Loanch Review 2026: a Promising P2P Lending Platform with High Yields

An in-depth review of Loanch P2P lending platform with high returns above 13%

Quick Verdict

Loanch is a promising new P2P lending platform launched in 2023 offering attractive yields above 13.5% with a strong focus on investor safety through a 30-day buyback guarantee. The platform features transparent loan originators based in Asia, short-term loans for good liquidity, and an experienced management team.

Try LoanchWhat is Loanch?

As for all Peer-to-Peer lending platforms, Loanch is a financial platform that allows investors to invest in loans, along with other investors in order to get interests payments over time. Loanch is a relatively new platform, as it was launched in 2023. The company is incorporated in Hungary.

What I really like about this platform is that they offer high interests rates, above 13%. They also focus on complete safety for investors, for example by providing a 30-day buyback guarantee, compared to the 60-day period which is the market average. They also provide complete automatisation of the investment process, which is of course something I will verify in this review.

They mostly use loan originators in Asia, which is something I will explore more later in the review.

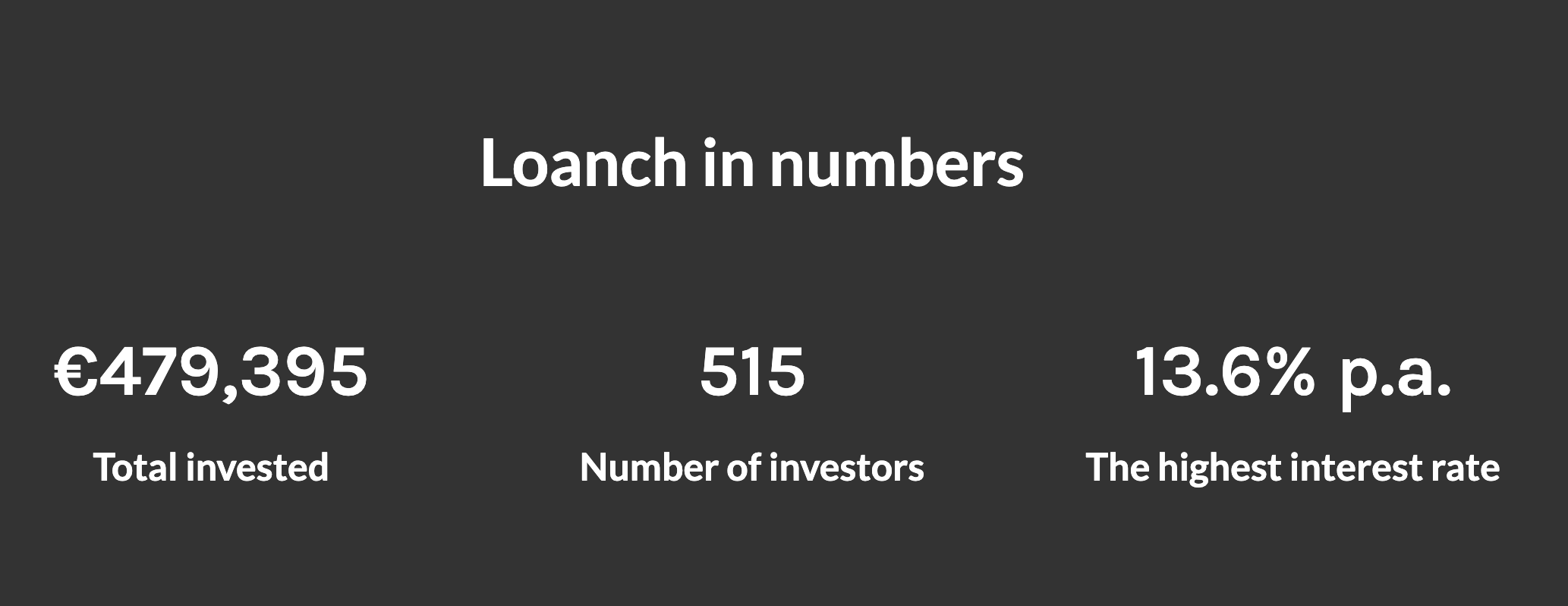

Having just launched, there is not a lot of historical statistics available at the moment about their number of users or amount of loans funded, but they already posted some data about their current investors & loans funded:

