I love to diversify my Peer-to-Peer lending investments on as many great platforms as possible, which is why I continuously review new platforms & share my experiences with those platforms on my site. In this article, I will review the Peer-to-Peer lending platform Finbee, which I added to my portfolio in 2024.

In the article, I will tell you what I think are the biggest strengths (and weaknesses) of the platform, how to start using it, and what you can expect from investing on the platform. Let's start!

What is Finbee?

As for all Peer-to-Peer lending platforms, Finbee is a financial platform that allows investors to invest in loans, along with other investors in order to get interests payments over time. Finbee is a platform with a long track record already, as it was launched in 2015. The company is incorporated in Lithuania, supervised by the Bank of Lithuania as a business loan operator and has received the ECSP.

What I really like about this platform is that they offer high interests rates, averaging at 15.3% in 2023. They also focus on complete safety for investors, for example by doing a good filtering job on the incoming loans requests, and approving only 7 out of 100 loan requests. They also provide complete automatisation of the investment process, which is of course something I will verify in this review.

They currently have over 22,000 investors, and paid out over 20 million Euros worth of interests to investors.

What returns can I expect from investing on Finbee?

The returns you can expect on Finbee will of course depend on which loans you invest in. Currently, with the information from the platform you can get up to 15.3% of annual returns, and they advertise the same returns on their main page as well.

The yield actually depends on which type of loan you invest in: 16.3% for consumer loans, and 13.8% for business loans in 2023.

This is good as it is the above the average that you can get on several similar platforms in the field, and I will of course verify that when I talking about how to get started on the platform.

Of course, reinvesting your profits on the platform will give you a nice compound interest.

Is it safe to invest on Finbee?

The question of the safety of the investors funds is central when investing on a Peer-to-Peer lending platform, as they will be managing all the money that you deposit on the platform and invest it in the loans. When reviewing a new platform before adding it to my portfolio, I look at three things: what the platforms offers in terms of guarantees, the company itself (and their team), and finally the sources of the loans present on the platform (loan originators).

Risks & guarantees on Finbee

On Finbee, loans come without a buyback guarantee, however the platform has several things in place to guarantee the safety of investors money.

First, they are completely transparent about the loans present on the platform, and it is really easy to know all the risk information about each loan present on the platform.

They also have a strict process to select loans that end up on their platform, as only 7 out of 100 loan requests are accepted.

Also, tall business loans are secured with a personal guarantee of the main stockholder of the borrowing company, so in a way these loans work as consumer loans on Finbee.

They also put security as a priority of the platform - having for example a fully automated identity verification process, as well as following all the regulations in terms of GDPR.

The company & the team

As I mentioned earlier, the company is incorporated in Lithuania. As for all platforms I add to my portfolio I checked if the company was officially registered in Lithuania, and it is indeed.

It was also very easy to find information about their team, which is something I really like to see on such a platform.

As for all the platforms I invest on, I checked the profiles of the management team of the platform to see their experience in the field. Especially here, as they put the experience of their team as a strong argument for the performance and reliability of the platform.

And indeed, they do have a really good team. Their CEO for example, Darius Noreika, has a solid background in banking, having worked at large banks as an analyst before working at Finbee.

So definitely a strong team of professionals with a lot of experience in the fintech & banking fields, which is a really good point for this platform.

Loan originators

I always checked where the loans are coming from on a platform, as this is really important for the security of your investments. For example, they are responsible for paying the buyback guarantee that I mentioned earlier, so it's critical to make sure a platform is transparent about their loan originators before investing.

In the case of Finbee, they actually are doing the loan origination themselves, as from the same platform you can also apply for a loan. This is really reassuring - as all is controlled by Finbee and not by an external company. They currently have an active portfolio of above 12 millions Euros worth of loans.

Getting started with Finbee

It is actually really easy to get started with Finbee and have your money start generating interests on the platform.

The first step is to open an account and get verified. This was done really quickly, and including the ID verification part it was all done in under 10 minutes.

Next, you will have to deposit funds in your account to start investing in loans and generate interests. This is also really to do with Finbee, as you can do it via a bank transfer.

Once this is done, you can actually start investing in loans on the platform. The platform has an auto-invest function, but you can also browse loans manually:

I could see here that indeed loans have interests rates above 10%, and some even going up to 22%. Definitely in the range that was indicated on their main page.

