Mintos Review 2026: My Results after 6 Years

Detailed review of Europe's largest P2P lending platform with 6 years of real investment data

Quick Verdict

After 6 years of investing, Mintos remains one of the most reliable P2P lending platforms with consistent 11.48% returns. The platform's investment firm license, 60+ loan originators, and €600M+ in assets make it ideal for diversified passive income investing.

Try MintosWhat is Mintos?

Mintos is a multi-asset platform based in Latvia and is currently the largest multi-asset platform in Europe, with over €600M+ in assets under administration. They currently have over 600K+ investors, coming from all over the world. They also reached profitability back in 2017, which is a very good sign for a multi-asset platform.

Mintos offers multiple wealth building assets, but their core product is investing in Loans via their marketplace. They are working with several loan originators to propose loans to the marketplace. They currently have 64 different loans originators, meaning that investors can diversify their investments in several countries, and also several loan types.

They also won several awards of the years, including the AltFi's 'People's Choice Award' for three years in a row, and they have a very good rating of 4 stars over 5 on Trustpilot, meaning it's a platform that is really popular amongst its users.

What Returns Can You Expect?

Real returns based on my investing experience

On their homepage, Mintos advertises a 11.5% average return for their investors. My personal return over the past years is currently at 11.48%, which is really close to the rate they advertise. I've also been investing in the platform since August 2015, and the returns have always been consistent.

The returns were slightly lower during the COVID-19 crisis, as some payments were delayed on the platform. However, Mintos made good efforts in recovering all the money that was not paid back on time, and in 2022 the yield picked up again and is slowly going back to around 12%.

Notes System - Instant Diversification

Mintos offers Notes, which are financial instruments that package multiple loans together for instant diversification and stable returns.

Bundled Loans

Each Note contains multiple loans packaged together as a financial instrument

Instant Diversification

Invest in several loans at once with every Note purchase

Stable Income

More consistent returns compared to investing in individual loans

Notes are only available on regulated platforms with an investment firm license, making Mintos unique in the P2P lending space.

Is Mintos Safe?

Key safety features and regulatory compliance

Investment Firm License

First P2P platform to receive an investment firm license in 2021, ensuring regulatory compliance and investor protection

Investor Compensation

All funds guaranteed by investor compensation schema up to €20,000 due to regulated status

64 Loan Originators

Massive diversification across multiple countries and loan types with transparent risk scoring

Financial Stability

Reached profitability in 2017 and manages €600M+ in assets with 600K+ active investors

🏛️ The Platform

There are many things that are included on Mintos to make sure that you only take a reduced amount of risk when investing on the platform.

The one thing in terms of safety that really sets Mintos aside is that they received an investment firm license in 2021, making it the first platform of this kind to receive such a license:

This is a really good point for the safety of investors money, as it certifies they have to follow a lot of rules to manage the money from investors.

Following the obtention of this license, they also started to offer financial instruments on their platform that are called Notes:

Basically, Notes are groups of individual loans that are packaged together into a financial instrument. This means instant diversification for the investor, as you invest in several loans at once every time. Compared to investing in individual loans, Notes also provide a more stable income for the investors.

Because of Mintos being a regulated platforms, all funds you have on the platform are also guaranteed by the investor compensation schema, up to 20,000 Euros.

Finally, as I already mentioned earlier, the fact that it is the largest platform in Europe & that they have some many loan originators means that it is really easy to have a very diversified portfolio on Mintos, reducing even more the level of risk on your investment.

👥 The Company & the Team

Next, I also checked the company itself, and the team running it.

First, I checked that the company was actually registered in Latvia, and I could indeed find it in the company registry of the country.

I also tried to find who is actually working at Mintos, and it was really easy to find some of the key employees from the main page of their site:

I also checked the profiles of the management team of Mintos, for example of their CEO Martins Sulte. Before co-founding Mintos, he actually spent over 6 years as an investment banker at SEB, which is a large banking group that is present in Scandinavian countries & the Baltics. This shows that he definitely has experience in the field of investing.

I also talked with him several times over Skype calls, whereas it was for my Youtube channel & podcast or just to talk about Mintos, and for sure he is someone that knows what he is talking about.