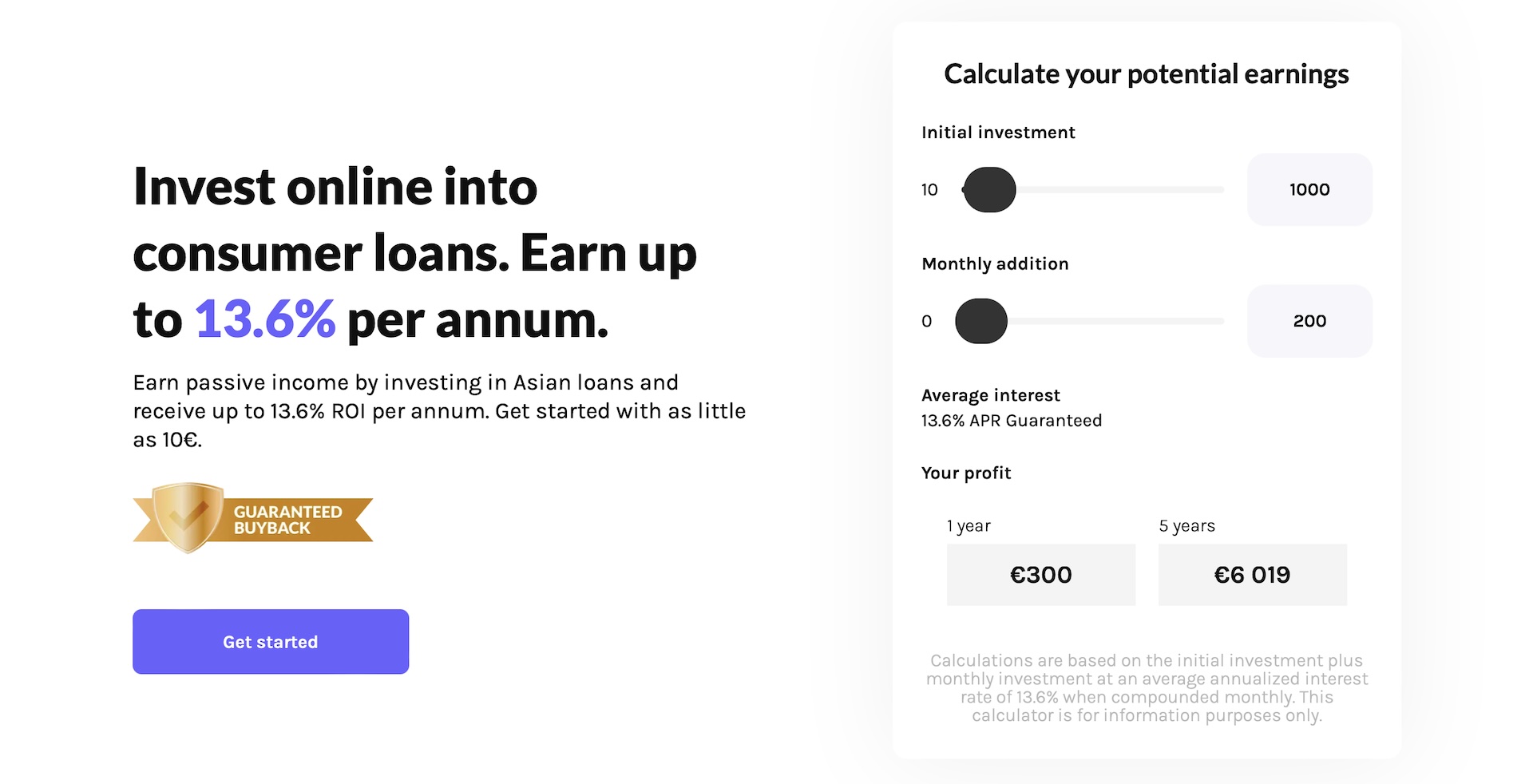

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on Loanch will of course depend on which loans you invest in. Currently, with the information from their loan originators listed on the platform you can get up to 13.6% of annual returns, and they advertise the same returns on their main page as well.

