Viainvest Review 2026: a Safe Platform with Great Returns

An in-depth review of Viainvest P2P lending platform with personal results after 2+ years of investing

Quick Verdict

Viainvest is a reliable P2P lending platform with consistent returns around 11-12% and strong safety features including buyback guarantees. After 2+ years of investing, the platform has delivered on its promised returns with an actual yield of 11.83%.

Try ViainvestWhat is Viainvest?

Viainvest is a typical Peer-to-Peer lending platform based in Latvia, mainly focused on short-term loans and credit lines for consumers. It currently proposes loans in Spain, Latvia, Czech Republic, and Poland. The yields on the loans are up to 12%, with an average of around 11% from what I am seeing on the platform. They also have a buyback guarantee on all the loans, which is pretty neat.

Also, note that all the loans proposed on the platform are already pre-funded, meaning that you will never have money 'sitting' in a loan and then returned to you because not enough investors wanted to fund this particular loan, so that's pretty neat as well.

What Returns Can You Expect?

Real returns based on my investing experience

As I mentioned earlier, most loans on the platform have returns around 11 - 12%, and the platform currently advertises an average return for investors which is also in this range.

After testing with real money for over 2 years, TrackInvest gives me an actual yield around 11.83%, which is really close to the expected yield of the platform. The returns have been consistent and reliable throughout my investment period.

Auto-Invest Function

The auto-invest function on Viainvest is really easy to setup and allows you to completely automate your investments on the platform.

Custom Strategy

Create a custom investment strategy tailored to your preferences in under 5 minutes

Full Automation

Once set up, all your investments are completely automated - no manual intervention needed

Flexible Settings

Choose loan types, countries, interest rates, and other parameters to match your risk profile

I went for a custom strategy, and it took me less than 5 minutes to set that up, and then your investments will be completely automated on the platform.

Is Viainvest Safe?

Key safety features and regulatory compliance

Buyback Guarantee

Most loans come with a buyback guarantee, protecting investors from defaults on consumer loans

Investment Broker License

Applied for investment broker license with strict rules to ensure investor funds are protected

Controlled Loan Originators

Works with 7+ loan originators, most in the same group for better control and oversight

Pre-funded Loans

All loans are pre-funded, ensuring no idle money waiting for loan fulfillment

🛡️ Risks & Guarantees on Viainvest

On Viainvest, most loans come with a buyback guarantee, which is a standard now on most Peer-to-Peer lending platforms, but it is already a good point here for Viainvest.

Note that business loans available on the platform however don't come with a buyback guarantee, so make sure to avoid those if you want to have completely safe investments on Viainvest.

