The European real estate debt market represents one of the most compelling yet underexplored opportunities for investors seeking stable, asset-backed returns. Unlike traditional equity investments, real estate debt offers predictable income streams backed by tangible assets, making it an attractive option for portfolio diversification. This market has traditionally been dominated by institutional investors and high-net-worth individuals, but innovative platforms like InDemo are democratizing access to these previously exclusive investment opportunities.

Understanding Real Estate Debt Investments

Real estate debt investments involve lending money secured by real property, typically in the form of mortgages or bridge loans. These investments sit higher in the capital structure than equity, offering greater protection and more predictable returns. The asset-backed nature of these loans provides a tangible security blanket that traditional bonds or stocks cannot match.

The European market presents particularly attractive characteristics due to its mature legal frameworks, stable property markets, and regulatory oversight. Countries like Spain, Germany, and France have established robust legal systems that protect lender rights while maintaining transparent foreclosure processes. This combination of legal certainty and asset backing creates an investment environment where risk-adjusted returns can be optimized.

Risk Profile and Legal Frameworks

The risk profile of European real estate debt is significantly enhanced by the continent's comprehensive legal structures. The European Union's harmonized regulations provide consistent investor protections across member states, while individual countries maintain specialized real estate laws that have been refined over decades.

Low loan-to-value (LTV) ratios are a cornerstone of prudent real estate debt investing. When mortgaged property values cover debt obligations by a factor of two or more, investors enjoy substantial downside protection. This conservative approach to lending ensures that even in adverse market conditions, the underlying asset value provides a meaningful buffer against losses.

Spain exemplifies these favorable conditions with its effective judicial system, EU membership benefits, and mature real estate market. The country's legal framework allows for predictable outcomes in default scenarios, while its eurozone membership provides currency stability for international investors.

Market Dynamics and Opportunities

The European real estate debt market has experienced significant evolution following the 2008 financial crisis. Banks have become more selective in their lending practices, creating opportunities for alternative lenders to fill the gap. This shift has opened doors for sophisticated investors to access deals that were previously the exclusive domain of traditional financial institutions.

Interest rates in the current environment have made real estate debt particularly attractive. While traditional fixed-income investments offer minimal yields, quality real estate debt can provide returns that meaningfully exceed inflation while maintaining capital preservation characteristics.

