I love to diversify my real estate crowdfunding investments on as many great platforms as possible, which is why I continuously review new platforms & share my experiences with those platforms on my site. In this article, I will review the real estate crowdfunding platform InRento, which I added to my portfolio in late 2021.

In the article, I will tell you what I think are the biggest strengths (and weaknesses) of the platform, how to start using it, and what you can expect from investing on the platform. Let's start!

What is InRento?

As for all real estate crowdfunding platforms, InRento is a financial platform that allows investors to invest in real estate projects, along with other investors in order to acquire shares of properties that are listed on the platform. InRento is a relatively new platform, as it was founded in 2020. They are based in Vilnius, Lithuania.

What I really like about this platform is that they offer what is called equity real estate crowdfunding - meaning you actually become part owner of properties listed on the platform, and you can enjoy monthly distributions of rent, like you would with "classical" real estate. You will also get a percentage of the profits once properties are sold at the end of each project.

They currently have around 50 properties listed on their site, with about 3 millions Euros already funded by the platform.

What returns can I expect from investing on InRento?

The returns you can expect on InRento depends on which projects you invest in, which I will tell you more about when we'll see how to use the platform. Currently, with projects listed on the platform you can get up to 9% annual distribution from rental income, and they advertise an average annual return of 7.08% for investors. This is above what you would usually get from classical real estate - in the past as the owner of classical real estate properties I would usually get around a 5% yield.

Is it safe to invest on InRento?

The question of the safety of the investors funds is central when investing on a real estate crowdfunding platform, as they will be managing all the money that you deposit on the platform and invest it in the projects. When reviewing a new platform before adding it to my portfolio, I look at three things: what the platforms offers in terms of guarantees, the company itself (and their team), and finally the source of the projects present on the platform.

Risks & guarantees on InRento

On InRento, all projects present on the platform are backed by real estate, in the form of first rank mortgages. They basically look for borrowers that want to launch real estate projects, and list them on their website to fund the projects using money from investors.

For each project that they list on the platform, they do a strict verification process of the borrower behind project, evaluating criteria like the borrower's experience in real estate and with rental properties. They also check his/her reputation by including any existing liabilities, conflicts or other things that could have a direct impact on the success of the real estate project.

Before listing a project on their platform, they also check the property itself to evaluate if the project can be a success - like the location of the asset, the usual occupancy rate in the area, and a lot of other factors to make sure the property will generate a good yield for investors.

