Hive5 Review 2026: a Promising P2P Lending Platform with High Returns

In-depth review of hive5 P2P lending platform: returns, safety, loan originators, and my investment experience

Quick Verdict

Hive5 is a promising new P2P lending platform offering high returns of up to 15% annually with a 60-day buyback guarantee. While the platform has a strong experienced team and good security features, it currently works with only one loan originator, which limits diversification options for now.

Try hive5What is hive5?

As for all Peer-to-Peer lending platforms, hive5 is a financial platform that allows investors to invest in loans, along with other investors in order to get interests payments over time. Hive5 is a really new platform, as it was launched in 2022. The company itself is incorporated in Croatia, and is operating mainly from Vilnius, Lithuania.

What I really like about this platform is that they offer higher yields compared to other similar platforms in the field - which of course I'll check in details when investing in loans on the platform. They also focus on complete transparency for investors, as well as providing a strong experience in the field with a highly skilled team, which is something I'll also verify in this review.

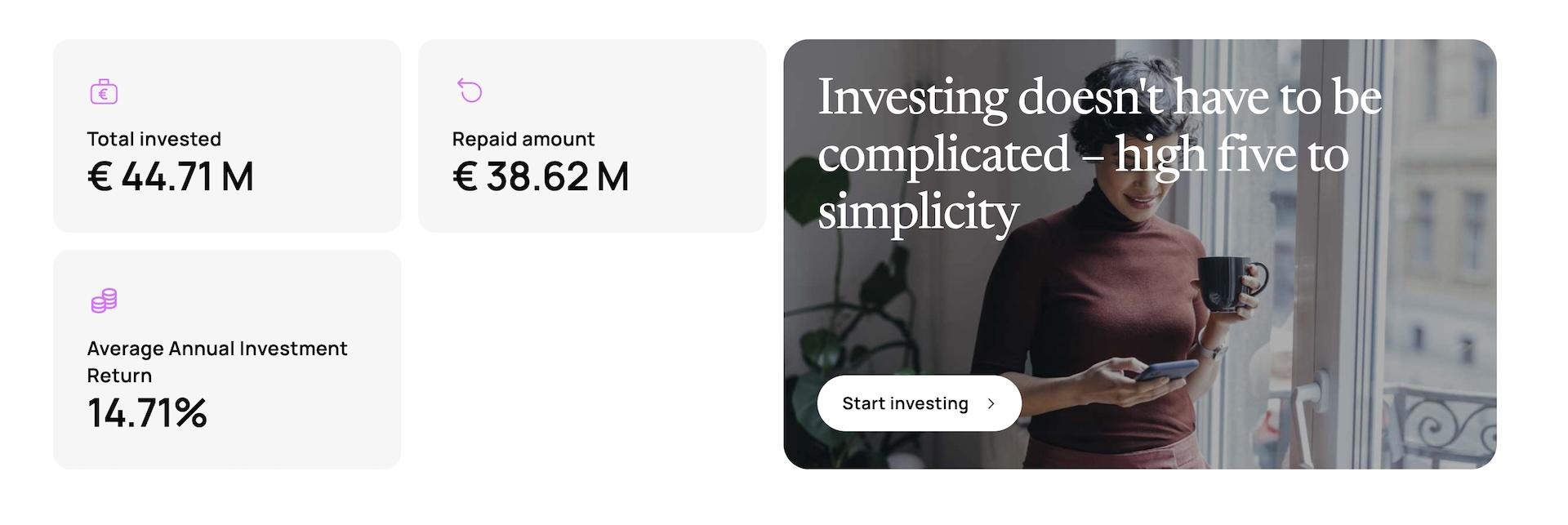

So far they issued on the platform over 228k Euros worth of loans with an average interest rate of 13.04%, and they have 250k Euros of skin in the game (in the future they want to keep 10% skin in the game on all loans on the platform).

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on hive5 will of course depend on which loans you invest in.

Currently, with loans listed on the platform you can get up to 15% of annual returns (most loans being in the 13-15% range), and they advertise an average annual return of 15% for investors on their main page, so it seems to make sense. As I mentioned earlier, this is above what you usually can expect from similar platforms, but I will of course verify that with my own investments at the end of the article.

Auto-Invest Feature

Hive5 offers a user-friendly auto-invest function that makes passive investing simple and efficient.

