Indemo Review 2026: a Regulated Real Estate Investment Platform

An in-depth review of the regulated European real estate platform offering mortgage loans and discounted debt investments

Quick Verdict

Indemo is a solid regulated EU real estate platform that offers unique access to both mortgage loans and discounted debt investments. With a strong team, clear interface, and attractive yields up to 15%, it's a great addition to any diversified investment portfolio.

Try IndemoWhat is Indemo?

Indemo is an investment platform that allows investors to access real estate assets on the Spanish market. As we'll see later in the review, there are two main type of secured loans that you can invest on the platform: mortgage loans, and discounted debt.

Even if Indemo is a relatively new platform, as it was launched in 2023, founders started to work on the project two years before the launch, in 2021. They are based in Riga, Latvia.

What makes them different from other similar platforms is that they offer investors to two different type of real estate assets - mortgage loans and discounted debt. Mortgage loans are the most classic way to invest in real estate - as you invest in a secured loan tied to real estate. Discounted debt investment are purely new on the the P2P market offering really different - as you invest in loans where the borrowers failed to make payments, and therefore you can access secured loans at a discount, meaning more yields for you as an investor.

We'll go back to those later in the review as we talk about the risks & guarantees of the platform, but it's nice to see that you can invest in two types of real estate assets from the same platform.

According to the information provided on the platform, they have funded six Notes so far, with a total amount 700k Euros.

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on Indemo completely depend on which projects you invest in, which I will tell you more about when we'll see how to use the platform.

Currently, you can get up to 10% returns on the platform for mortgage loans, and they advertise an average annual return of 15.1% for investors with discounted debt investment, which I will of course verify in this review and by investing on the platform.

Unique Investment Types

Indemo offers two distinct investment opportunities that set it apart from other real estate platforms

Mortgage Loans

Classic secured loans backed by operational real estate properties with low LTV ratios for maximum security

Discounted Debt

Unique access to non-performing loans purchased at ~50% discount with higher yield potential of 15.1% average

Investment Map

Clear, innovative interface showing all projects on an interactive map with detailed location information

The discounted debt investments are particularly unique to Indemo, allowing investors to benefit from properties sold at significant discounts with profit sharing on the recovery.

Is Indemo Safe?

Key safety features and regulatory compliance

EU Regulated Platform

Fully regulated and supervised by the Central Bank of Latvia with investor protection up to €20,000

Secured Loans

All investments backed by real estate with low LTV ratios for mortgage loans and ~50% PTV for discounted debt

Experienced Team

Management team with 20+ years of banking and fintech experience, including former Mintos Senior Legal Counsel

Independent Valuations

Properties valued by independent appraisers like Idealista, Tinsa, and Thirsa

🔒 Risks & Guarantees on Indemo

On Indemo, you invest in secured loans in the European union - meaning all projects present on the platform are backed by property, which is the foundation of the investors funds safety on the platform.

For mortgage loans, the LTVs (Loan To Value) on the platform are usually low, meaning that the amount of the loan of a given project is always much than the value of the asset attached to the project. This means that in case of a problem with a project, the asset that will be sold to cover the loan will be more than enough to give the money back to investors & to cover all the legal costs associated with the sale.

For discounted debt investments, we have to look at the PTV (price paid for the debt divided by the value of the property), which shows the discount paid for the attached real estate, which usually is around 50% on the debts I've seen so far on the platform. In practical terms, it means the real cash buffer to secure investors' potential returns from the possible price fluctuations that the attached real estate might have when sold on the market at the end of the recovery process.

Also, all mortgaged real estate offered on Indemo are factual operational premises, either apartments or private houses. It is significant, as the construction and development risks are absent there, which we have seen recently on other real estate investing platforms when it was hard to recover invested amounts from the construction sites or not commissioned estates.

Finally, the company is fully regulated and supervised by the Central Bank of Latvia, meaning your funds are also protected up to 20,000 Euros by the EU investor compensation scheme. Then, Indemo has passports to operate as a regulated investment company in several European countries, including Germany – where it is listed on BaFin database and Spain, listed in the CNMV database.

