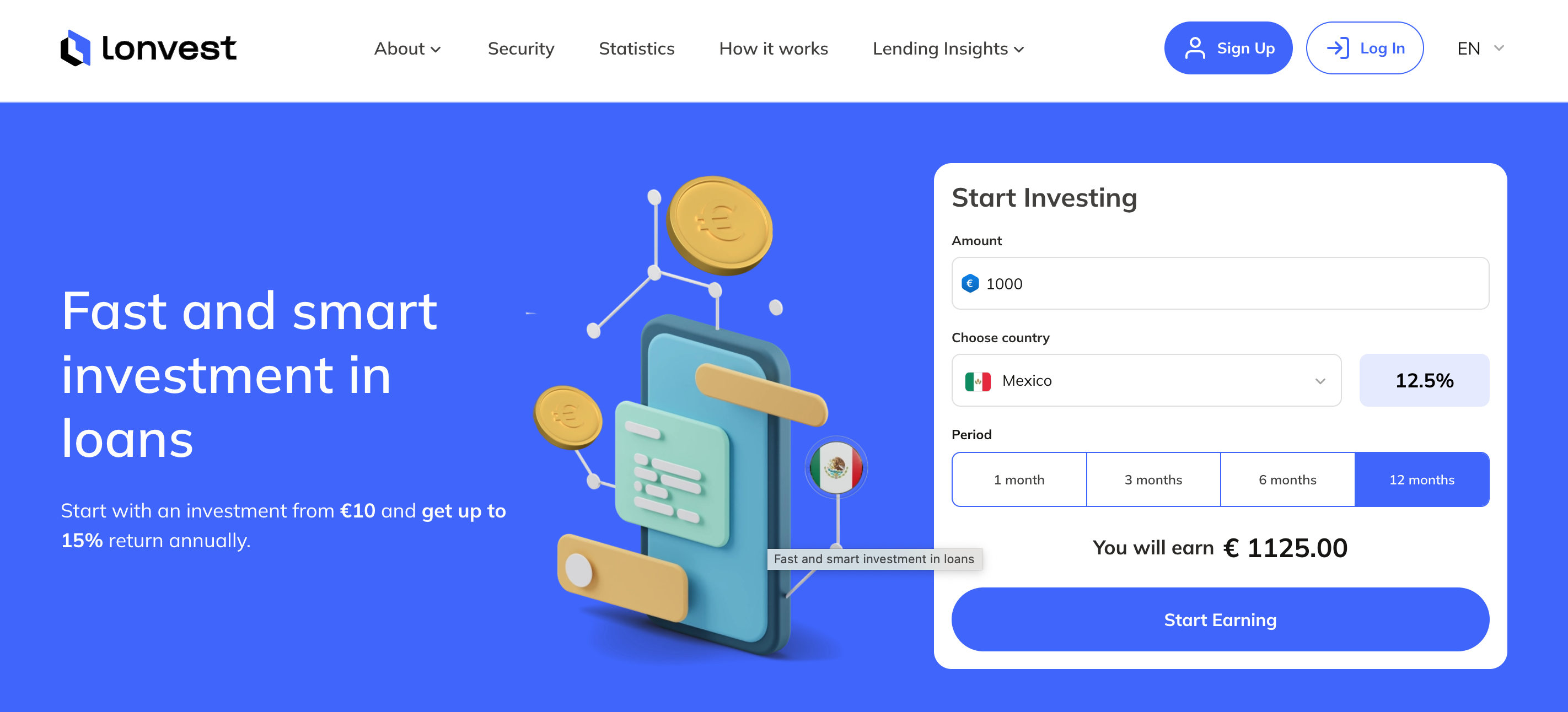

Lonvest Review 2026: a Peer-to-Peer Lending Platform with Integrated Loan Originators

Complete review of the Croatian P2P lending platform with controlled loan originators and 12% average returns

Quick Verdict

Lonvest is a regulated Croatian P2P lending platform with strong transparency through integrated loan originators. With 12% average returns, buyback guarantees, and an experienced team, it's a solid addition to any diversified P2P portfolio.

Try LonvestWhat is Lonvest?