It is also really easy to get information about a given loan:

Of course, what I recommend is to use the auto-invest function, which will automate all your investments on the platform. It is also really easy to use with several presets you can use, depending to the level of risk you want to take:

Once activated, it will automatically start investing in loans for you.

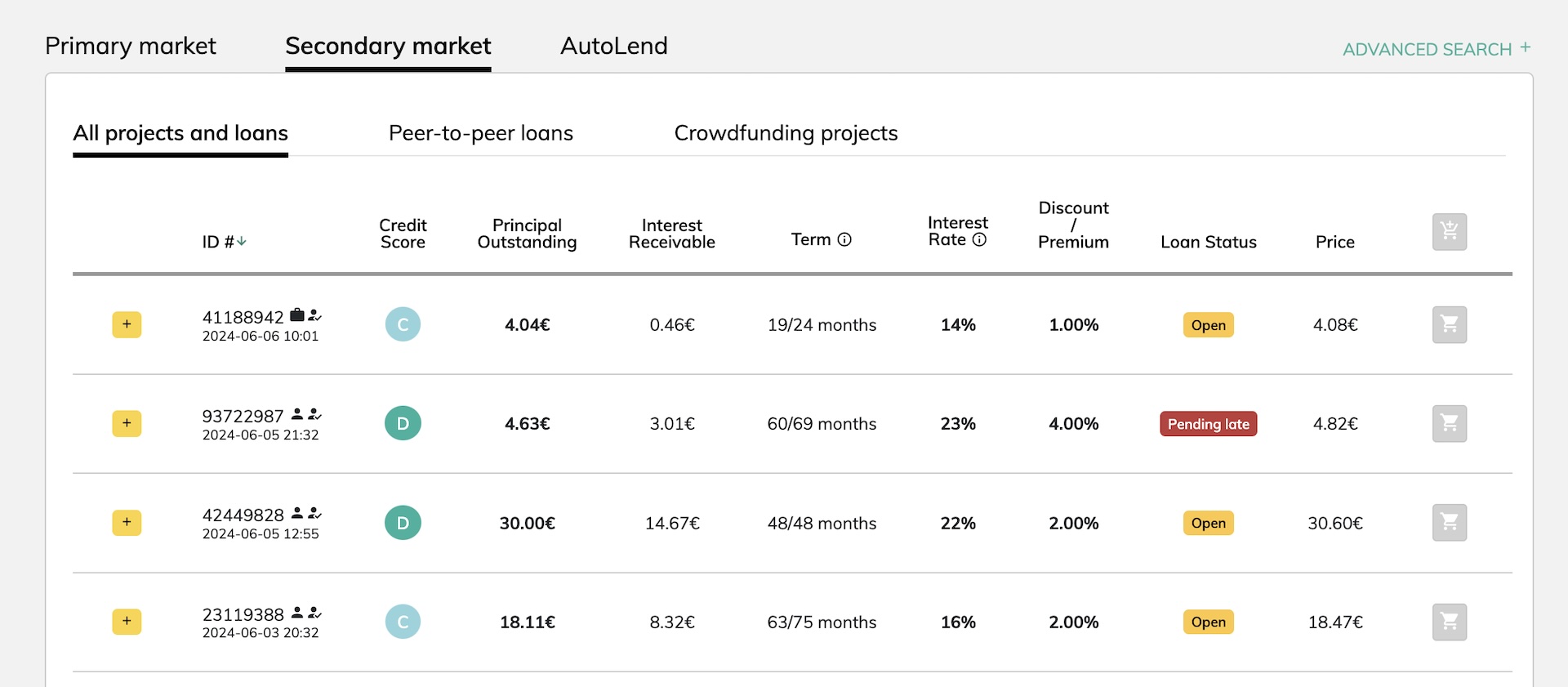

Note that there was a large amount of loans available, which is something I like to see on a platform. They also have a secondary market:

My Results so far with Finbee

With the settings that I used on Finbee, I should get returns of around 15-19% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.

Should you invest on Finbee?

I can definitely say that I enjoyed using Finbee an investment platform. The platform has good yields, there is no buyback guarantee but that is compensated by those high yields & the strict process they use to select loans. The platform is also well-built and was really easy to use.

For all those reasons, I can really recommend trying out Finbee and adding it in any investment portfolio.

The information contained in this article is for informational purposes only. None of the information presented in the article is financial, legal or tax advice. The content of this article solely represents the opinion of the author who is not a licensed financial advisor or registered investment advisor. The author does not guarantee any particular outcome.