Reinvest24 Review 2026: My Results After 4 Years

Real estate crowdfunding platform with equity-based projects and monthly rental income

Quick Verdict

Reinvest24 is an excellent equity-based real estate crowdfunding platform that delivers consistent rental yields around 7-8% with monthly distributions. After 4 years of investing with solid results and no issues, I highly recommend it for building a diversified real estate portfolio.

Try Reinvest24What is Reinvest24?

Reinvest24 is a real estate crowdfunding platform based in Tallinn, Estonia. The platform launched in 2018 and has already funded over 10 million worth of real estate projects, returning over 3 million back to investors as profit.

What is really nice about Reinvest24 is that they focus on real estate equity projects, meaning that you actually become the owner of part of the projects, just like you would when you buy an apartment to rent it for example.

For the investor, this means that you will get monthly distributions of the rental income of the property, of course, proportional to the number of shares you own in the project. And if the property is sold (usually at the end of the predefined period of time), you will also get profits from the capital growth of the property, just like you would in 'classical' real estate investing.

What Returns Can You Expect?

Real returns based on my investing experience

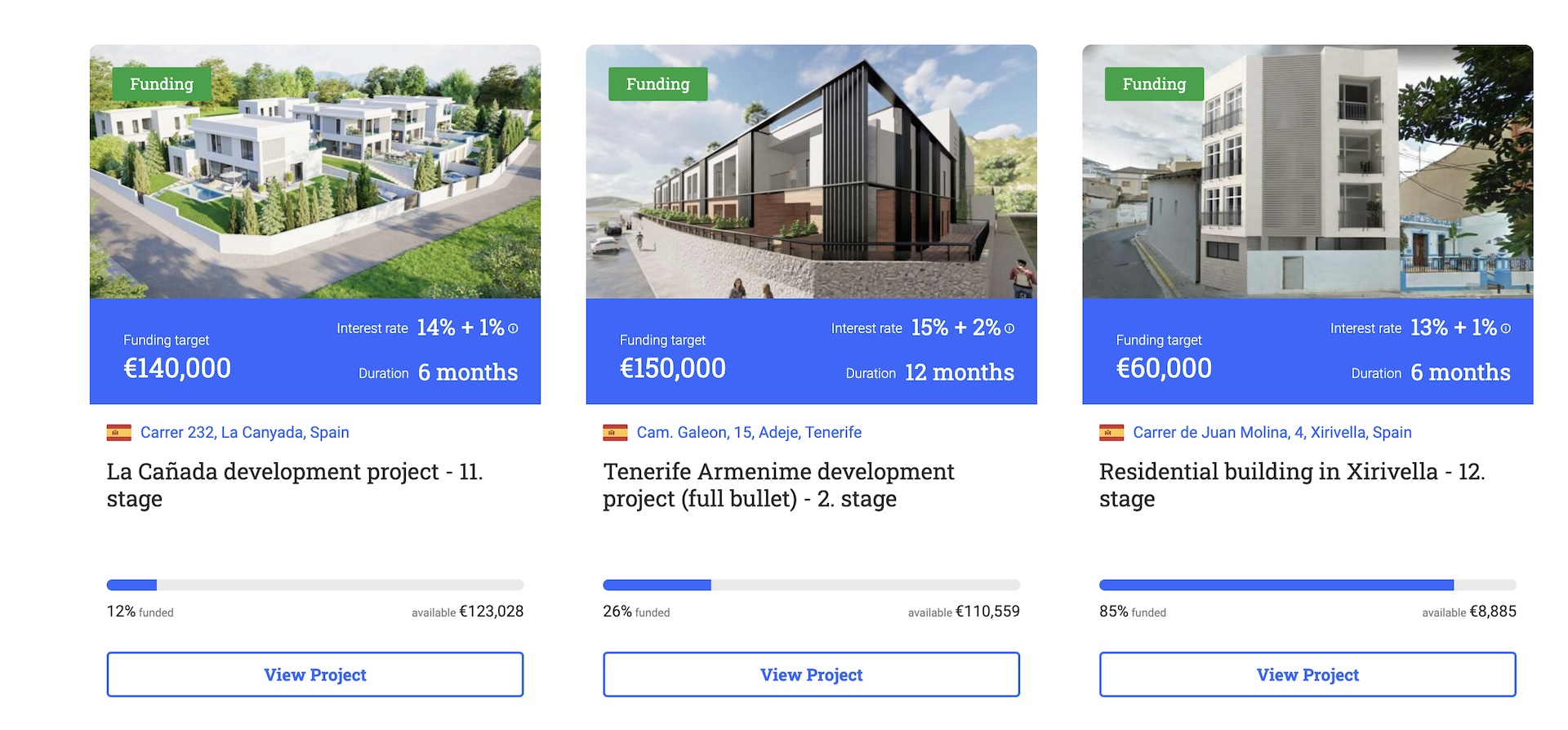

Reinvest24 advertises an average 14.6% annual return rate on the platform (from rental income & capital growth combined). Most properties listed on the platform have a yield of around 8% and a yearly capital growth around 5%.