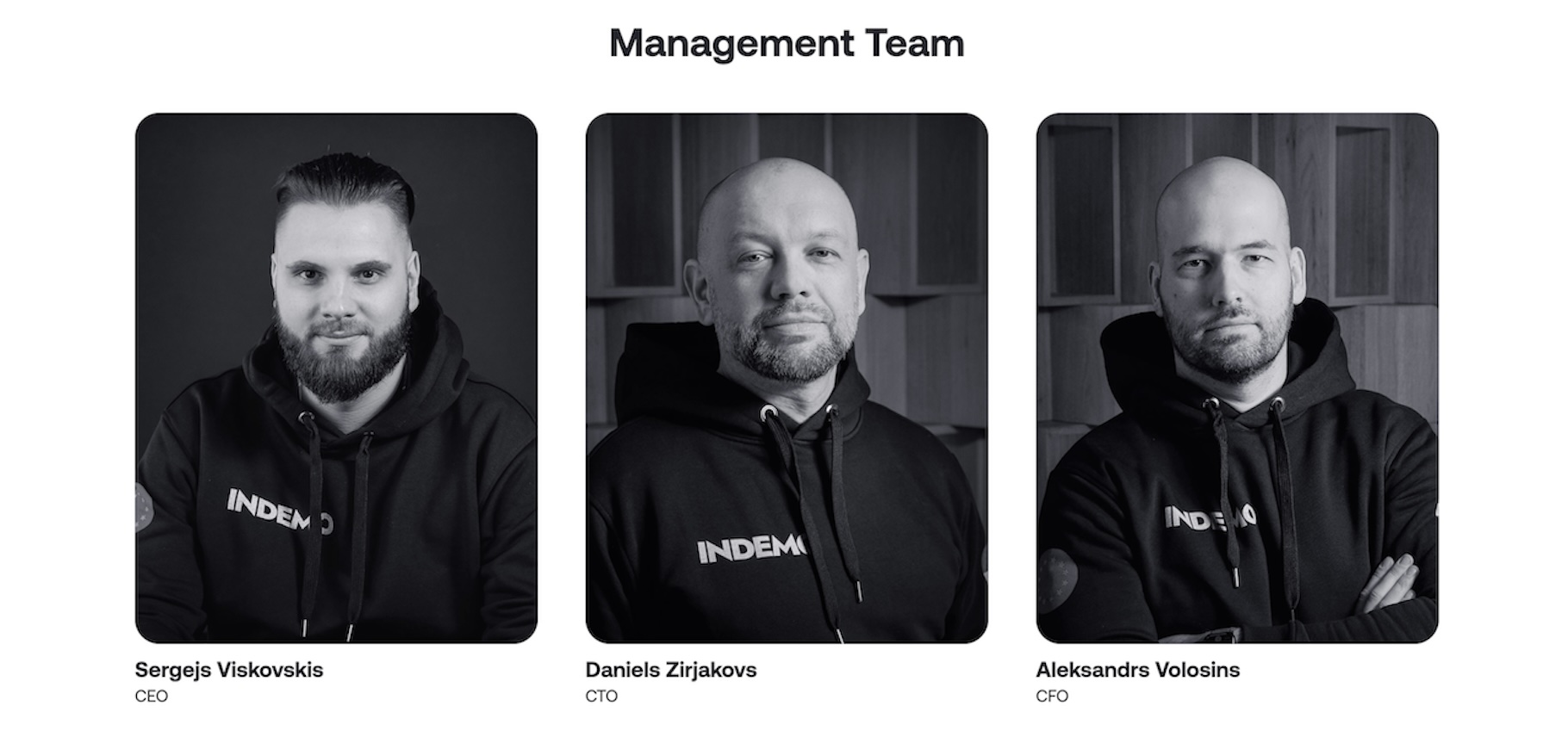

🏢 The Company & the Team

After that, I always check the company is indeed a registered company. Here, I checked the official company register in Latvia, and it is indeed registered as a company.