Easy Setup

Configure your investment preferences once and let the platform handle the rest automatically

Customizable Parameters

Set your preferred interest rates, investment amounts, and loan terms to match your strategy

Automatic Reinvestment

Returns are automatically reinvested according to your settings, maximizing compound growth

The auto-invest feature is recommended over manual investing as it ensures your money is always working for you without constant monitoring.

Is hive5 Safe?

Key safety features and regulatory compliance

60-Day Buyback Guarantee

All loans come with a 60-day buyback guarantee. If a borrower defaults, the loan originator automatically buys back the loan after 60 days and returns money to investors.

Experienced Management Team

CEO with 15+ years in finance, team members from successful platforms like PeerBerry and Aventus. Strong professional background across all leadership positions.

Skin in the Game

€250k platform investment with plans to maintain 10% co-investment on all future loans, aligning platform interests with investor success.

Regulatory Plans

Applying for European crowdfunding license to provide additional regulatory oversight and investor protection as the platform matures.

🔒 Risks & Guarantees on hive5

On hive5, all loans present on the platform are coming with a 60-day buyback guarantee, meaning that if someone doesn't pay back his loan, after 60 days the loan will be automatically bought back by the loan originator and the money returned to the investors. This is now pretty standard on several platforms, but it is definitely something good to have for the security of your investments.

They are not yet regulated, but in a recent interview they stated that they will apply for the European crowdfunding license in November 2022, once the framework around the license is officially announced. I will of course update the article once they are in the process of getting the license.

🏢 The Company & Team

As I mentioned earlier, the company is operating from Lithuania, with a company incorporated in Croatia. As for all platforms I add to my portfolio I checked if the company was officially registered in Croatia, and it is indeed.

It was also very easy to find information about their team, which is something I really like to see on such a platform.

