Lendermarket Review 2026: A Solid Platform for P2P Lending

After several years of investing on Lendermarket, here's my genuine experience with returns, security, and what makes this P2P platform reliable for passive investing

Quick Verdict

After several years with Lendermarket, it's a solid addition to a diversified investment portfolio. The platform delivers on its core promises of good returns and passive investing with zero fees and automated investing. While liquidity constraints exist and occasional rebalancing is needed, it represents a reasonable option for investors seeking to diversify beyond traditional assets.

Try LendermarketWhat is Lendermarket?

When I first discovered Lendermarket in 2022, I was searching for better returns than traditional savings accounts. After researching various P2P lending platforms, Lendermarket caught my attention for its straightforward approach and transparent fee structure.

Lendermarket is a P2P lending platform that connects investors with loan originators across multiple countries, offering an average annual return of 15.58%. The platform specializes in automated investing with zero commission fees, making it accessible for both beginners and experienced investors looking to diversify beyond traditional assets.

What Returns Can You Expect?

Real returns based on my investing experience

Returns and Performance

Lendermarket advertises an average annual return of 15.58%, which initially seemed optimistic. However, my experience has been largely positive, with steady returns that consistently outperform traditional savings accounts.

The platform delivers on its promise of zero commission fees, which is refreshing in an industry where hidden charges can eat into profits. Every euro earned goes directly to your account, making the actual returns more attractive than many competitors.

That said, returns can vary depending on market conditions and the specific loan originators you're invested in. While the platform maintains good overall performance, individual experiences may differ based on investment strategy and timing.

The Auto-Invest Feature

Auto-Invest is probably Lendermarket's strongest feature. For busy investors, it eliminates the need to manually select individual loans.

Automated Portfolio Management

Set your criteria for interest rates, loan terms, and preferred countries, then let the system handle the rest without constant monitoring.

Automatic Diversification

The system automatically spreads investments across different loan originators and regions, helping reduce concentration risk.

Buyback Guarantee Protection

When loans default, the originator repurchases them, protecting your principal. The process works as advertised though timing can vary.

The system sometimes favors certain originators over others, which means you might need to adjust settings occasionally to maintain your preferred allocation. It's not completely "set and forget," but it's close enough for most investors.

Is Lendermarket Safe?

Key safety features and regulatory compliance

Buyback Guarantee

The main protection ensuring loan originators repurchase defaulted loans. This works effectively, though processing times can vary depending on market conditions.

Skin in the Game

Each loan originator maintains 5-10% ownership in their loans, aligning their interests with investors and ensuring quality control.

Regulatory Compliance

The platform operates under appropriate financial regulations, providing necessary legal frameworks for investor protection.

Geographic Diversification

Investments spread across different economies and loan originators, reducing concentration risk across multiple markets.

🔒 Security and Platform Reliability

Security was my primary concern when starting with P2P lending. Lendermarket addresses this through several mechanisms.

The buyback guarantee is the main protection, ensuring loan originators repurchase defaulted loans. This works effectively, though processing times can vary depending on market conditions and originator workload.

Each loan originator maintains 5-10% ownership in their loans, aligning their interests with investors. This "skin in the game" approach helps ensure quality control and responsible lending practices.

The platform operates under appropriate financial regulations, providing necessary legal frameworks. However, P2P lending remains less regulated than traditional banking, which investors should consider.

Customer support has been generally responsive when I've needed assistance, though response times can vary during peak periods. The team is knowledgeable about the platform's features and investment strategies.

