Scramble Review 2025: Invest in Promising Consumer Brands

A detailed review of the Scramble investment platform, covering returns, safety features, and my personal experience investing in consumer goods brands

Quick Verdict

Scramble presents a compelling opportunity for investors seeking higher returns through alternative investments in consumer goods brands. With competitive returns up to 25%, strong safety measures including co-founder guarantees, and short 6-month investment terms, it's a valuable addition for those willing to diversify beyond traditional investments.

Try ScrambleWhat is Scramble?

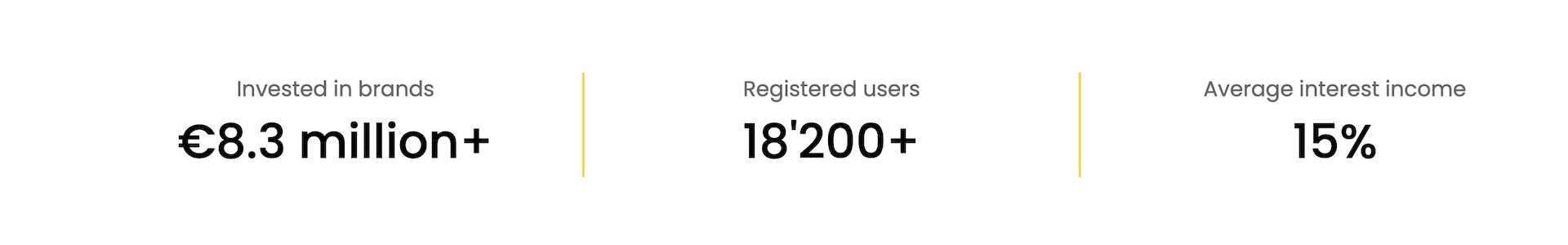

Scramble is an innovative investment platform that bridges the gap between investors and consumer goods brands seeking growth capital. With over €8.3 million invested in various brands and a growing community of more than 18,200 registered users, Scramble is carving out a niche in the alternative investment landscape. The platform offers investors the opportunity to fund batches of loans to carefully selected consumer goods companies, providing them with short-term capital to fuel their growth ambitions.

What sets Scramble apart is its focus on consumer goods brands that exhibit high sales margins and are led by competent teams of co-founders committed to successful growth. By connecting investors directly with these promising businesses, Scramble enables a symbiotic relationship where investors can earn attractive returns while supporting the growth of emerging brands.

What Returns Can You Expect?