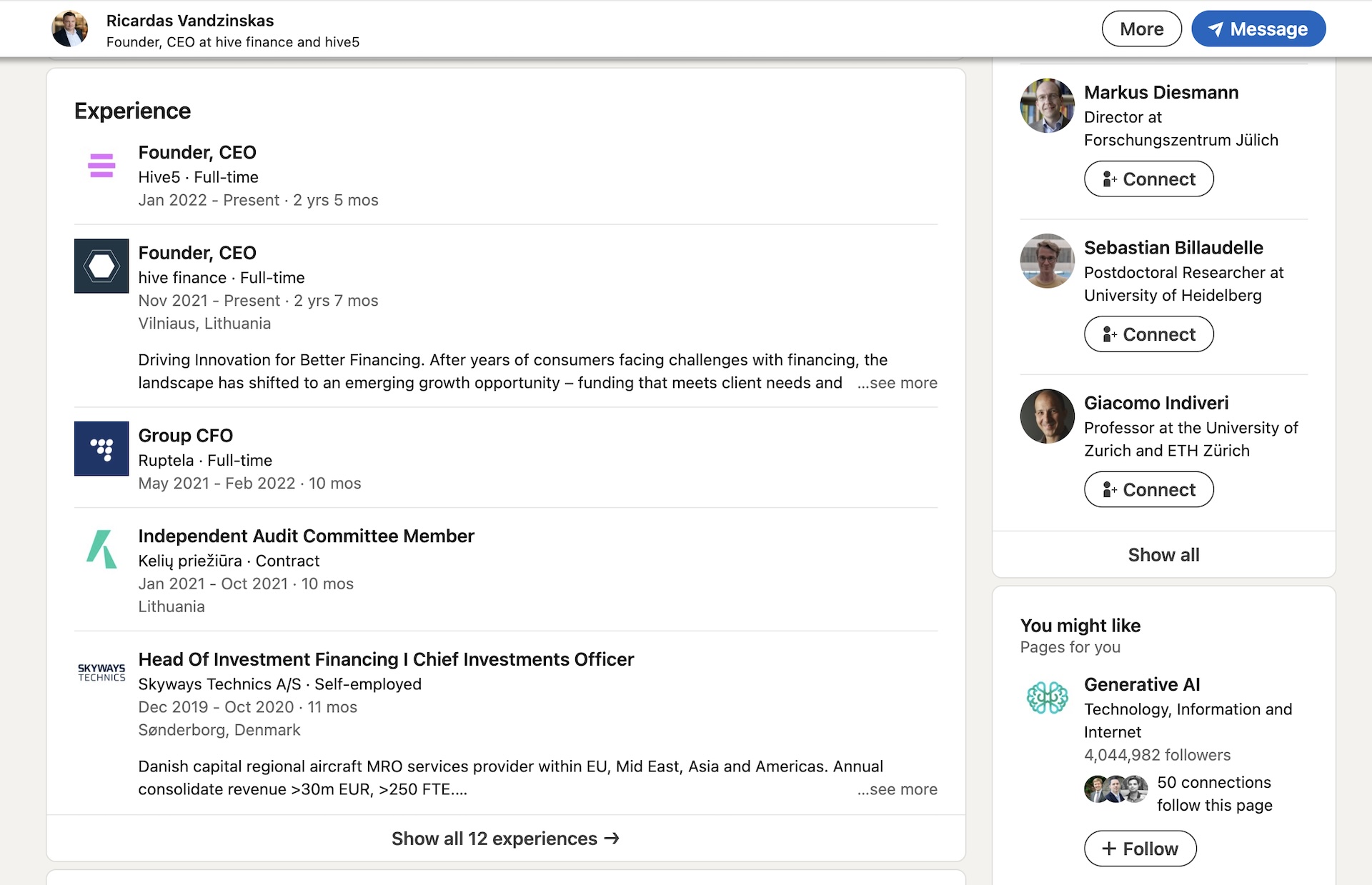

As for all the platforms I invest on, I checked the profiles of the management team of the platform to see their experience in the field. Especially here, as they put the experience of their team as a strong argument for the performance and reliability of the platform.

And indeed, they do have a really strong team. Their CEO for example, Ricardas Vandzinskas, has over 15 years of experience in the field of finance:

The rest of their team is composed of really experience people as well, for example their head of marketing Karolina Tomasevice who has over 8 years of experience in the marketing field, including several years at PeerBerry, another platform that I have in my portfolio.

Their CTO Aleksey Kalevich for example also has a lot of experience in the field, as he worked at Aventus before hive5.

So definitely a strong team of professionals with a lot of experience in the P2P lending field, which is a really good point for this platform.

🏦 Loan Originators

I always checked where the loans are coming from on a platform, as this is really important for the security of your investments. For example, they are responsible for paying the buyback guarantee that I mentioned earlier.

In the case of hive5, they currently work with just one loan originator from Poland, called Ekspres Pozyczka and that is owned by the holding company of hive5. As for all loan originators on P2P lending platforms, I checked that they actually exist as a loan company, and they do.

While it's a good thing to work with loan originators that have really close ties to the platform, I would have liked to see more diversity in terms of loan originators, especially from more countries as well, as they promote diversification as one of the main strength of the platform.

However the platform is still really young and this will probably change in the future. I reached out to them about this - and they confirmed to me that this is only the very beginning of their expansion plan. Hive5 will phase its geographies into three continents: 1. Europe – countries of target 10+million of the population; 2. Africa – ex-British colonies with a fast-growing capital city-based mobile lending market; 3. Asia – with a fintech hub in Singapore, servicing growing online lending markets like India, Sri Lanka and a few others. Also, investors will be able to diversify their portfolios between consumer, business, real estate, green and venture loans.

Getting Started on hive5

Open Account & Get Verified

Create your account and complete ID verification. The entire process takes under 5 minutes and is straightforward. You'll need a valid ID document for verification.

Deposit Funds

Fund your account via bank transfer or connect your bank directly (works with Revolut and other banks) for instant deposits. This allows you to start investing immediately without waiting for transfers.

Configure Auto-Invest

Set up the auto-invest feature with your preferred parameters including investment amount per loan, interest rate range (13-15%), and loan terms. This automates your investing process.

Start Earning Returns

Once auto-invest is activated, your money automatically gets invested in matching loans and starts generating interest. Monitor your portfolio and adjust settings as needed.

Pros & Cons

✅ Pros

- ✓High annual returns of 13-15%, above industry average

- ✓60-day buyback guarantee on all loans

- ✓Highly experienced management team with 15+ years in finance

- ✓Strong team from successful platforms like PeerBerry and Aventus

- ✓Fast account verification (under 5 minutes)

- ✓Easy auto-invest feature for passive investing

- ✓Quick withdrawals (1 day processing time)

- ✓Direct bank connection option for instant deposits

- ✓Ambitious expansion plans across Europe, Africa, and Asia

- ✓€250k skin in the game (targeting 10% on all loans)

❌ Cons

- ✗Very new platform (launched in 2022) with limited track record

- ✗Currently works with only one loan originator

- ✗Limited geographical diversification (only Poland currently)

- ✗Not yet regulated (European crowdfunding license pending)

- ✗Loan originator owned by platform's holding company

My Investment Results with hive5

With the settings that I used on hive5, I should get returns of around 14% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.