This is good as it is the above the average that you can get on several similar platforms in the field, and I will of course verify that when I talking about how to get started on the platform.

Of course, reinvesting your profits on the platform will give you a nice compound interest - and also you will get a quite good liquidity in your portfolio as most the loans present on the platform are short-term (some around 60 days), which is something I really like to see on a platform.

Investment Features

Loanch offers several features to make investing easy and profitable

Auto-Invest Function

Fully automated investment system that invests in loans based on your preferences, making passive investing effortless.

Short-Term Loans

Focus on loans with ~60 day duration providing excellent portfolio liquidity and faster reinvestment opportunities.

Cashback & Referrals

Regular cashback campaigns (currently 2%) and referral programs provide additional ways to generate income.

The minimum investment per loan is just €10, making it accessible for investors of all levels.

Is Loanch Safe?

Key safety features and regulatory compliance

30-Day Buyback Guarantee

All loans come with a buyback guarantee. If a borrower defaults, the loan originator buys back the loan within 30 days - faster than the 60-day industry standard.

Segregated Accounts

Investor funds are kept separate from company accounts, ensuring your money is protected and used only for loan investments.

Automated Identity Verification

Platform uses fully automated identity verification process and follows all GDPR regulations to ensure security and compliance.

Strong Due Diligence

Comprehensive vetting process for loan originators including background checks of main shareholders and detailed transparency reports.

🔒 Risks & Guarantees on Loanch

On Loanch, all loans present on the platform are coming with a buyback guarantee - meaning that if someone doesn't pay back his loan, after a period of time the loan will be automatically bought back by the loan originator and the money returned to the investors. This is now pretty standard on several platforms, but it is definitely something good to have for the security of your investments.

Here, the buyback period is of 30 days, which is lower than the 60 days period which is the norm on other European platforms. It means that even if something goes wrong with a loan, you won't have to wait more than 30 days to get your money back.

They also use segregated accounts - meaning that the money deposited by investors and that is used to fund loans is on another account than the company main account. This should be the standard on all platforms, but it's nice to see it written here.

They also put security as a priority of the platform - having for example a fully automated identity verification process, as well as following all the regulations in terms of GDPR.

👥 The Company & The Team

As I mentioned earlier, the company is incorporated in Hungary. As for all platforms I add to my portfolio I checked if the company was officially registered in Hungary, and it is indeed.

