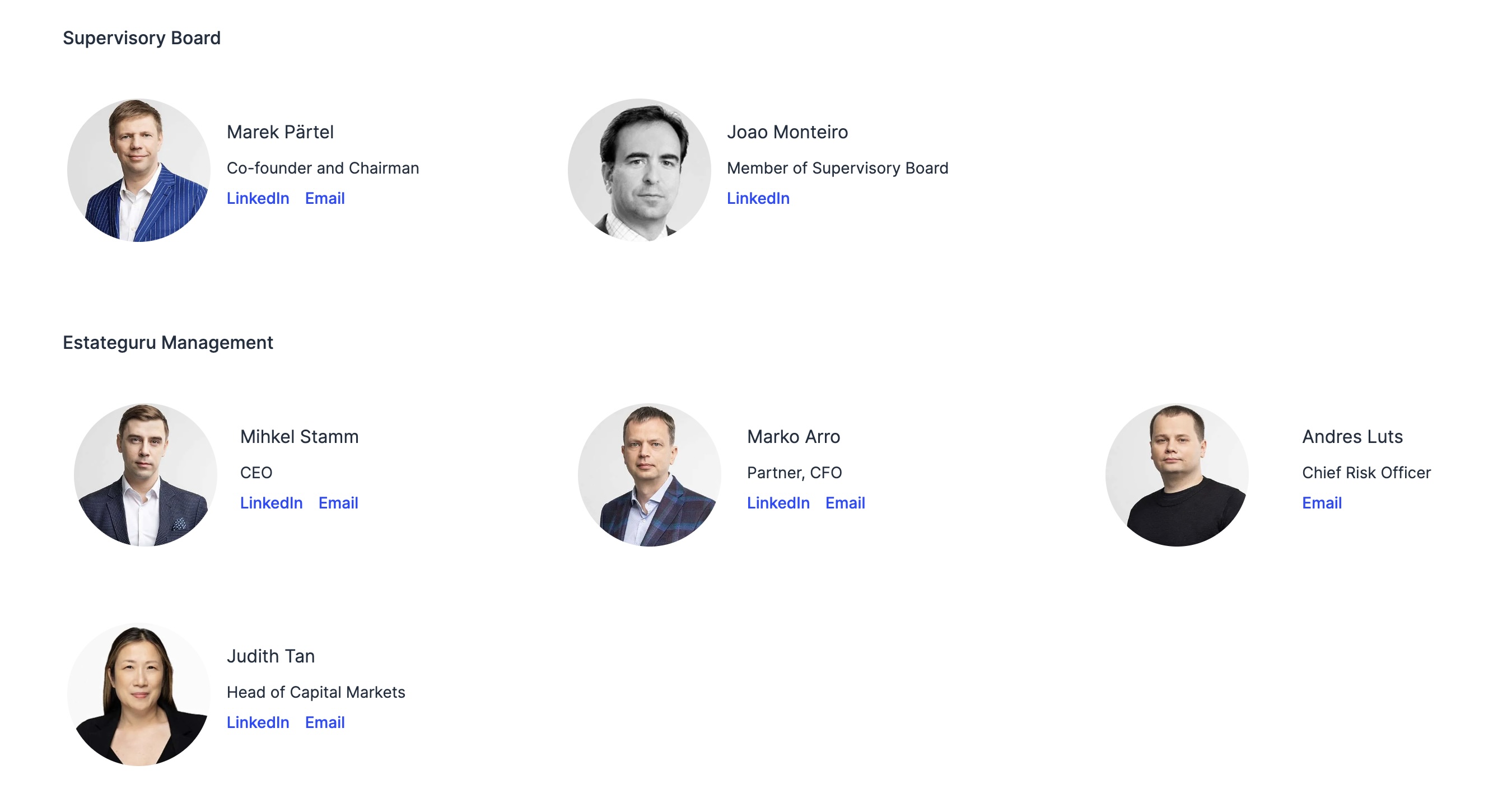

👥 The Company & The Team

As for all the platforms I add to my portfolio, I checked that EstateGuru was actually a real company registered in Estonia, and it is.

I also checked their management team, to see who is actually behind the platform. The information about who is on their team was really easy to find on their site, and I really liked this transparency.

I for example checked the profile of their co-founder Marek Partel. I found that he has a long track record in the field of finance & real estate, having for example be the co-founder of Invego, a company that is building real estate projects in Estonia.