As for all Peer-to-Peer lending platforms, Lonvest is a financial platform that allows investors to invest in loans, along with other investors in order to get interests payments over time. Lonvest is a really new platform, as it was launched in 2023. The company is incorporated in Croatia.

What I really like about this platform is that they completely control their loan originators - which provides additional transparency and stability to the platform, compared to a platform that uses external loan originators. They also focus on complete safety for investors, as well as providing complete automatisation of the investment process & high yields, which is of course something I will verify in this review.

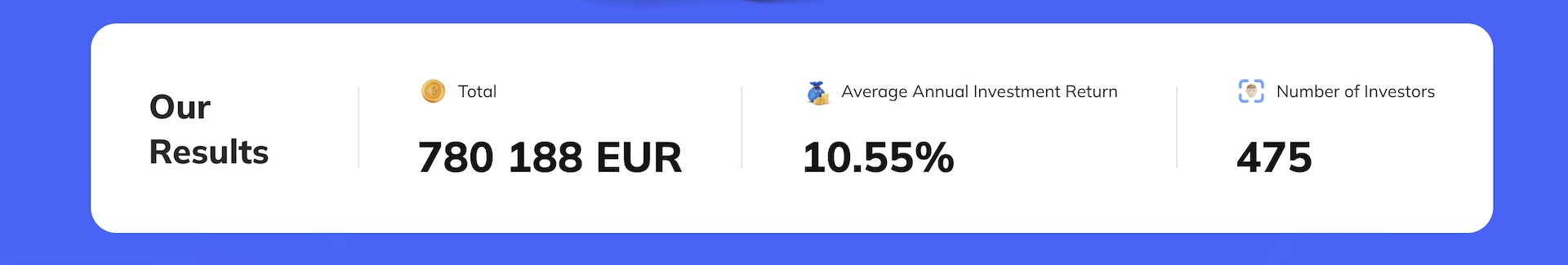

So far they issued on the platform over 220k Euros worth of loans on the platform, with over 100 registered investors.

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on Lonvest will of course depend on which loans you invest in. Currently, with the information from their loan originators listed on the platform you can get up to 13% of annual returns, and they advertise an average annual return of 12% for investors on their main page.

This is good as it is the average you can get on several similar platforms in the field, and I will of course verify that when I talking about how to get started on the platform.

Unique Platform Features

What sets Lonvest apart from other P2P lending platforms

Integrated Loan Originators

Unlike most platforms, Lonvest controls all loan originators in-house, providing unprecedented transparency and stability

Full Automation

Complete investment automation through their auto-invest function ensures your money is always working for you

Referral Program

Earn 1% cashback on your friends' investments (up to €1000) for the first 30 days when you refer them to the platform

The combination of controlled loan originators and full automation makes Lonvest one of the most transparent and hands-off P2P platforms available.

Is Lonvest Safe?

