PeerBerry Review 2026: My Results After Over 2 Years

My personal experience investing €1,000+ in PeerBerry over 2+ years with 10.91% returns

Quick Verdict

PeerBerry is a reliable P2P lending platform offering 10-12% returns with full buyback guarantees on all loans. After over 2 years of investing, my portfolio has achieved 10.91% annual returns with excellent liquidity and transparency from the loan originators.

Try PeerBerryWhat is PeerBerry?

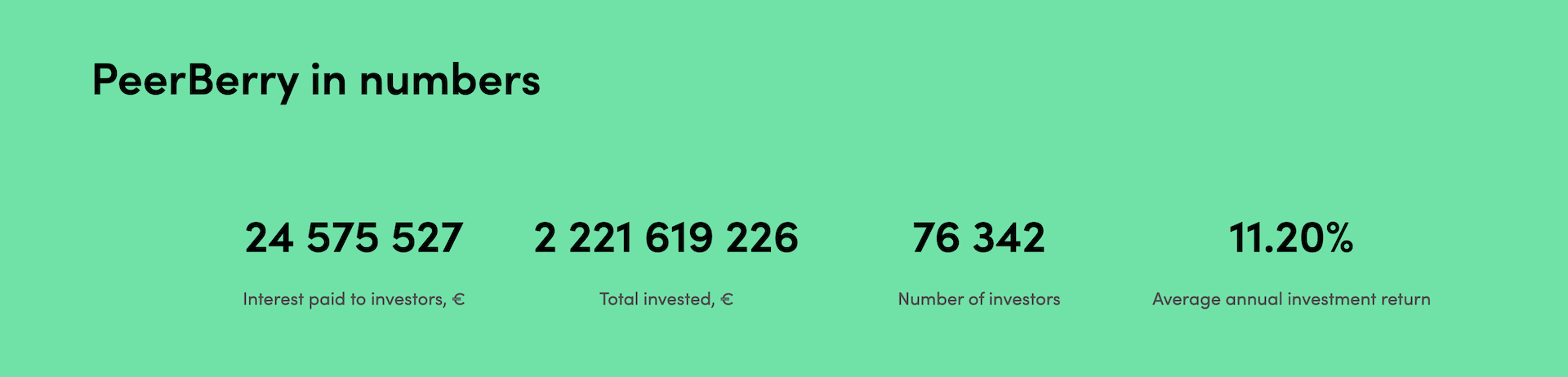

PeerBerry is a Peer-to-Peer lending platform based in Latvia and offers loans with returns up to 12%, which is similar to what is offered by many European Peer-to-Peer lending platforms. The platform lists loans from Lithuania, Poland, Czech Republic, Denmark, and Ukraine. They now have over 13,000 investors and funded over 128 million Euros worth of loans.

All loans offered on PeerBerry are in Euros, which protects you from currency swings for loans that are in countries not using Euros (like Poland or Ukraine).

What Returns Can You Expect?

Real returns based on my investing experience

As I mentioned earlier, most loans on the platform have returns around 10 - 12%, and the platform currently advertises an average return for investors which is close to 11% per year.

My estimated annual return is at 10.91%, which makes sense as I mostly invested in loans with a yield around 11%. The returns are consistent and automated through the auto-invest feature, which continuously reinvests both principal and interest payments.

Auto-Invest Feature

PeerBerry offers a powerful auto-invest feature that completely automates your investments across the platform.

Easy Setup

Simple configuration with few parameters - select countries, interest rates, and loan terms to match your criteria

Automatic Diversification

Automatically spreads investments across multiple loans matching your criteria for instant diversification

Continuous Reinvestment

Automatically reinvests both principal and interest payments to compound your returns

I activated all countries, with interest rates above 9%. Once I activated the auto-invest portfolio on PeerBerry, it quickly invested all the money I deposited in loans that matched my criteria.

Is PeerBerry Safe?

Key safety features and regulatory compliance

Buyback Guarantee

All loans on the platform come with a buyback guarantee, ensuring you get your money back even if a loan defaults

Short-Term Loans

Many short-term loans available ensuring your money isn't stuck for long periods and providing better liquidity

Euro-Denominated

All loans are in Euros, protecting investors from currency fluctuations in non-Euro countries

Transparent Team

Full transparency about the team and management, including detailed backgrounds of key personnel

🛡️ Risks & Guarantees on PeerBerry

All the loans listed on the platform comes with a buyback guarantee, meaning that even if a loan goes in default, you will still get your money back from the platform. So that's a great thing to have as an investor. They have a lot of short-term loans, which is something I really like as it makes sure your money is not stuck in loans for long periods of time.

You can also invest on PeerBerry for just 10 Euros in each loan, meaning it's really easy to quickly have a diversified portfolio on the platform.