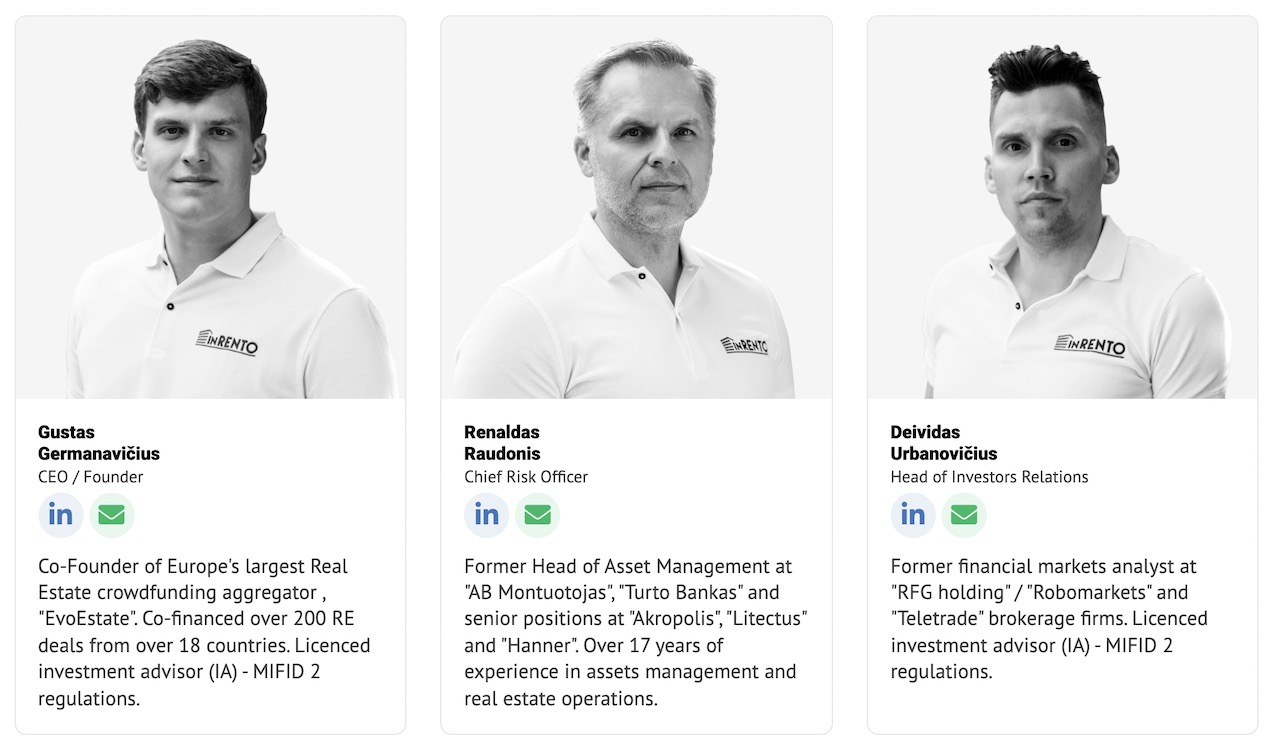

The company & the team

As I mentioned earlier, the company is operating from Lithuania, and as for all platforms I add to my portfolio I checked if the company was officially registered in Lithunia, and it is indeed.

They also are completely transparent about their team on their website, with a complete description of the role of each person in the team, which is also something I appreciate seeing on a platform.

Compared to other new platforms that I review, I didn't have to check the profile of the CEO for InRento as he already has an excellent track record in the real estate crowdfunding space, for example by being also the co-founder of the EvoEstate platform which I have been using for several years now.

Projects originators

I already mentioned earlier projects originators for InRento, that are basically the borrowers that list projects on the platform. I just wanted to add here that in case the property stays vacant for a long time, the borrower behind the project will have to pay an increased interest rate to cover for the rental distributions, meaning additional security for the investors.

Getting started with InRento

It is actually really easy to get started with InRento and have your money start generating rental income on the platform.

The first step is to open an account and get verified. This was done really quickly, and including the ID verification part it was all done in under 5 minutes.

Next, you will have to deposit funds in your account to start investing in loans and generate interests. This is also really easy to do with InRento, as you can do it via a bank transfer.

Once this is done, you can actually start investing in properties on the platform. For that, the first option is to check the primary market:

From there, you can immediately see what projects are currently available, and get some details about the properties like the rental yield, property type, and distribution period. Note that the minimum investment amount is 500 Euros, which is in the higher range compared to other similar platforms but still much lower than any deposit you would make in a "classical" real estate deal.