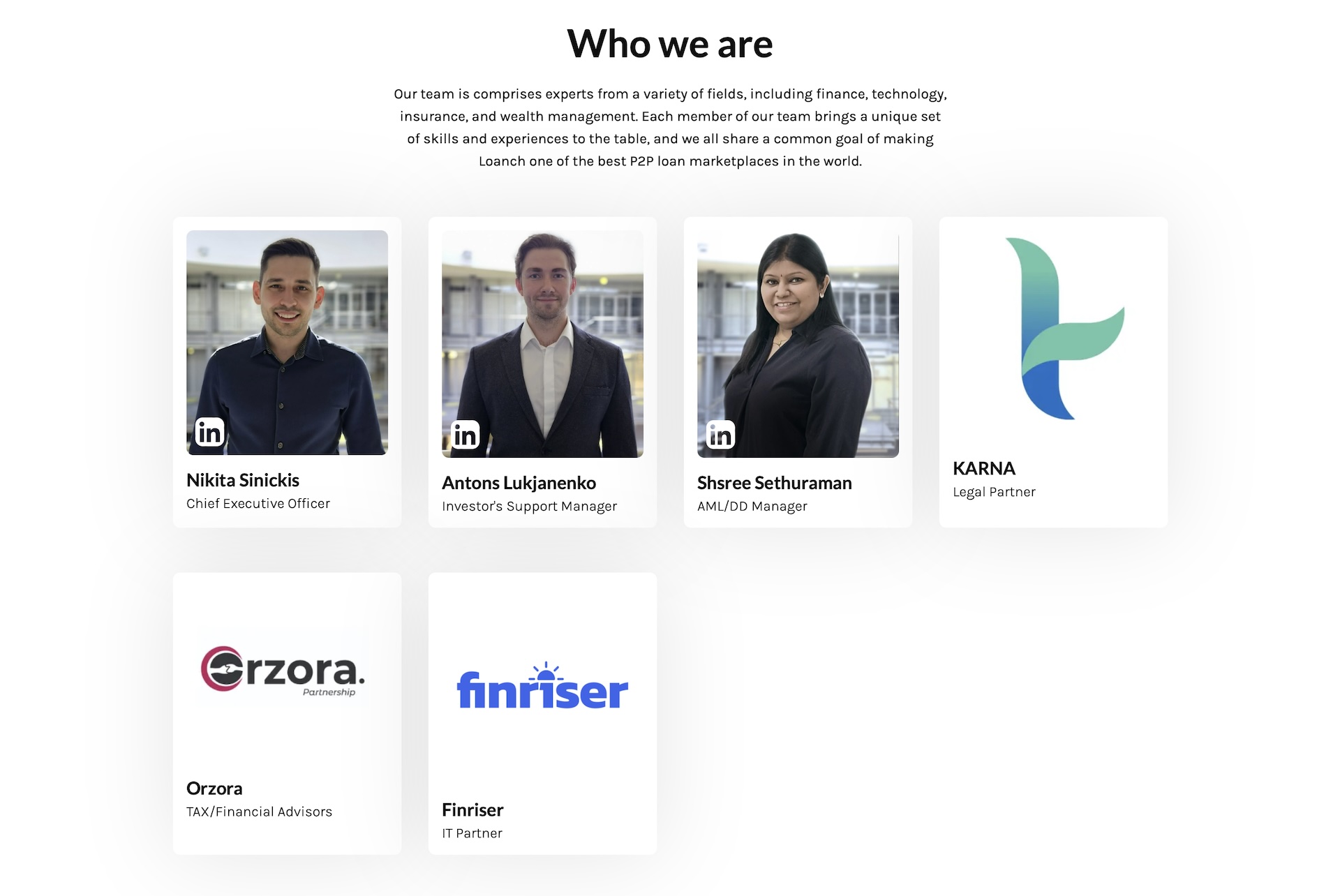

It was also very easy to find information about their team, which is something I really like to see on such a platform.

As for all the platforms I invest on, I checked the profiles of the management team of the platform to see their experience in the field. Especially here, as they put the experience of their team as a strong argument for the performance and reliability of the platform.

And indeed, they do have a really good team. Their CEO for example, Nikita Sinickis, has a unique background which is a mix of project management, engineering and finance. Indeed, with an education in engineering with a focus on business finance, and then experience in the insurance field & project management, he has the required skills to run such a platform. For him, launching this platform was a natural progression in his career, fuelled by him becoming an active investor in 2016 and his exposure and interest gained during his professional career while working on several projects in a start-up providing white-label solutions for P2P platforms.

They are also partners with Finriser, a SaaS platform that is powering several platforms in the field, some that I know for a long time, so that's definitely a good sign here.

So definitely a strong team of professionals with a lot of experience in the fintech & banking fields, which is a really good point for this platform.

Note that as several other platforms in the field, they also have a Telegram chat on which you can talk directly to their team.