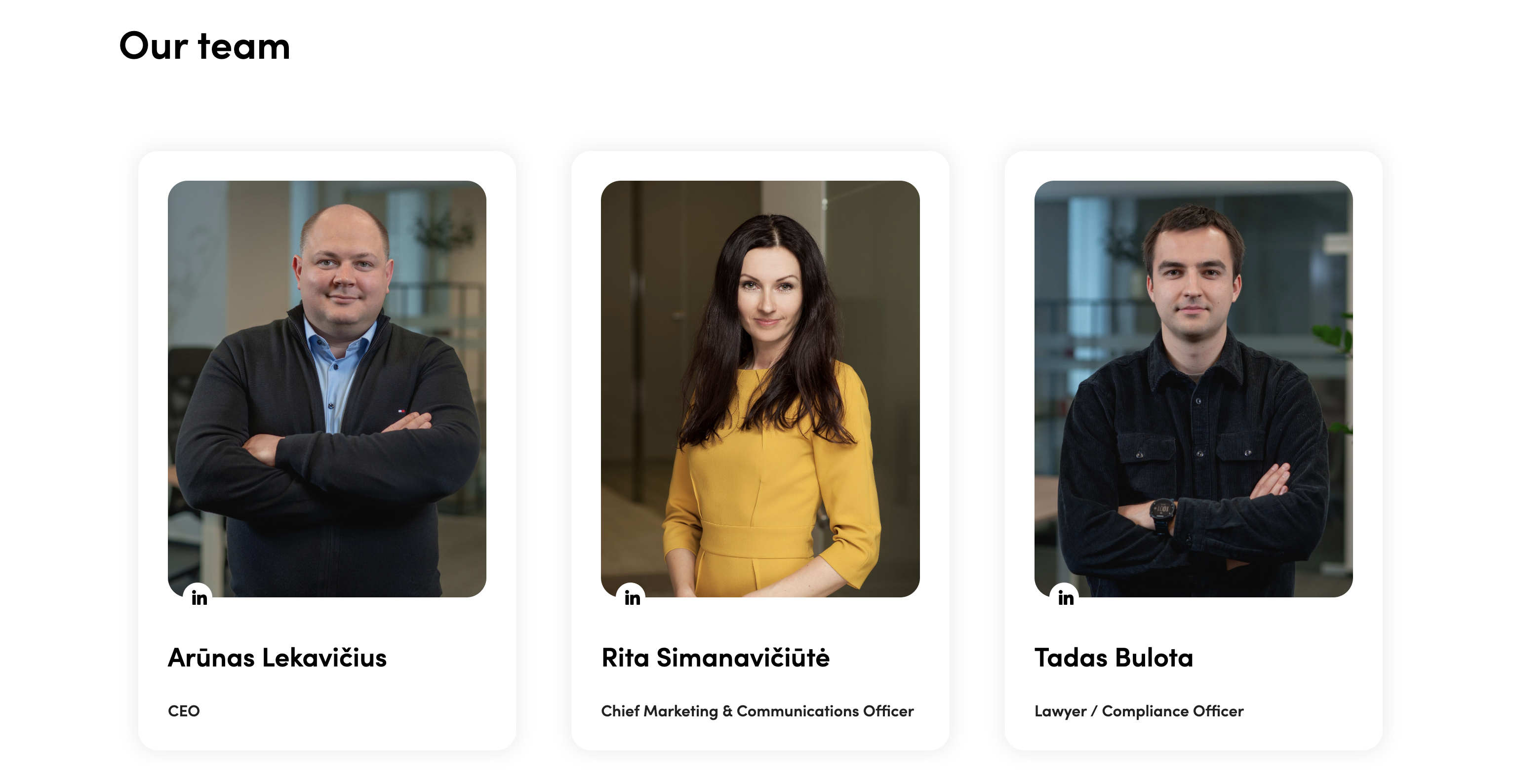

👥 The Company & The Team

As for all Peer-to-Peer lending platforms I add to my portfolio, I also check the company itself and see what they are doing in terms of security & safety of the investors funds.

PeerBerry is very transparent about their team, and I had no issues finding who is currently on their team and what are their roles.

For example, their CEO Arunas Lekavicius worked in another financial services companies for over 8 years before becoming the CEO of PeerBerry.

🏢 Loan Originators

I also always do a close examination of the loan originators a platform uses, as this is usually where a platform will encounter problems if anything bad happens like a financial crisis.