Having invested in the platform since December 2018, it is still way too early to calculate my own overall yield on the platform, but so far all payments have been made on time and with a yield close to what was expected.

Equity-Based Real Estate Crowdfunding

Unlike traditional debt-based platforms, Reinvest24 offers true property ownership through equity investments

Monthly Rental Income

Receive regular monthly distributions from rental income proportional to your ownership shares

Capital Growth

Benefit from property value appreciation when projects are sold at the end of the investment period

True Ownership

Become a real property owner through SPV structure, just like traditional real estate investing

Get the benefits of real estate ownership without the hassles of property management

Is Reinvest24 Safe?

Key safety features and regulatory compliance

Property Collateral

Your investment is secured by the actual property, ensuring you retain value even in worst-case scenarios

SPV Protection

Each property has its own SPV company structure, protecting investors even if the platform closes

Strict Property Selection

Properties evaluated on market liquidity, vacancy index, and price growth expectations

Easy Diversification

€100 minimum allows building a diversified portfolio across multiple properties

🏠 Equity-Based Investment Security

As mentioned earlier, Reinvest24 mainly focuses on equity-based real estate crowdfunding, meaning you become an owner of the property along with other investors.

As for all real estate crowdfunding platforms, the collateral for each project is the property itself, meaning that the money you invest is actually guaranteed by the piece of property that you get. You could still lose some money of course, for example, if the real estate market goes down or the property doesn't have a tenant, but this is the risk that comes with any real estate investment. But compared to an unsecured loan where you can lose all your investment, with property you are sure to get at least a good part of your investment back in the worst-case scenario.

✅ Property Selection Criteria

The team at Reinvest24 also focuses on only selecting the best properties to put on their platform. For each property, they evaluate three criteria:

How easy it will be to sell the property on the market

The vacancy index, or how easy it will be to find a tenant

The price growth expectation, or what is the typical capital growth for similar properties

📊 Diversification Strategy

You can also invest from 100 Euros in each property, meaning that you can invest in many properties on the platform even with small capital. This means that you should definitely invest in as many properties as possible to reduce the risk you are taking on the platform. Indeed, if you have for example 10 properties in your portfolio, the impact of one tenant not paying for a month will be significantly lower than if you just had one property.

🏢 SPV Structure Protection

Finally, for each property, an SPV (Single Purpose Vehicle) is created, which a simplified company structure. As an investor, you basically become a shareholder of this simplified company, that owns the property you are investing in. This means that even if Reinvest24 was to close down, you will still be the rightful owner of the property and not loose money.

So with all of this combined, it is definitely much safer to build a portfolio on a platform like Reinvest24 than buying a single apartment to rent it out for example.

Getting Started on Reinvest24

Make a Deposit

Make a bank transfer to the platform with provided bank details. Money typically arrives within 1-2 days.

Browse Available Properties

Click on the Properties tab to view current investment opportunities and their detailed information.

Review Project Details

Click on projects to access detailed descriptions, financial projections, rental yields, and capital growth expectations.

Invest in Properties

Enter your investment amount (minimum €100) and click Invest to add the property to your portfolio with live return estimations.

Pros & Cons

Pros

- ✓Focus on equity-based real estate projects with ownership benefits

- ✓Monthly rental income distributions from properties

- ✓Capital growth potential when properties are sold

- ✓Low minimum investment of €100 per property

- ✓Average 14.6% annual return (rental income + capital growth)

- ✓Easy portfolio diversification across multiple properties

- ✓SPV structure protects investors even if platform closes

- ✓Excellent support team and transparent communication

- ✓Verified Estonian company registration

- ✓Properties selected based on strict evaluation criteria

Cons

- ✗Limited number of projects available initially (improving over time)

- ✗Returns dependent on rental market conditions

- ✗Risk of tenant vacancies affecting income

- ✗Capital locked in for project duration

My Investment Results After 4 Years

Let's now dive more into the results that I got so far on Reinvest24. I opened my account back in December 2018 with just 500 Euros to try out the platform but actually invested only later in 2019 as there were not so many projects available at the start. I then invested all of it in a single project as this was the only one available on the platform, which is a group of 13 apartments in Tallinn.

For sure I would have preferred to diversify more on the platform, which is what I will do in the future as they now have more opportunities available on the platform.

In terms of returns, the project was listed with an expected yield of 8%. From the rental income distributions I got so far, I have an estimated annual yield of 7.4%, which is close to what was expected when I invested.

Since then, I invested in 2 more projects on the platform - for a total of around 900 Euros. One is currently being funded, and the other one is already delivering dividends as expected.

From those early results, I can say that Reinvest24 delivers as expected - with a solid rental income yield and no issues whatsoever at the moment. If I keep getting consistent results on the platform, I will definitely add more money on it in the future.