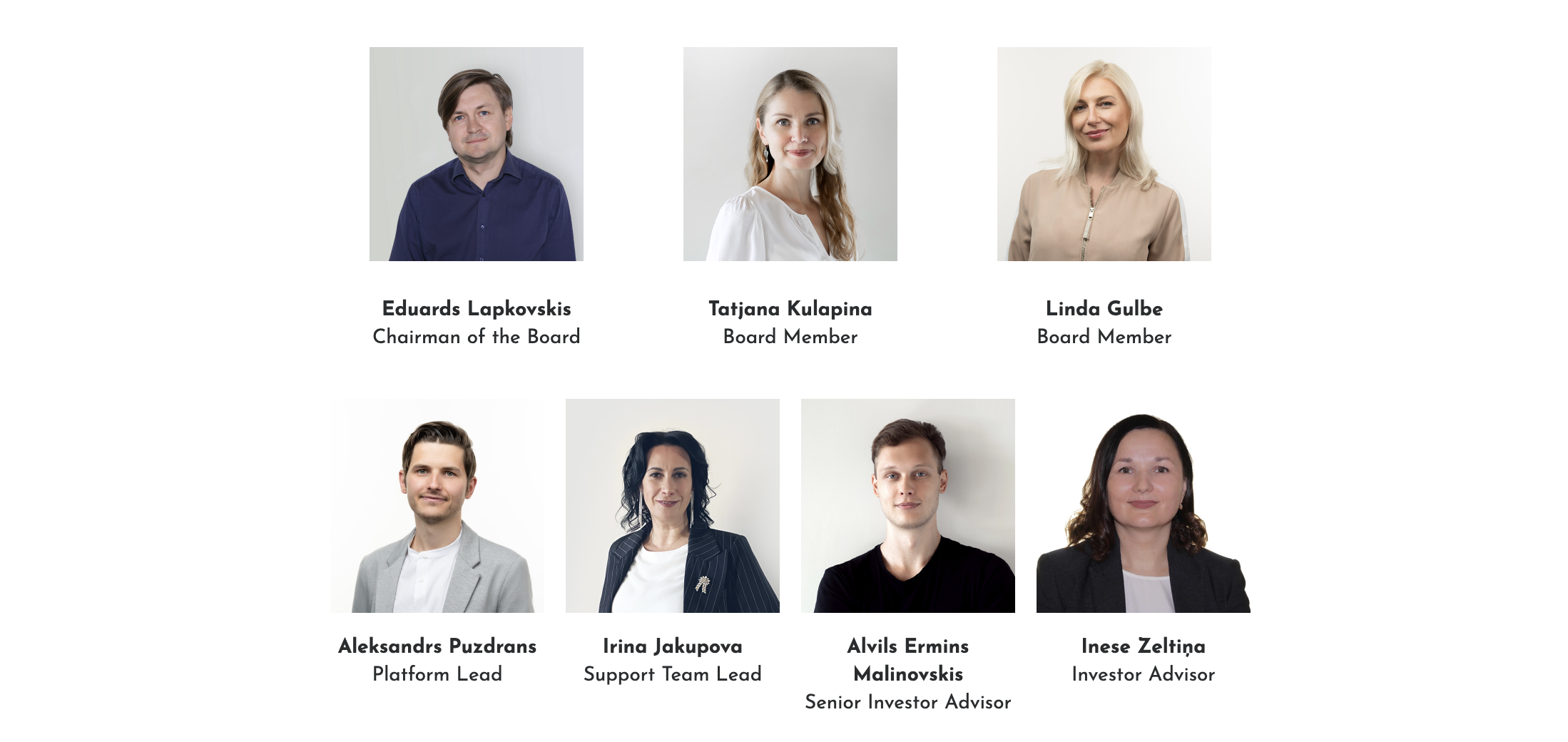

🏢 The Company & The Team

As for all Peer-to-Peer lending platforms I add to my portfolio, I also check the company itself and see what they are doing in terms of security & safety of the investors funds.

The good thing here is that Viainvest currently applied for an investment broker license, meaning they will have to adhere to very strict rules to ensure the investors funds are protected, which is a very good point here.

I also checked who is on their team, and it was very easy to do as they are very transparent about it on their website.

Their CEO for example, Eduards Lapkovskis, has been also the CEO of the VIA SMS group since 2010, which is a very large company across Europe specialised in financial services.

🏦 Loan Originators

I also always have do a close examination of the loan originators a platform uses, as this is usually where a platform will encounter problems if anything bad happens like a financial crisis.

Viainvest is working with several loan originators, most of them being in the same group as Viainvest itself, which is a model that other Peer-to-Peer lending platforms are using. This ensure they have a much better control over their loan originators as they are part of the same entity.

They currently have over 7 loan originators, in countries like Latvia, Spain, Sweden, Poland, and Romania.

Getting Started on Viainvest

Open Your Account

Opening an account is straightforward and takes less than 5 minutes. You'll need to provide your basic information and verify your identity.

Transfer Funds

Make a bank transfer to your Viainvest account. Funds typically arrive in less than 24 hours.

Set Up Auto-Invest

Configure the auto-invest function with your preferred settings (loan types, countries, interest rates). It takes about 5 minutes to set up a custom strategy.

Start Investing

Your investments will now be completely automated. The platform will automatically invest your funds according to your strategy.

Pros & Cons

✅ Pros

- ✓Consistent returns of 11-12% on most loans

- ✓Buyback guarantee on consumer loans

- ✓All loans are pre-funded - no idle money

- ✓Applied for investment broker license

- ✓Transparent team and company structure

- ✓Easy-to-use auto-invest function

- ✓Fast withdrawals (2 days)

- ✓Quick account opening (under 5 minutes)

- ✓Strong loan originator control (same group)

- ✓Growing platform with increasing loan volumes

❌ Cons

- ✗Business loans don't have buyback guarantee

- ✗Withholding taxes applied automatically

- ✗Tax documentation required to avoid withholding

- ✗Limited to 4 countries currently

My Personal Results

After more than 2 years of investing on the platform, I achieved an actual yield of 11.83% according to TrackInvest data, which is very close to the expected yield advertised by the platform. The returns have been consistent throughout this period, and I am still very satisfied with Viainvest's performance.