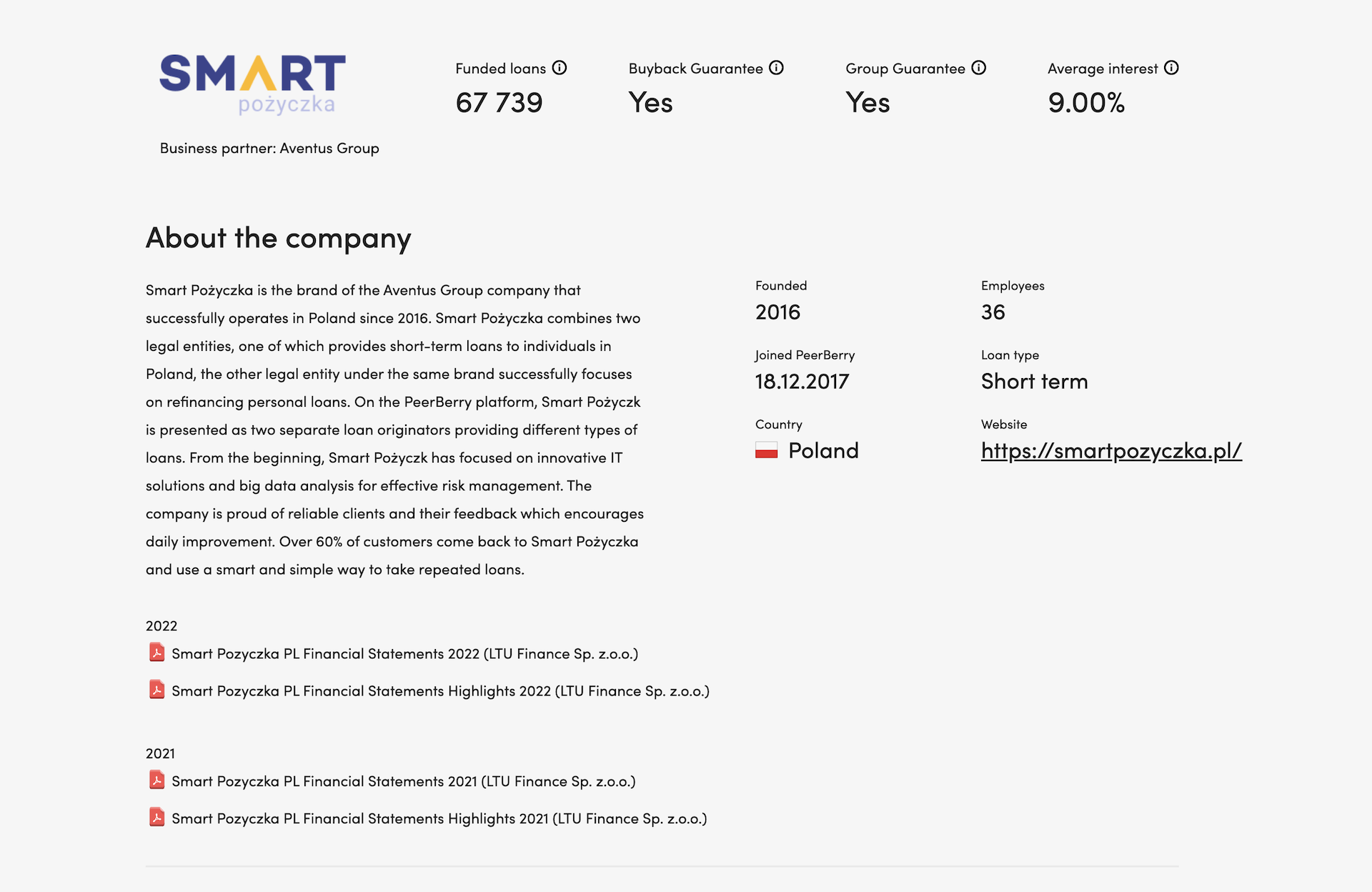

PeerBerry mainly works with a partner called the Aventus Group for its loan originators, which provides loans from Poland & Ukraine on the platform. They also works with several other loan originators, providing loans in countries like the Czech Republic and Lithuania.

Overall, I really liked the fact that they are fully transparent with their loan originators, and it is really easy to find detailed information about each of them on the website of PeerBerry.

The combination of all those factors makes it really safe to invest on PeerBerry compared to other Peer-to-Peer lending platforms.

Getting Started on PeerBerry

Open Your Account

Sign up on PeerBerry - the process is really easy and takes under 5 minutes to complete

Deposit Funds

Transfer money to your account via bank transfer or TransferWise - funds typically arrive in less than 2 days

Configure Auto-Invest

Set up your auto-invest preferences by selecting countries, interest rates (9%+), and loan terms that match your investment goals

Start Investing

Let the auto-invest feature automatically invest your funds in loans matching your criteria and start earning returns

Pros & Cons

✅ Pros

- ✓All loans come with buyback guarantee protection

- ✓High returns of 10-12% per year

- ✓Low minimum investment of just €10 per loan

- ✓Short-term loans available for better liquidity

- ✓All loans denominated in Euros (no currency risk)

- ✓Transparent about team and loan originators

- ✓Easy auto-invest feature for automation

- ✓Fast withdrawals (2 days)

- ✓Over €128 million in funded loans

- ✓Simple account opening process (under 5 minutes)

❌ Cons

- ✗Platform is relatively new compared to established competitors

- ✗Limited to European markets only

- ✗Relies heavily on Aventus Group for loan origination

- ✗Real estate loans have longer terms (up to 1 year)

My PeerBerry Investment Results

When I first started to invest in the platform, I immediately activated the auto-invest function, and also made deposits for a total of 1000 Euros over the first months of investing. I also made one withdrawal to check if everything was working fine to get your money back (and it does!).

It's now been over a year that I invested on the platform, and I can say that so far, everything is working as expected. My estimated annual return is at 10.91%, which makes sense as I mostly invested in loans with a yield around 11%.