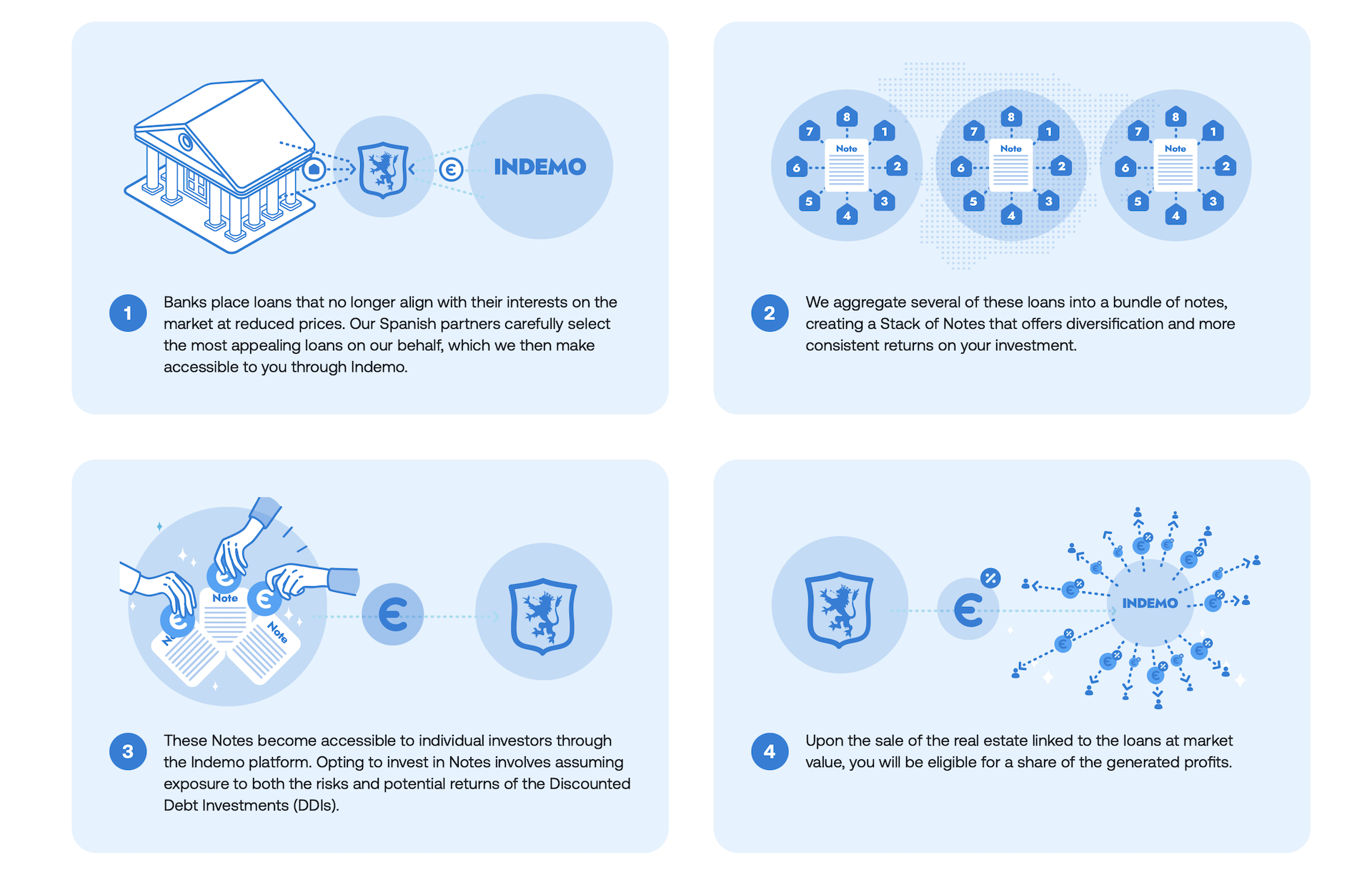

InDemo: A Case Study in Accessible Real Estate Debt

InDemo serves as an excellent example of how technology is transforming access to European real estate debt markets. With an impressive 8-year track record and over €14.2 million in total funds invested, the platform demonstrates the viability of democratizing institutional-quality investments.

The platform's approach centers on Spanish real estate debt, leveraging the country's robust legal framework and predictable judicial system. InDemo offers discounted debt investments with expected returns of 15.1% annually.

The platform's approach centers on Spanish real estate debt, leveraging the country's robust legal framework and predictable judicial system. InDemo offers discounted debt investments with expected returns of 15.1% annually.

What sets InDemo apart is its commitment to low LTV ratios, ensuring that mortgaged property values cover debt obligations by a factor of two. This conservative underwriting approach has contributed to the platform's ability to maintain consistent returns while protecting investor capital.

The platform's regulatory compliance is noteworthy, being fully licensed and regulated within the EU framework. Investors benefit from coverage under the EU Investor Compensation Scheme, protecting cash and securities up to €20,000. This regulatory oversight provides additional confidence for investors considering real estate debt as a portfolio component.

Operational Excellence and Risk Management

InDemo's operational framework demonstrates best practices in real estate debt management. The platform works with a loans servicing company licensed and supervised by the Central Bank of Spain, managing a portfolio exceeding €65 million. This institutional-grade servicing ensures professional loan administration and collection processes.

Independent property valuations conducted by renowned appraisers like Tinsa and Idealista provide objective asset assessments. This third-party validation is crucial for maintaining investor confidence and ensuring accurate pricing of underlying collateral.

The platform's security structure allows for swift asset control in default scenarios, a critical feature that distinguishes quality real estate debt investments from unsecured lending. This operational control mechanism provides investors with tangible recourse beyond traditional collection methods.

Portfolio Integration and Accessibility

InDemo has successfully lowered barriers to entry, allowing investments starting at just €10. This accessibility enables retail investors to diversify across Spanish real estate objects, limiting exposure while reducing portfolio volatility. The platform's user-friendly interface includes features like visual notifications, investment mapping, and auto-invest capabilities that simplify portfolio management.

With over 10,900 investors and €1.8 million in total repayments, InDemo demonstrates the growing appetite for accessible real estate debt investments. The platform's 24.6% average annual return highlights the potential for real estate debt to enhance portfolio performance while maintaining asset-backed security.

Conclusion

The European real estate debt market represents a compelling opportunity for investors seeking stable, asset-backed returns within a robust legal framework. Platforms like InDemo are making these previously exclusive investments accessible to a broader range of investors, democratizing access to institutional-quality opportunities.

While the Spanish real estate market currently offers relatively low but stable yields, Indemo's approach - investing in discounted debt sold by Spanish banks - presents a compelling opportunity to earn double-digit returns from real estate-backed assets, without the burden and risk of direct property ownership. This makes it an attractive option for investors seeking above-market returns backed by tangible collateral.

As traditional fixed-income yields remain suppressed, real estate debt offers an attractive alternative that combines predictable income with tangible asset backing, making it an essential consideration for modern portfolio construction.

Also note that till August 1st at 23:59 GMT, InDemo offers a unique opportunity to exceed the expected 15.1% annual ROI by earning up to 4% instant cashback - which can be reinvested immediately to boost your future returns:

€250+= 1% cashback

€1,500+= 3% cashback

€5,000+= 4% cashback