Key safety features and regulatory compliance

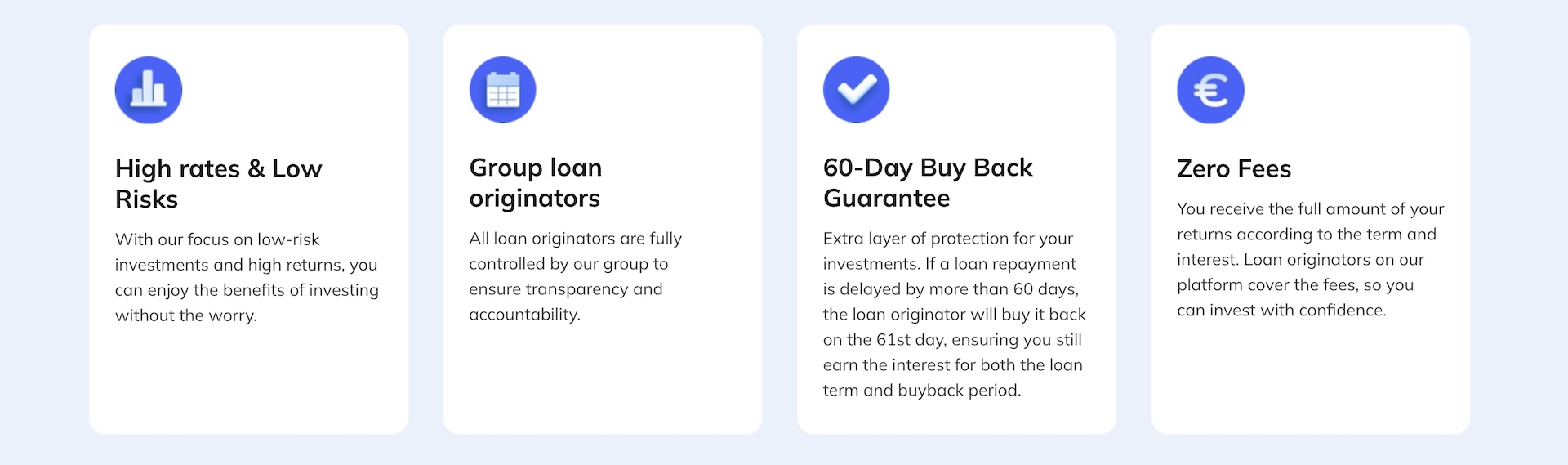

Buyback Guarantee

All loans come with buyback guarantee - if a borrower defaults, the loan originator automatically buys back the loan and returns money to investors

Group Guarantee

Additional protection layer through group guarantee system that provides extra security for investor funds

AI-Powered Security

Advanced AI-powered identity verification process ensures platform security and GDPR compliance

Controlled Loan Originators

Platform controls all loan originators in-house, providing maximum transparency and stability compared to external originators

🛡️ Risks & Guarantees on Lonvest

On Lonvest, all loans present on the platform are coming with a buyback guarantee, along with a group guarantee - meaning that if someone doesn't pay back his loan, after a period of time the loan will be automatically bought back by the loan originator and the money returned to the investors. This is now pretty standard on several platforms, but it is definitely something good to have for the security of your investments.

As I mentioned earlier, they control all the loan originators present on the platform, which is something I'll talk about more when talking about all the loan originators on the platform.

They also put security as the priority of the platform - having for example an AI-powered identity verification process, as well as following all the regulations in terms of GDPR.

You can also read more about all the regulation & legal details regarding Lonvest on their Terms & Conditions page.

