In an era where digital platforms dominate the financial landscape, transparency has emerged as a cornerstone for building trust between financial institutions and investors. The rapid evolution of financial technology has brought about unprecedented opportunities, but it has also introduced new challenges in ensuring that transactions and operations are conducted with openness and integrity. This article delves into the significance of transparency in financial services and how it serves as a vital component in fostering investor confidence.

The Importance of Transparency in Financial Services

Transparency in finance refers to the availability and clarity of information provided by financial institutions to all stakeholders. It encompasses the disclosure of financial performance, operational processes, risk factors, and any other relevant data that can influence investment decisions. In the digital age, where information is abundant yet sometimes overwhelming, providing clear and accessible information is more critical than ever.

Transparent financial practices enable investors to make informed decisions by understanding the true nature of investment products and the risks associated with them. It reduces the asymmetry of information between financial institutions and investors, thereby leveling the financial playing field. Moreover, transparency helps prevent fraudulent activities and enhances regulatory compliance, contributing to the overall stability of the financial system.

How Transparency Builds Trust Among Investors

Trust is the bedrock of any financial relationship. Investors are more likely to engage with financial platforms and institutions that demonstrate honesty and openness in their operations. Transparency fosters trust in several ways:

Accountability: Transparent practices hold institutions accountable for their actions, ensuring they act in the best interest of their clients.

Confidence: When investors have access to complete information, they feel more confident in their investment choices.

Reputation: Transparency enhances an institution's reputation, attracting more investors and promoting long-term success.

Compliance: Transparent operations align with regulatory requirements, safeguarding investors' interests.

In the digital realm, where personal interactions are minimal, the significance of transparency is amplified. Investors rely heavily on the information presented online to gauge the credibility and reliability of a financial service provider.

Hive5: A Transparent Platform for P2P Lending

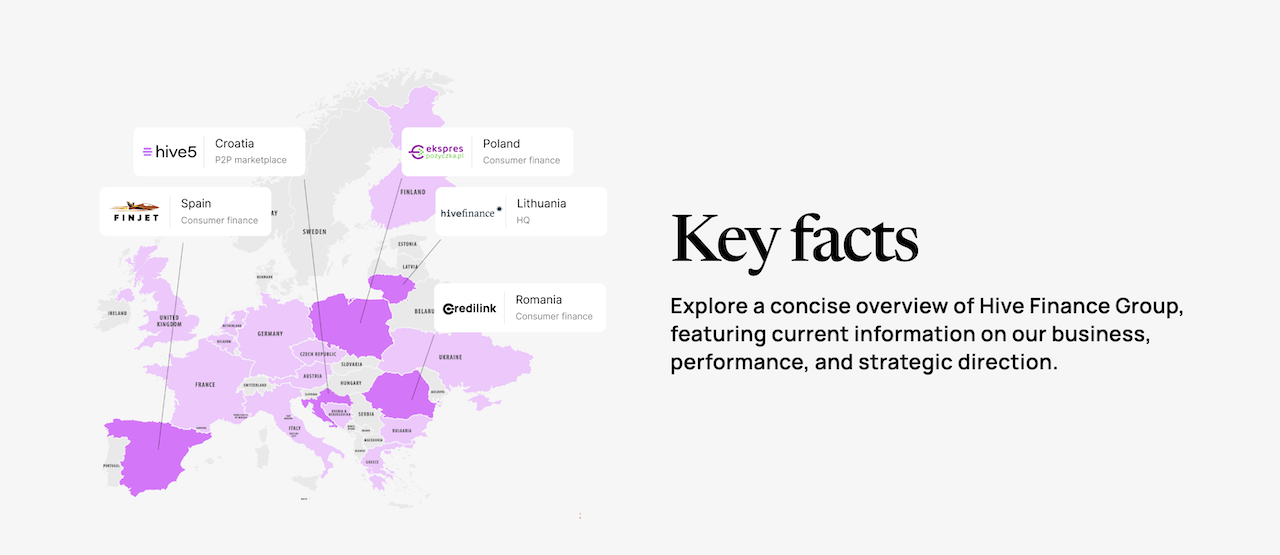

Amidst the myriad of digital financial platforms, Hive5 stands out as a paragon of transparency in the peer-to-peer (P2P) lending space. As the fastest growing marketplace to invest in loans, Hive5 has earned the trust of private investors, high-net-worth individuals (HNWI), and companies alike.