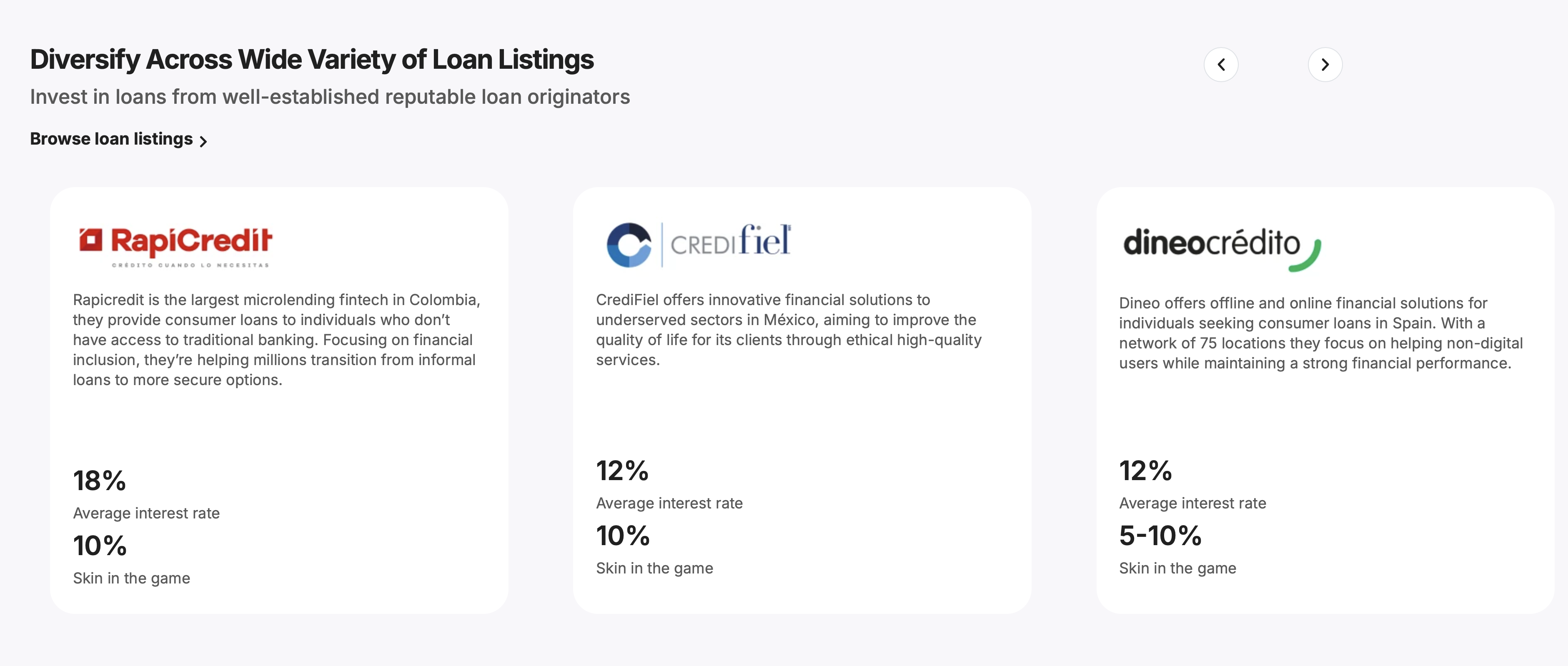

🌐 Loan Originators and Diversification

Lendermarket partners with established loan originators across different countries, each bringing unique strengths to the platform.

Rapicredit (Colombia)

Offering 18% average interest rates, Rapicredit focuses on microlending in Colombia. Their 10% skin in the game demonstrates commitment to loan quality. The higher rates reflect the emerging market opportunity, though this also means higher inherent risk.

CrediFiel (Mexico)

CrediFiel provides 12% average returns with a focus on financial inclusion in Mexico. They maintain solid performance with reasonable risk levels, making them a good balance option for conservative investors.

Dineo (Spain)

For European exposure, Dineo offers 12% returns through both online and offline consumer loans. Their physical presence across Spain adds stability, though returns are naturally lower than emerging market opportunities.

The geographic diversification is valuable, spreading risk across different economies. However, this also means exposure to currency fluctuations and varying regulatory environments, which some investors might prefer to avoid.

💻 User Experience

The platform interface is clean and intuitive, making it accessible for both beginners and experienced investors. Account setup is straightforward, and the dashboard provides clear information about your investments and performance.

Navigation is logical, and most features are self-explanatory. The mobile experience works well for checking performance on the go, though most serious portfolio management is better done on desktop.

One minor drawback is that detailed loan information is somewhat limited compared to platforms like Mintos. If you prefer extensive due diligence on individual loans, you might find the available data insufficient.

⚠️ Practical Considerations

Getting started with Lendermarket is relatively simple. The verification process is quick, and you can begin investing shortly after your first deposit. The minimum investment requirements are reasonable, making the platform accessible to various investor sizes.

Liquidity is worth considering. While you can withdraw funds, you'll need to wait for loans to mature or be repurchased. This typically takes several weeks to months, so it's not suitable for emergency funds or short-term savings.

The platform works best for investors with medium to long-term horizons. If you're looking for quick access to your money, traditional savings accounts might be more appropriate despite lower returns.

Tax implications vary by country, and the platform doesn't provide tax advice. You'll need to understand your local requirements for reporting P2P lending income.

Getting Started on Lendermarket

Sign Up and Verify

Create your account and complete the quick verification process. You'll be able to start investing shortly after your first deposit.

Set Up Auto-Invest

Configure your investment criteria including interest rates, loan terms, and preferred countries. The system will handle diversification automatically.

Make Your First Deposit

Fund your account with an amount you won't need for at least 1-2 years. Remember that liquidity is limited as loans need time to mature.

Monitor and Adjust

Check your portfolio periodically and adjust Auto-Invest settings if needed to maintain your preferred allocation across originators.

Pros & Cons

Pros

- ✓Average annual return of 15.58% consistently outperforms traditional savings

- ✓Zero commission fees - every euro earned goes to your account

- ✓Effective Auto-Invest feature that handles diversification automatically

- ✓Buyback guarantee protects principal when loans default

- ✓Clean and intuitive platform interface for beginners and experienced investors

- ✓Transparent fee structure with no hidden charges

- ✓Geographic diversification across multiple countries and loan originators

- ✓5-10% skin in the game from loan originators aligns interests

- ✓Quick verification process and easy account setup

- ✓Responsive customer support team

Cons

- ✗Returns can vary depending on market conditions and specific loan originators

- ✗Auto-Invest sometimes favors certain originators requiring occasional adjustments

- ✗Buyback processing can take longer than stated timeframes during busy periods

- ✗Limited liquidity - withdrawals take weeks to months as loans mature

- ✗Less regulated than traditional banking with corresponding risks

My Personal Experience

After several years of investing on the platform, I can share my genuine experience with what has become a reliable part of my investment portfolio. My experience has been largely positive, with steady returns that consistently outperform traditional savings accounts. The platform delivers on its promise of zero commission fees, which is refreshing in an industry where hidden charges can eat into profits.

Final Verdict

After several years with Lendermarket, I consider it a solid addition to a diversified investment portfolio. The platform delivers on its core promises of good returns and passive investing, though not without some minor inconveniences.

The combination of decent returns, zero fees, and automated investing makes it competitive in the P2P space. The buyback guarantee provides reasonable security, though it's not foolproof insurance.

What I appreciate most is the platform's transparency about fees and processes. There are no hidden charges, and the investment mechanism is straightforward to understand.

The main limitations are liquidity constraints and the need for occasional portfolio rebalancing. These aren't deal-breakers, but they're worth considering in your investment planning.

For investors seeking to diversify beyond traditional assets while maintaining a relatively passive approach, Lendermarket represents a reasonable option. Just ensure you understand the risks and don't invest more than you can afford to have tied up for extended periods.

Overall, it's a platform that does what it promises, with realistic expectations about both returns and limitations.