🌏 Loan Originators

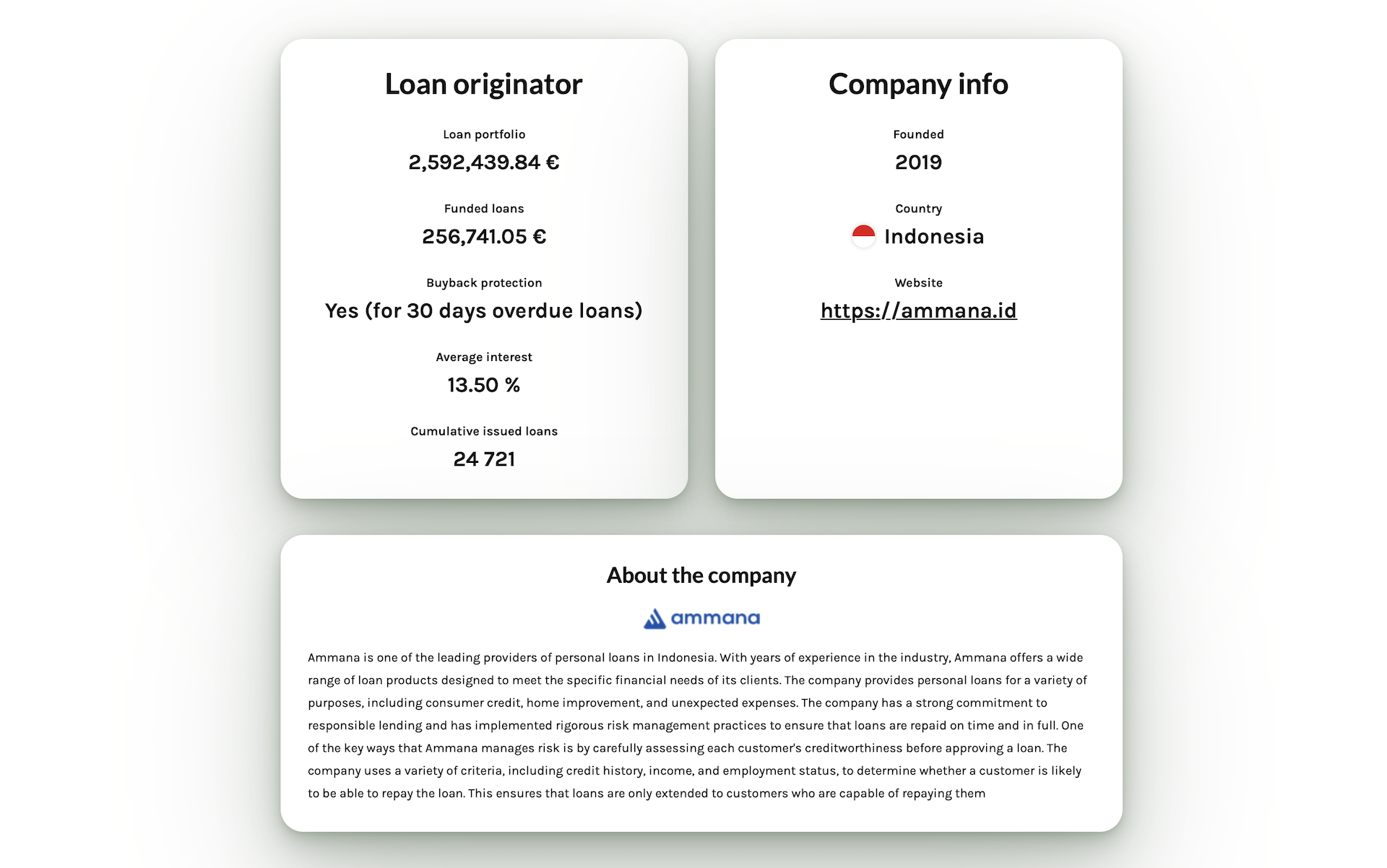

I always checked where the loans are coming from on a platform, as this is really important for the security of your investments. For example, they are responsible for paying the buyback guarantee that I mentioned earlier, so it's critical to make sure a platform is transparent about their loan originators before investing.

In the case of Loanch, they currently have three loan originators based in Asia.

It was also really easy to find more information about the loan originator present on the platform:

Overall, I like the fact they that they provide good transparency about their loan originators, as it was really easy to find more details about each loan originators:

They also do a strong due diligence process on each loan originator, including a background check of the loan originators main shareholders.

Getting Started on Loanch

Open an Account & Get Verified

Sign up for an account and complete the verification process. This includes automated ID verification and takes under 10 minutes to complete.

Deposit Funds

Transfer money to your Loanch account via bank transfer. The process is straightforward and your funds will be ready to invest once received.