Then, I check the management team to see who is actually running the company & their track records. The information about their team was really easy to find on their site:

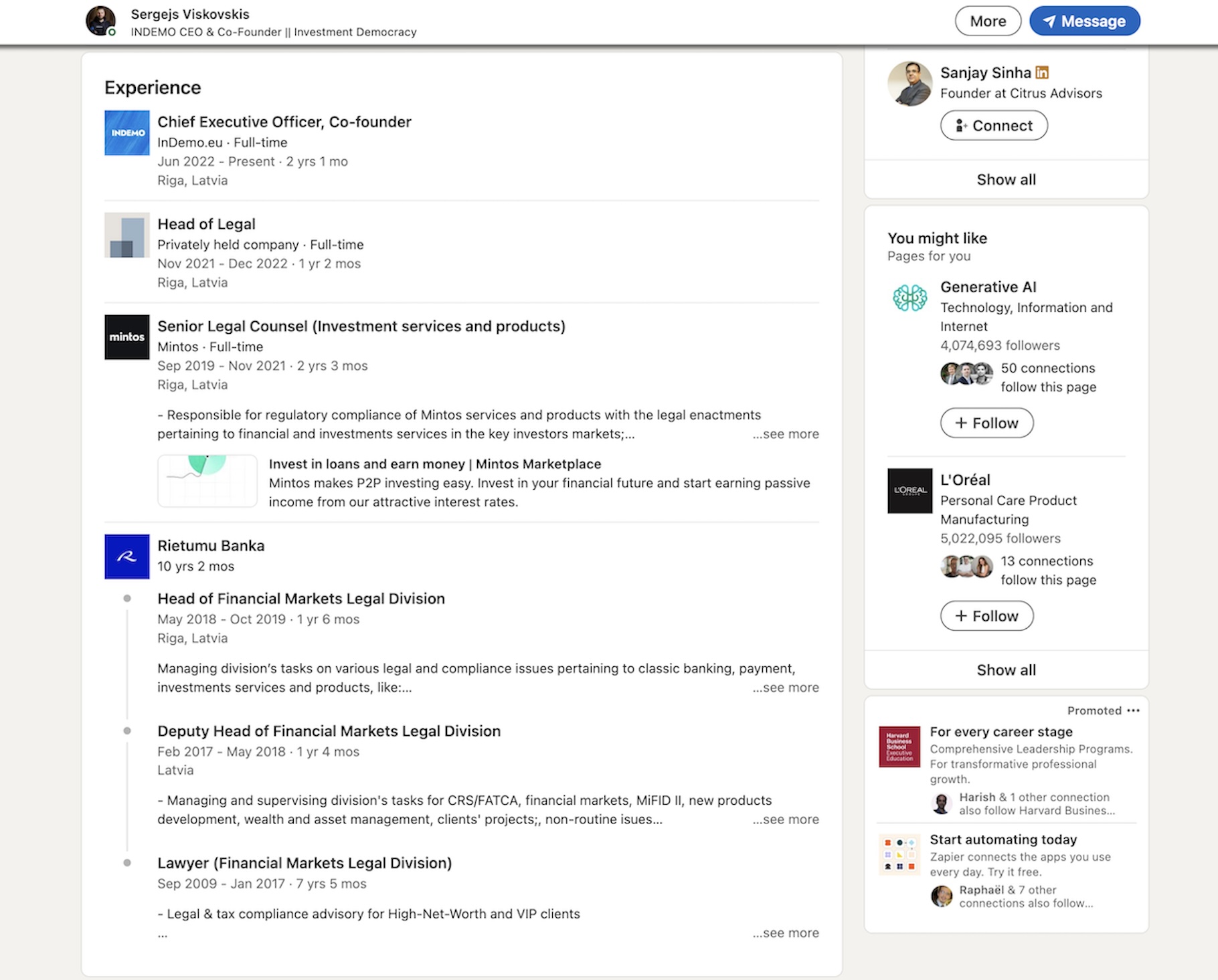

I first checked the profile of their CEO and Co-Founder, Sergejs Viskovskis, with who I actually talked for over nearly 2 years now as they were building the platform.

I could verify that he was working in a bank for nearly 10 years, and also had a 2 years experience at Mintos as a Senior Legal Counsel. Sergejs is a public face and also actively participates in the community events, like Finfellas and other Fintech related ones.