Real returns based on my investing experience

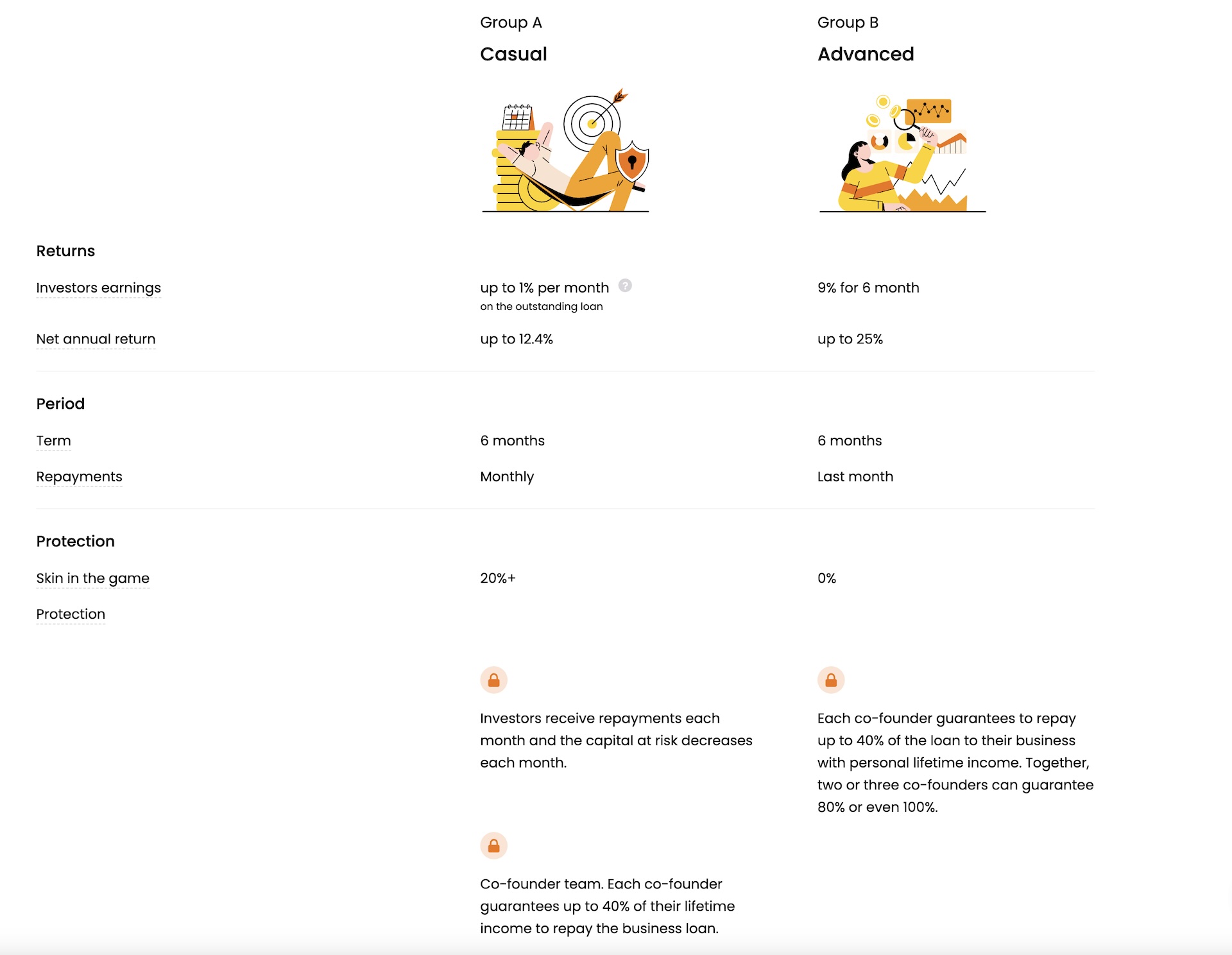

Scramble offers competitive returns that are quite enticing, especially when compared to traditional investment vehicles. The platform provides two main loan groups for investors to choose from, each with its own risk and return profile:

Group A (Casual Investors): Investors can earn up to 1% per month on the outstanding loan amount, which translates to a net annual return of up to 12.4%. This group is designed for those who prefer a more conservative approach while still enjoying substantial returns.

Group B (Advanced Investors): For those willing to take on a bit more risk for higher rewards, Group B offers returns of up to 25% over a 6-month period. This option is tailored for investors looking to maximize their earnings potential. Both loan options are short-term, lasting 6 months, with Group A offering monthly repayments that help reduce the risk of failure by decreasing the capital at risk each month. Group B investors receive their repayments at the end of the term.

Investment Groups & Features

Scramble offers two distinct investment groups designed for different investor profiles and risk appetites

Group A - Casual Investors

Conservative approach with monthly repayments and up to 12.4% annual returns

Group B - Advanced Investors

Higher risk/reward profile with up to 25% returns over 6 months

Cashback Bonus

€5 bonus for every €100 investment in Group A for first-time investors

Both groups feature short 6-month terms, allowing for relatively quick capital turnover

Is Scramble Safe?