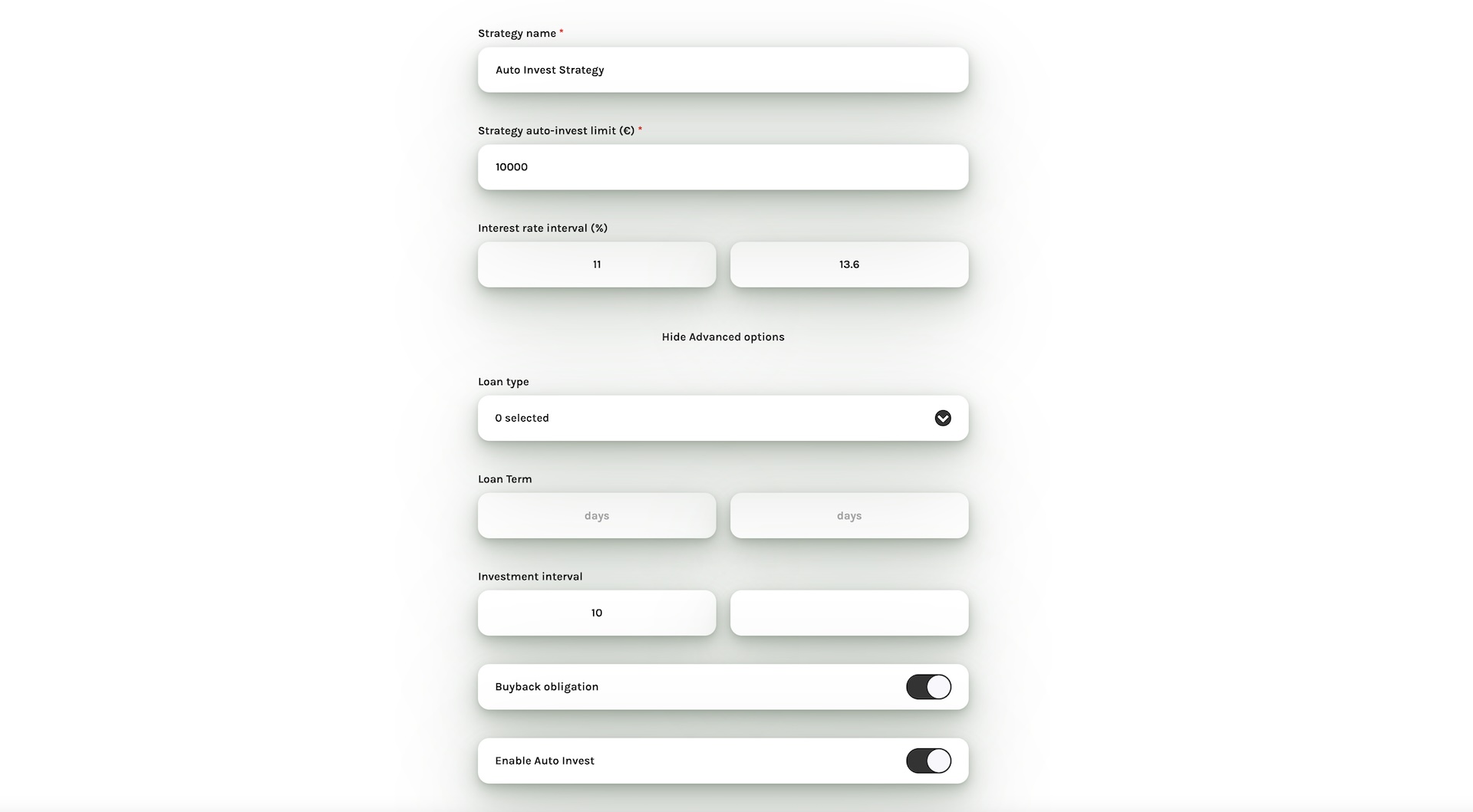

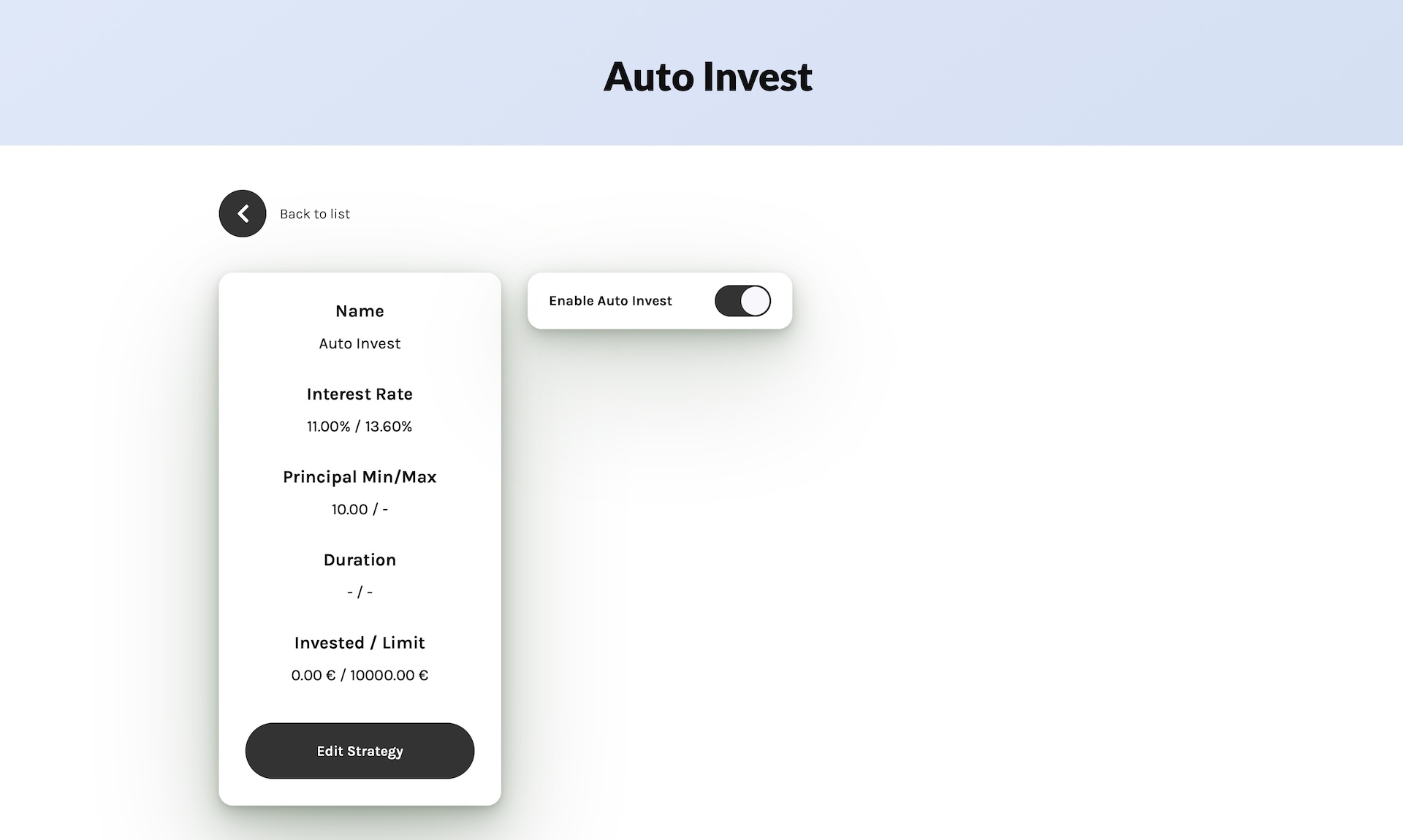

Set Up Auto-Invest

Configure the auto-invest function with your preferred settings (loan originators, interest rates, loan duration, investment amount per loan). This will automate all your investments on the platform.

Start Earning Returns

Once activated, auto-invest will automatically invest in loans matching your criteria. You can also browse and invest in loans manually if you prefer more control.

Pros & Cons

✅ Pros

- ✓High interest rates above 13.5% annually

- ✓Short 30-day buyback guarantee period (better than 60-day industry standard)

- ✓Focus on short-term loans (around 60 days) providing good portfolio liquidity

- ✓Full transparency about loan originators with detailed information

- ✓Experienced management team with strong fintech and finance backgrounds

- ✓Fully automated investment process with auto-invest function

- ✓Quick account verification process (under 10 minutes)

- ✓Fast withdrawals (1-2 days)

- ✓Segregated accounts for investor protection

- ✓Regular cashback campaigns and referral programs

❌ Cons

- ✗Relatively new platform launched in 2023 with limited track record

- ✗Limited number of loan originators (only three based in Asia)

- ✗No secondary market available yet

- ✗Limited historical statistics and performance data

My Results so far with Loanch

With the settings that I used on Loanch, I should get returns of around 13.5% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.