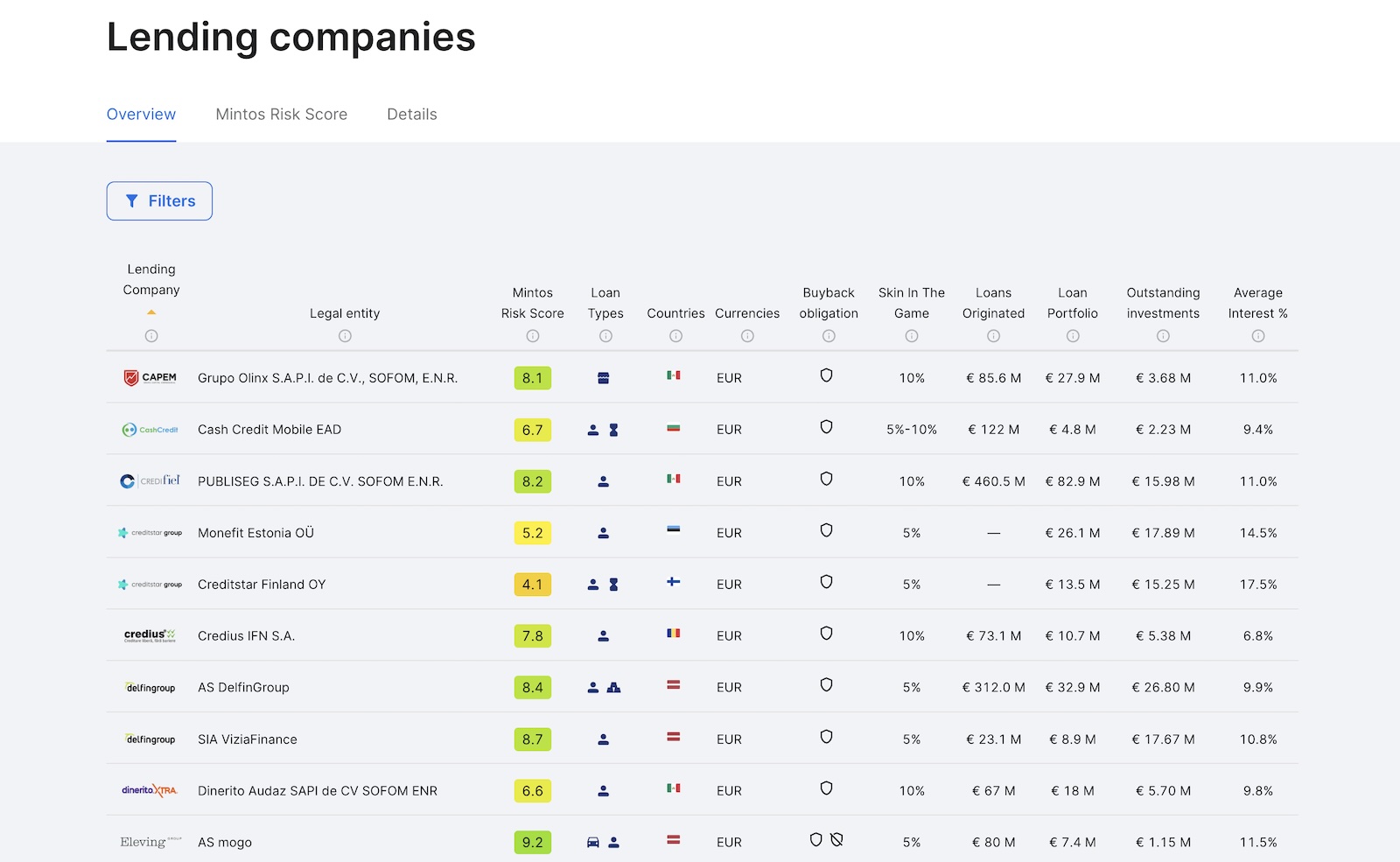

🏦 Loan Originators

Let's now talk about loan originators that are present on Mintos. I appreciated the fact that the platform is fully transparent about the loan originators that they use, and they even made a really nice page where you can explore they current loan originators:

As for many other Peer-to-Peer lending platform, they had some issues during the COVID-19 crisis in 2020 and 2021, and several loan originators had issues as well. However, they communicated very well with investors on the matter (where other platforms were really silent), and now all the issues have been resolved. They also introduced their own risk score for loan originators, which is really useful to set the level of risk you want on your portfolio.

I also like the fact that they have over 60 different loan originators from all over the globe, meaning you can get a really diversified portfolio on Mintos.

Getting Started on Mintos

Create Your Free Account

Open a free account on Mintos website. Takes less than 5 minutes including identity verification step.

Deposit Funds

Transfer money to your Mintos account using their provided bank details. Money typically arrives in one day.

Choose Investment Strategy

Either browse and select Notes manually, or set up automated strategies like Core Loans for passive investing.

Start Earning Returns

Your money will be automatically invested according to your strategy, earning around 11.5% annual returns.

Pros & Cons

Pros

- ✓Europe's largest P2P lending platform with €600M+ in assets

- ✓Investment firm license received in 2021 - first platform of its kind

- ✓Over 60 loan originators providing excellent diversification

- ✓Consistent 11.5% average returns with stable performance

- ✓Investor compensation up to €20,000 included

- ✓Notes system provides instant diversification and stable income

- ✓Reached profitability in 2017 showing financial stability

- ✓Excellent communication during COVID-19 crisis

- ✓Easy automated investment strategies available

- ✓Active secondary market for liquidity

Cons

- ✗Some loan originators had issues during COVID-19 crisis

- ✗Returns temporarily decreased during pandemic period

- ✗Platform can be overwhelming for beginners due to many options

- ✗Identity verification required before investing

- ✗Some loan originators carry higher risk levels

My Personal Results

So far, I managed to get an annual return of 11.48% on my investments. This number was slightly lower than that during the COVID-19 crisis, as Mintos was hit by the crisis like most platforms, which resulted in some payments being delayed on the platform and therefore a lower yield. However, they did good efforts in recovering all the money that was not paid back on time, and in 2022 the yield picked up again and it slowly going back to around 12%.

Overall, I can say that I still got very solid results from Mintos after all those years of investing on the platform. Of course, I will update this section regularly as I have more results coming from the platform.