Key safety features and regulatory compliance

Co-founder Guarantees

Each co-founder guarantees to repay up to 40% of the loan with personal lifetime income, with multiple co-founders covering up to 100%

Skin in the Game

Co-founders have significant equity stakes in their businesses, ensuring full commitment to success

Monthly Repayments

Group A features monthly repayments that reduce capital at risk over time

Rigorous Selection

Thorough 3-step brand selection process evaluating founders, business health, and legal safety

🔒 Risks & Guarantees on Scramble

Safety is a paramount concern for any investor, and Scramble has implemented several measures to protect its investors' capital:

Co-founder Guarantees: Each co-founder of the borrowing business guarantees to repay up to 40% of the loan with their personal lifetime income. In scenarios where there are multiple co-founders, these guarantees can cover up to 80% or even 100% of the loan amount. This personal commitment underscores the co-founders' confidence in their business and aligns their interests with those of the investors.

Skin in the Game: For Group A, there is an added layer of protection as the co-founders have significant equity stakes in their businesses. This "skin in the game" ensures that they are fully invested in the success of their companies, which bodes well for investors.

Monthly Repayments (for Group A): The monthly repayment structure reduces the capital at risk over time, as investors receive portions of their principal and interest each month. While no investment is entirely without risk, Scramble's model incorporates several safeguards to mitigate potential losses and enhance investor confidence.

👥 The Company & The Team

As I mentioned earlier, the company is incorporated in Estonia. As for all platforms I add to my portfolio I checked if the company was officially registered in Estonia, and it is indeed.

It was also very easy to find information about their team, which is something I really like to see on such a platform.

As for all the platforms I invest on, I checked the profiles of the management team of the platform to see their experience in the field. Especially here, as they put the experience of their team as a strong argument for the performance and reliability of the platform.