📋 Project Originators

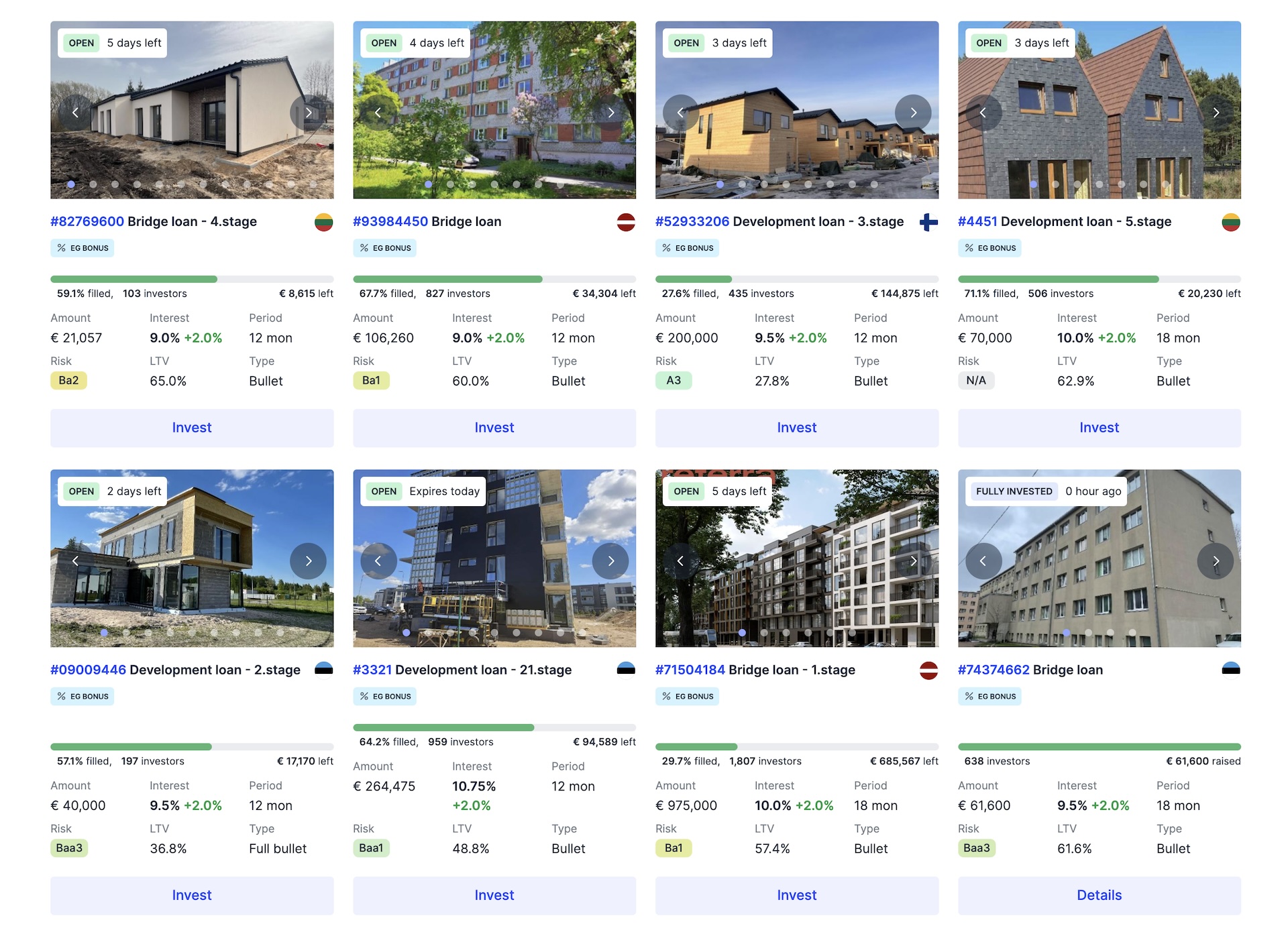

Let's now talk about the projects that are present on the platform, as most of the risks will come from this part of the platform.

On EstateGuru, all projects are coming from borrowers that apply for funding on EstateGuru. They are currently coming from many EU countries, like the Baltic states but also countries like Spain or Portugal.

They also use a strict process to select which real estate projects will be funded by the platform, evaluating the financials of the projects, but also the experience and track record of each the borrowers that apply on the platform. As I already mentioned before, they only take projects with low LTV, usually around 50% from what I saw recently on the platform.

Getting Started on EstateGuru

Create Your Account

Opening an account on EstateGuru is very easy and takes less than 5 minutes. Simply provide your basic information and verify your identity to get started.

Deposit Funds

Transfer money to your EstateGuru account via bank transfer or services like TransferWise. Funds typically arrive within 2 days and are ready to invest.

Browse Available Deals

Explore the available property loans on the platform. Each loan shows detailed information including interest rates (around 11%), property details, borrower information, and loan repayment schedules. Some even include drone footage of properties.

Set Up Auto-Invest

Configure the auto-invest function with your preferred settings (loan duration, countries, interest rates). This ensures automatic diversification across multiple loans for optimal risk management.

Pros & Cons

✅ Pros

- ✓Property-backed loans with collateral guarantee

- ✓Excellent average returns of 10.34%

- ✓Low LTV ratios around 50% for added security

- ✓ECSPR licensed and regulated platform

- ✓Transparent operations with regular reports

- ✓100% recovery rate on defaulted loans so far

- ✓Experienced management team with real estate background

- ✓Auto-invest function for easy diversification

- ✓Quick account setup in under 5 minutes

- ✓Expanding across multiple European countries

❌ Cons

- ✗Some loans can experience delays (31-60 days late)

- ✗Default rate of 8.88% requires diversification

- ✗Recovery process on defaults can take time

- ✗Loans fund very quickly, making manual investing difficult

- ✗Property loan model rather than equity ownership

My Current Results with EstateGuru

Let's now talk about the returns that I got on the platform since I first invested. At the time I've updated this article, it's now been several years since I started to invest on the platform. I currently only have one project that is in the 31-60 days late zone, one which is over 60 days late, and four defaults. I have invested in over 85 projects so far, so this gives us a default rate at the moment of 8.88%. However, EstateGuru has an excellent track record of defaults recovery, and so far no capital have been lost for investors on the platform. I will of course update this section has I get more information about those defaulted loans. For two of them, EstateGuru is already in the process of collecting funds, and the process is well under way for the two others.

My forward yield is also now estimated at 11.05% by the platform, which is completely in line with the projects I invested in on the platform.

I will of course update this article when I receive more money from the projects I invested in via EstateGuru.