Their CFO, Aleksandrs Volosin, also has a long track record of nearly 20 years working in banking & corporate finance.

Overall, it's safe to say that the Indemo platform is in the hands of a team of experienced professionals.

Indemo as a regulated platform required to prepare audited annual financial reports according to IFRS standrards, which are avalible on their website for year 2022.

🏗️ Projects Originators

I also always have a close look at where the projects on the platform are coming from, as this is usually where a platform will start to have issues if anything bad happens like a financial crisis.

First, it's worth noting that for all projects present on the platform, Indemo is doing a careful research so only the best investments end of of the platform for investors - also using market valuations done by independent appraisers like Idealista, a well-known real estate platform in Spain, or classic valuators like Tinsa and Thirsa.

Both loan origination and debt servicing and collection is performed by a Indemo partnering professional servicing companies authorised by the Bank of Spain as real estate lending entity.

On Indemo, there are two main types of projects as I already mentioned before.

The first type of projects available on the platform are discounted debt investments, which I found really interesting and unique to this platform. It basically consists in investing in loans on which the borrower failed to pay, and therefore the bank will sell those properties with a significant discount on the market. Then, once the property is actually sold, investors will make good profits on the sale.

Discount debt investments are created from mortgage loans on which the borrower has not made payments. The large Spanish banks (like Sabadell, Santander, BBVA, Caixabank etc.) sell these loans on the loans market at a considerably discounted price, including the real estate asset associated with them.

By investing in bonds, we as investors gain exposure to those debts at a considerable discount, usually in the basket of eight debts. Once each attached property is sold for its market value, the investor receives a 50% profit share from the differential between the discounted price paid and the proceeds from the sale of the property. Usually, the average discount for objects placed on Indemo platform is around 40%.

Investor gets repayment of the part of the investment amount and profit allocation once each and any debt in the basket is recovered. The debt recovery and servicing of the debt is performed by professional servicing. Discounted debts do not generate recurring payments, however, they can generate higher returns with the proceeds from the sale of the associated home as collateral.

You can assess the valuation of the attached real estate by your own, check the location, photos, and market value assessed by Thirsa.

The major transparency and engagement tool is the Flow page. It in real time follows each debt recovery and real estate foreclosure progress, basically answering to the question when my money will be repaid and I will earn the profit.

The second type of project, the most classic one, is mortgage loans. Here, you invest in loans that are backed by real restate on the Spanish market, meaning a lower market volatility for investors.

Also note that because Indemo is a regulated platform, you don't directly invest in loans on the platform but in Notes, that are financial assets that usually encapsulates 8 different loans, meaning more stable returns and diversification by default for investors.

Getting Started on Indemo

Open and Verify Your Account

Quick registration process taking under 5 minutes using Veriff identification service. Complete the suitability questionnaire to start investing.

Deposit Funds

Transfer funds via bank transfer or use Instant SEPA deposits through LHV Bank for immediate availability.

Browse the Investment Map

Explore available projects on the interactive investment map. Review details including annual returns, LTV ratios, and property locations. Minimum investment is just €10.

Invest or Enable Auto-Invest

Manually select projects or activate the auto-invest function to automatically diversify your investments across available opportunities.

Pros & Cons

✅ Pros

- ✓Fully regulated by Central Bank of Latvia with EU investor protection up to €20,000

- ✓Unique access to discounted debt investments with higher yields (15.1% average)

- ✓Low minimum investment of just €10

- ✓Experienced management team with banking and fintech background

- ✓Clear and innovative interface with investment map

- ✓Auto-invest function available

- ✓Fast withdrawals (2 days)

- ✓Instant SEPA deposits with LHV Bank

- ✓Low LTV ratios on mortgage loans for better security

- ✓Professional debt servicing and collection

❌ Cons

- ✗Relatively new platform (launched in 2023)

- ✗Limited to Spanish real estate market only

- ✗Small number of projects funded so far (6 notes, €700k)

- ✗Discounted debt investments may have longer recovery periods

My Experience with Indemo

At the time I published this article, I just started investing on Indemo, and it is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.