Hive5 offers investors the opportunity to earn passive income by investing in loans with returns of up to 16% per annum. With a low entry barrier of just 10€, it opens the doors for both novice and seasoned investors to diversify their portfolios.

What sets Hive5 apart is its unwavering commitment to providing clear and comprehensive information about its operations, ensuring that investors are well-informed at every step of their investment journey.

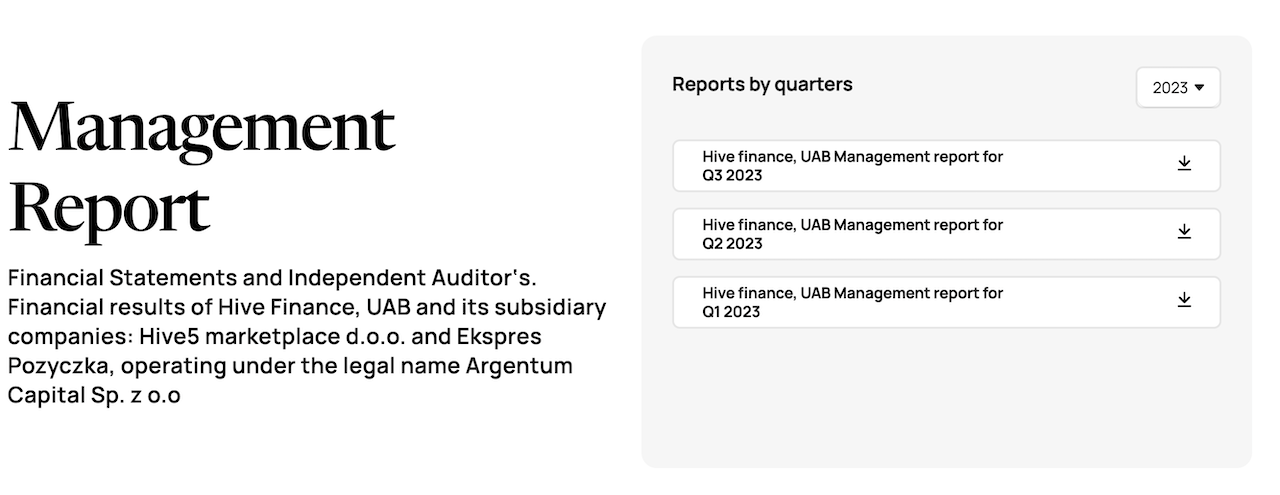

It is also very easy to find reports about their operations on their site, again showing a full transparency.

How Hive5 Exemplifies Transparency

Hive5 embodies transparency through several key features that not only inform but also protect its investors:

Comprehensive Performance Metrics

Hive5 openly shares its performance statistics:

Total Invested: € 68.11 million

Repaid Amount: € 58.36 million

Average Annual Investment Return: 14.69%

By providing these figures, Hive5 allows investors to gauge the platform's success and reliability, fostering a sense of trust and confidence.

Buyback Obligation

Transparency extends to risk management. All loans on Hive5 are secured with a Buyback Obligation. If payments are delayed over 60 days, the loan originator will buy back the loan in full, including accrued interest. This feature clearly communicates how Hive5 mitigates risk, reassuring investors about the safety of their investments.

Accessible Investment Opportunities

Hive5 provides detailed information about its loan offerings, including:

Competitive ROI: Investors can earn up to 16% returns by investing in short-term and business loans.

Investment from 10 Euros: Start investing with as little as 10€, making it accessible for all.

Auto Investment: Create Auto-Invest portfolios to automatically invest as new loans are added.

Maintain Full Control: Customize investment criteria and manually invest as desired.

By offering clear terms and accessible investment options, Hive5 empowers investors to make decisions aligned with their financial goals.

Dedicated Investor Support

Understanding the importance of guidance, Hive5 ensures full support for investors throughout their investment journey. The team is committed to ongoing professional development, enabling them to provide expert assistance and address any concerns promptly.

Conclusion

In the digital age, transparency is not just a desirable trait but a fundamental necessity for financial institutions. It builds trust, fosters investor confidence, and promotes a healthy financial ecosystem. Platforms like Hive5 exemplify how transparency can be integrated into financial services, offering investors a secure and informed environment to grow their wealth.

By prioritizing openness and clear communication, Hive5 has set a standard for others in the industry to follow. As investors continue to seek platforms that offer both high returns and trustworthy practices, transparency will remain a key differentiator in the competitive financial landscape.