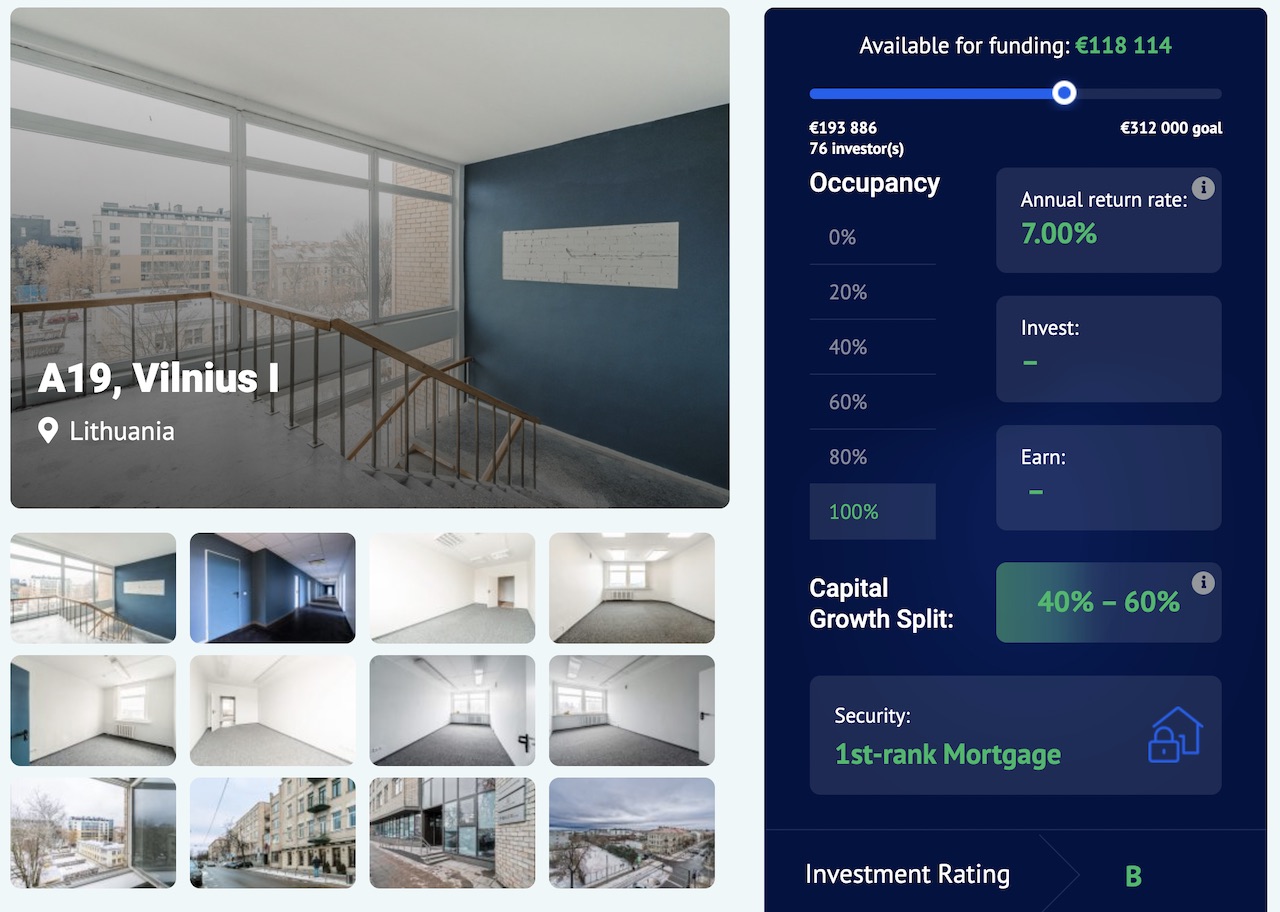

If you want more details, you can simply click on the projects you want to get more information about it:

On those pages, you will find much more details about the project, like pictures of the property, funding goal & remaining amount to be funded, as well as the risk rating of the investment.

The cool thing is that they also have a calculator on each of the properties, that you can use to quickly see how much money you will get from rental distributions according to the money you invest in the property.

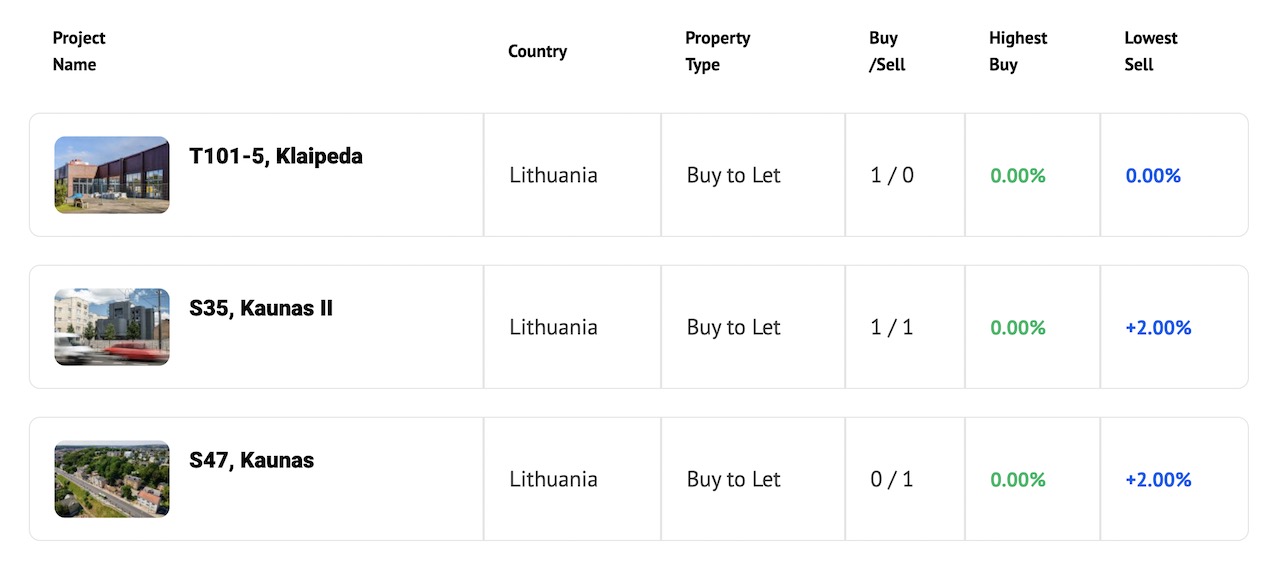

The nice thing about InRento is that they also have a secondary market, where you can buy shares in projects that are already running. When I first started to use InRento, there was a few projects already available on the secondary market:

Note that for now, there is no auto-invest function on the platform, so you will have to select projects manually. I am currently talking to their team to see when this function will be available on this platform.

As for all the platforms I review, I also tried to withdraw money, and the money was back on my account in just 1 day.

My Results so far with InRento

I only invested in one project project so far on InRento, and it should give me a return of 7% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.