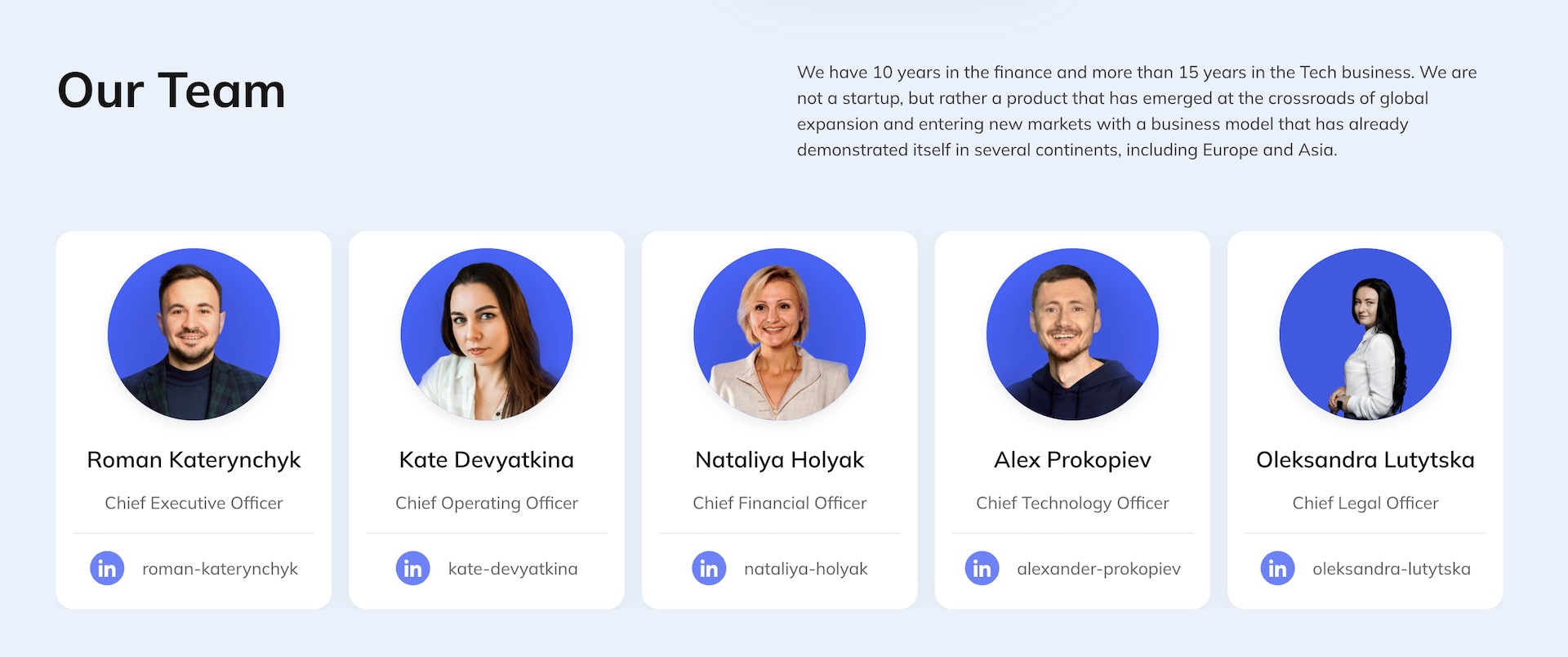

👥 The Company & The Team

As I mentioned earlier, the company is incorporated in Croatia. As for all platforms I add to my portfolio I checked if the company was officially registered in Croatia, and it is indeed.

It was also very easy to find information about their team, which is something I really like to see on such a platform, with a direct link to the LinkedIn profile of each of the main team members:

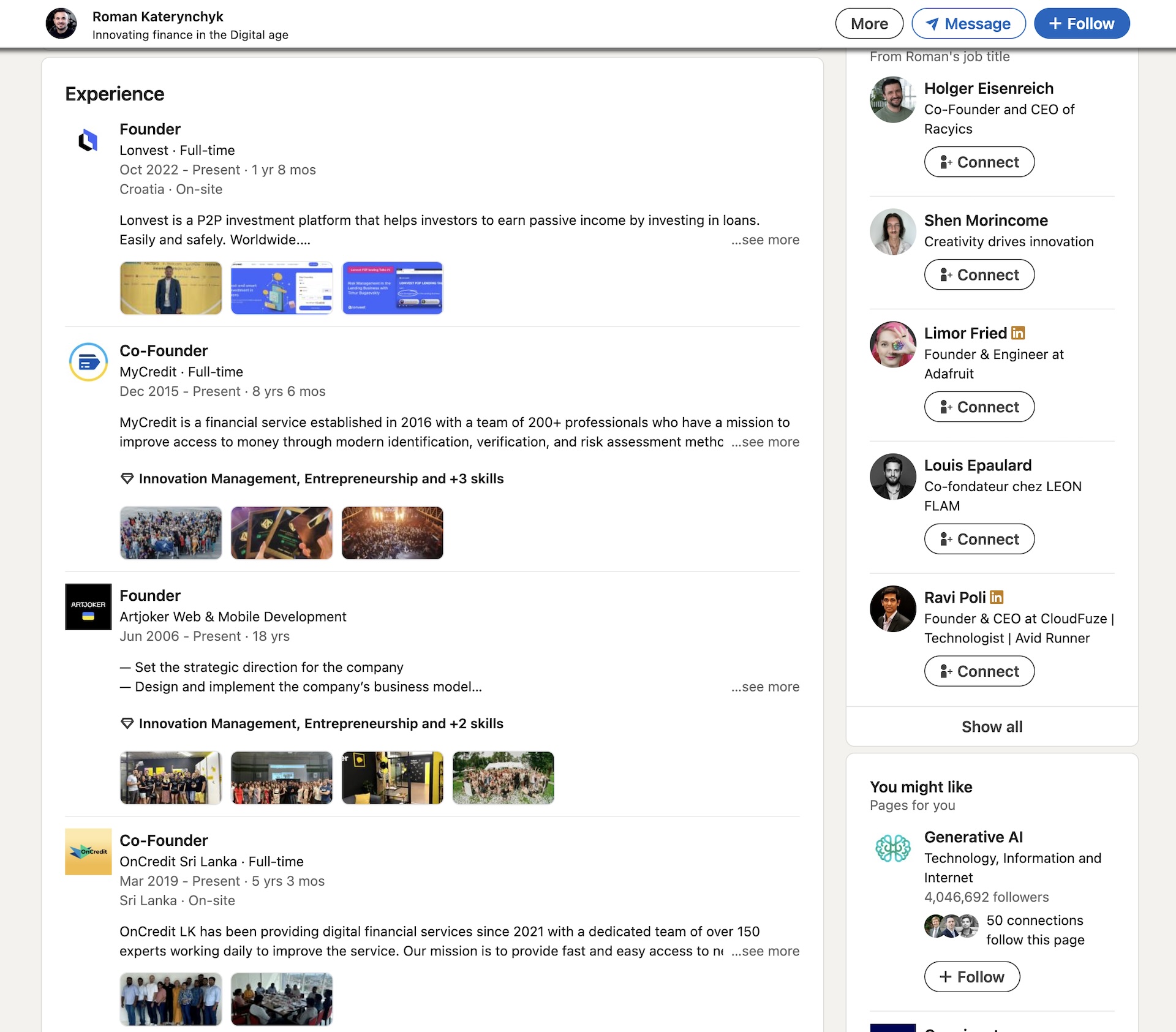

As for all the platforms I invest on, I checked the profiles of the management team of the platform to see their experience in the field. Especially here, as they put the experience of their team as a strong argument for the performance and reliability of the platform.

And indeed, they do have a really strong team. Their CEO for example, Roman Katerynchyk, has a strong experience in the field of finance:

You can see for example that he worked as well since 2015 in the loan originators that Lonvest uses.

The rest of their team is composed of really experience people as well, for example their COO Kate Devyatkina who has over 13 years of experience in the marketing field.

So definitely a strong team of professionals with a lot of experience in the P2P lending field, which is a really good point for this platform.

🏦 Loan Originators

I always checked where the loans are coming from on a platform, as this is really important for the security of your investments. For example, they are responsible for paying the buyback guarantee that I mentioned earlier.

In the case of Lonvest, they are different from other platforms in the field as they control all the loan originators that are present on the platform. It allows the platform to provide much more stability and transparency, and also provide the group guarantee that I mentioned earlier.

It is also really easy to find more information about the loan originators present on the platform:

I really like the fact that non only they control their loan originators, but also that they actually have a good diversity of loan originators. You can also click on each of them to get more information about their past performance.

Overall, I think it's one of the platform I invested on that provides the best transparency about their loan originators, so definitely a good point for the platform here.

Getting Started on Lonvest

Open Account & Get Verified

Sign up for a Lonvest account and complete the ID verification process. This takes less than 5 minutes thanks to their streamlined AI-powered verification system.

Deposit Funds

Transfer money to your Lonvest account via bank transfer. They support instant SEPA transfers, so your funds can arrive in under 10 minutes if your bank supports it.

Configure Auto-Invest

Set up the auto-invest function with your preferred settings. The platform only offers automated investing, which ensures your money is continuously working for you across diversified loans.

Start Earning Returns

Once auto-invest is activated, your money will be automatically invested in loans matching your criteria. You'll start generating interest immediately as your funds are deployed across the platform.

Pros & Cons

✅ Pros

- ✓Integrated loan originators controlled by the platform for maximum transparency

- ✓12% average annual returns with up to 13% on top loans

- ✓Buyback guarantee on all loans for investor protection

- ✓Group guarantee providing additional security layer

- ✓Experienced management team with strong P2P lending background

- ✓Quick registration and verification process (under 5 minutes)

- ✓Instant SEPA transfers supported for fast deposits

- ✓Full automation through auto-invest function

- ✓Good diversity of loan originators

- ✓AI-powered identity verification for security

❌ Cons

- ✗Very new platform launched in 2023 with limited track record

- ✗Only auto-invest available, no manual loan selection

- ✗Smaller loan volume compared to established platforms (€220k issued)

My Results with Lonvest

With the settings that I used on Lonvest, I should get returns of around 12% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.