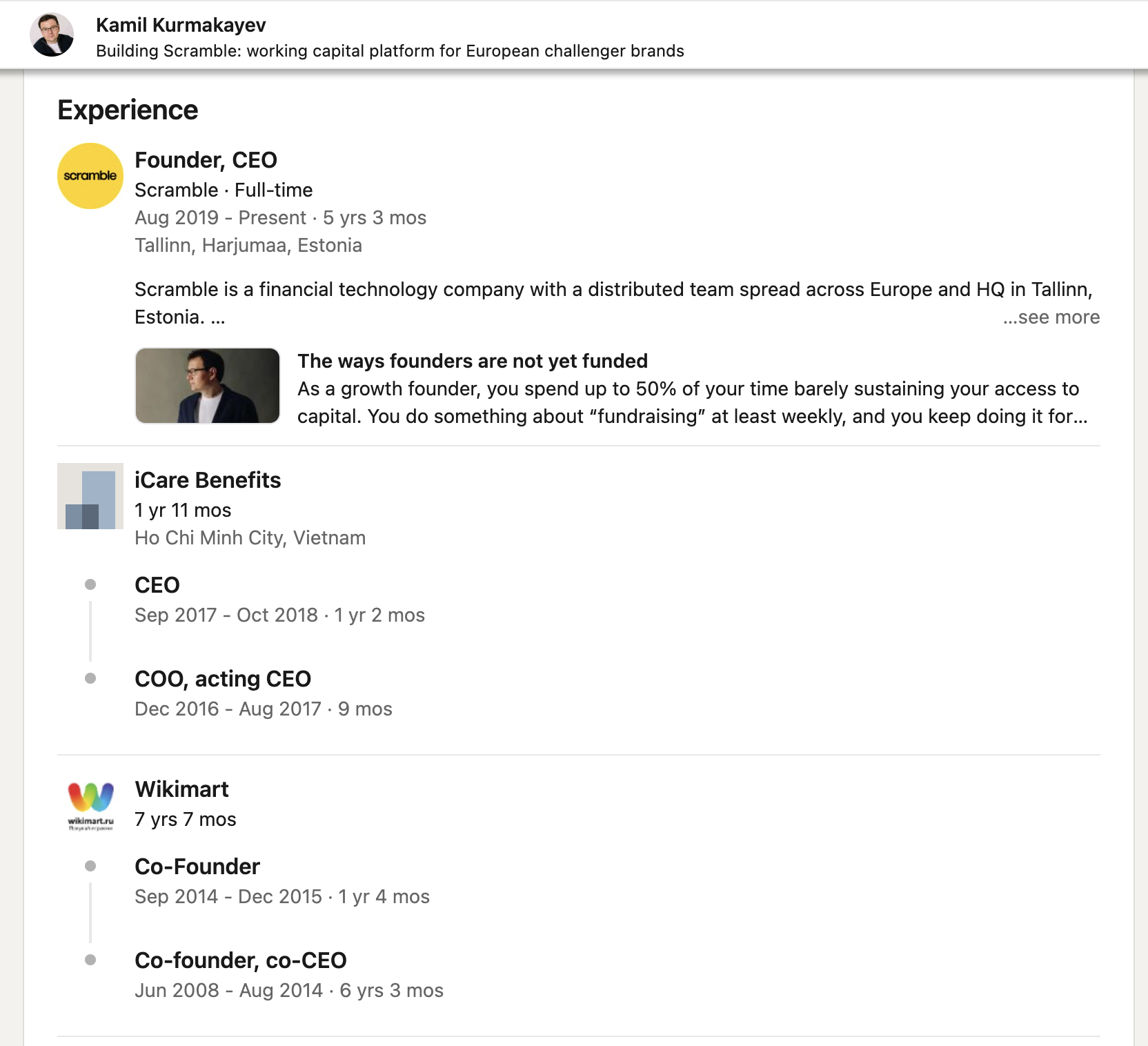

And indeed, they do have a really strong team. Their CEO for example, Kamil Kurmakayev, has a strong experience in the field:

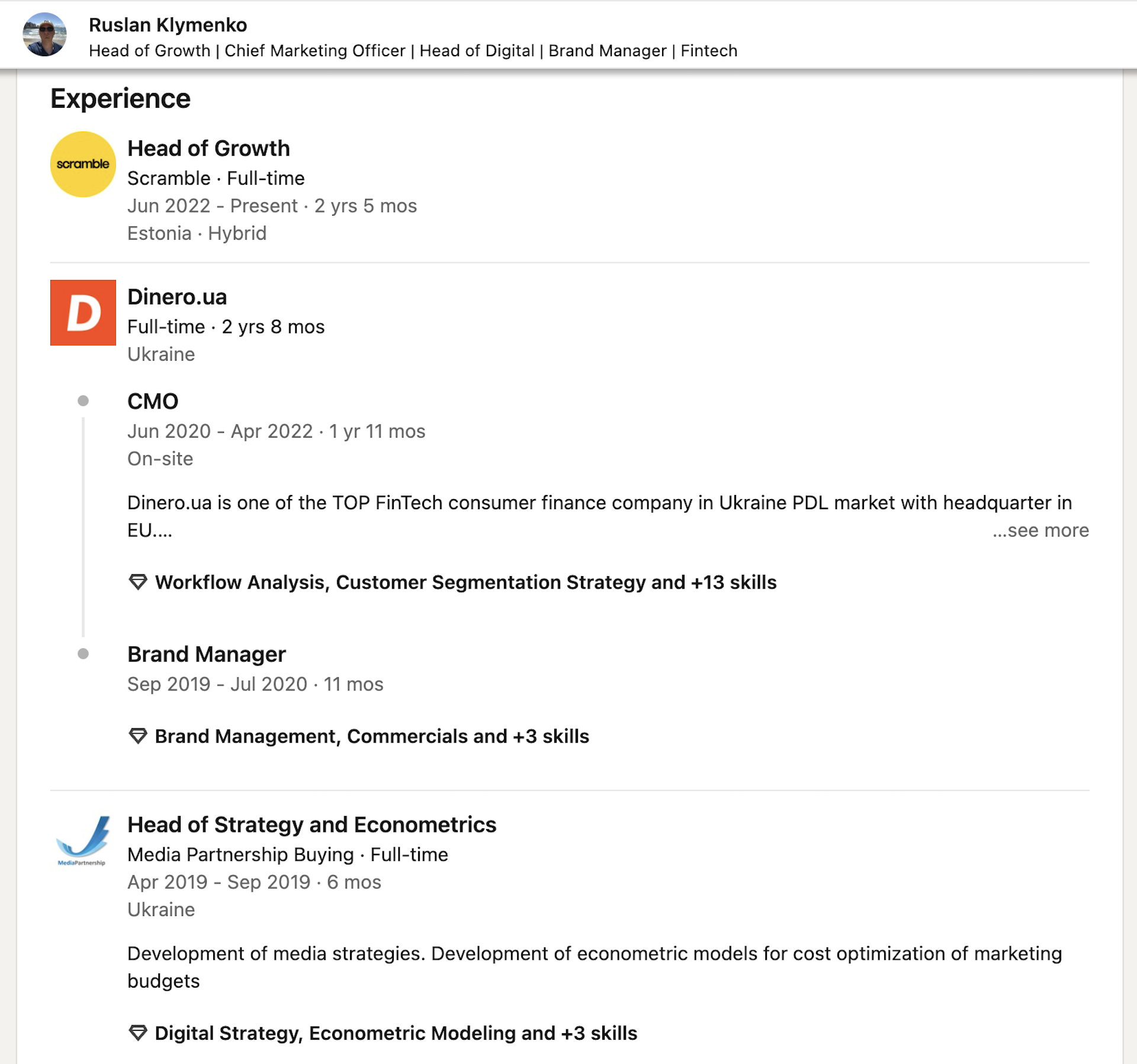

The rest of their team is composed of really experience people as well, like their CMO, Ruslan Klymenko:

So definitely a strong team of professionals with a lot of experience in the finance field, which is a really good point for this platform.

🎯 How Are Brands Selected?

I always checked where the projects are coming from on a platform, as this is really important for the security of your investments.

Scramble's brand selection process is centered around supporting the best companies by carefully choosing a limited number of brands committed to effective development and financial well-being.

The process involves three key steps.

First, they analyze the founder's background, focusing on education, professional experience, reputation, network, leadership qualities, and entrepreneurial background to assess their ability to run the business effectively.

Second, they evaluate the business health, looking for high growth potential and ensuring due diligence to assess potential risks.

Lastly, they assess the legal safety of the company, conducting thorough due diligence to ensure business compliance and implement a risk mitigation framework, thereby reducing legal uncertainty and increasing the security of the funding process.

Getting Started on Scramble

Open Account & Get Verified

Quick registration process completed in under 5 minutes including ID verification

Deposit Funds

Easy funding via bank transfer or instant top-up with Revolut

Explore Investment Options

Review available brands and choose between Group A (conservative) or Group B (advanced) investments

Start Investing

Invest in selected brands with detailed information available for each opportunity, including €5 cashback bonus for first €100 investment

Pros & Cons

✅ Pros

- ✓Competitive returns up to 25% for Group B investors

- ✓Net annual returns of up to 12.4% for Group A

- ✓Co-founder personal guarantees up to 100% of loan amount

- ✓Short-term investment horizon of 6 months

- ✓Monthly repayments for Group A reduce risk over time

- ✓Strong, experienced management team

- ✓Thorough brand selection process with multiple evaluation steps

- ✓Quick and easy account setup under 5 minutes

- ✓Responsive customer service

- ✓Cashback bonus of €5 for every €100 first investment in Group A

❌ Cons

- ✗Limited to consumer goods brands only

- ✗Relatively new platform with limited track record

- ✗Higher risk compared to traditional investment vehicles

- ✗No secondary market for early exit

- ✗Limited diversification within single platform

My Results So Far with Scramble

Having ventured into the world of alternative investments, I decided to explore Scramble as a means to diversify my portfolio.

I was particularly drawn to the platform's focus on consumer goods brands and the opportunity to support emerging businesses with strong growth potential.

I started by investing in Group A loans to familiarize myself with the platform while mitigating risk. I will of course update this section as I get more results from the platform.

Throughout my journey with Scramble, the platform's customer service has been responsive, addressing any queries I had promptly.

The overall experience has been positive, and I plan to continue investing through Scramble as part of my broader investment strategy.