Crowdpear Review 2026: a Regulated Crowdlending Platform

A comprehensive review of Crowdpear, the real estate crowdfunding platform backed by PeerBerry

Quick Verdict

Crowdpear is a solid real estate crowdfunding platform backed by PeerBerry with the European ECSP license. While it would benefit from more projects on the primary market and an auto-invest function, it offers competitive returns of up to 12% and strict project vetting.

Try CrowdpearWhat is Crowdpear?

As for all crowdlending platforms, Crowdpear is a financial platform that matches borrowers with investors, that will lend money on the platform in exchange of interests on loans. Crowdpear is a relatively new platform, as it was founded in 2021. They are based in Vilnius, Lithuania.

What makes them different from other similar platforms is that they offer investors to invest in real estate (like houses or apartment blocks), but also in business loans - all on the same platform. This is something quite unique about this platform, and I believe it makes it really interesting.

It's also worth noting that the platform is actually not completely new - as it's the same shareholders and people as PeerBerry - one of the largest Peer-to-Peer lending platform in the field. This adds a good level of confidence to this platform, as PeerBerry has a very solid track record in the field.

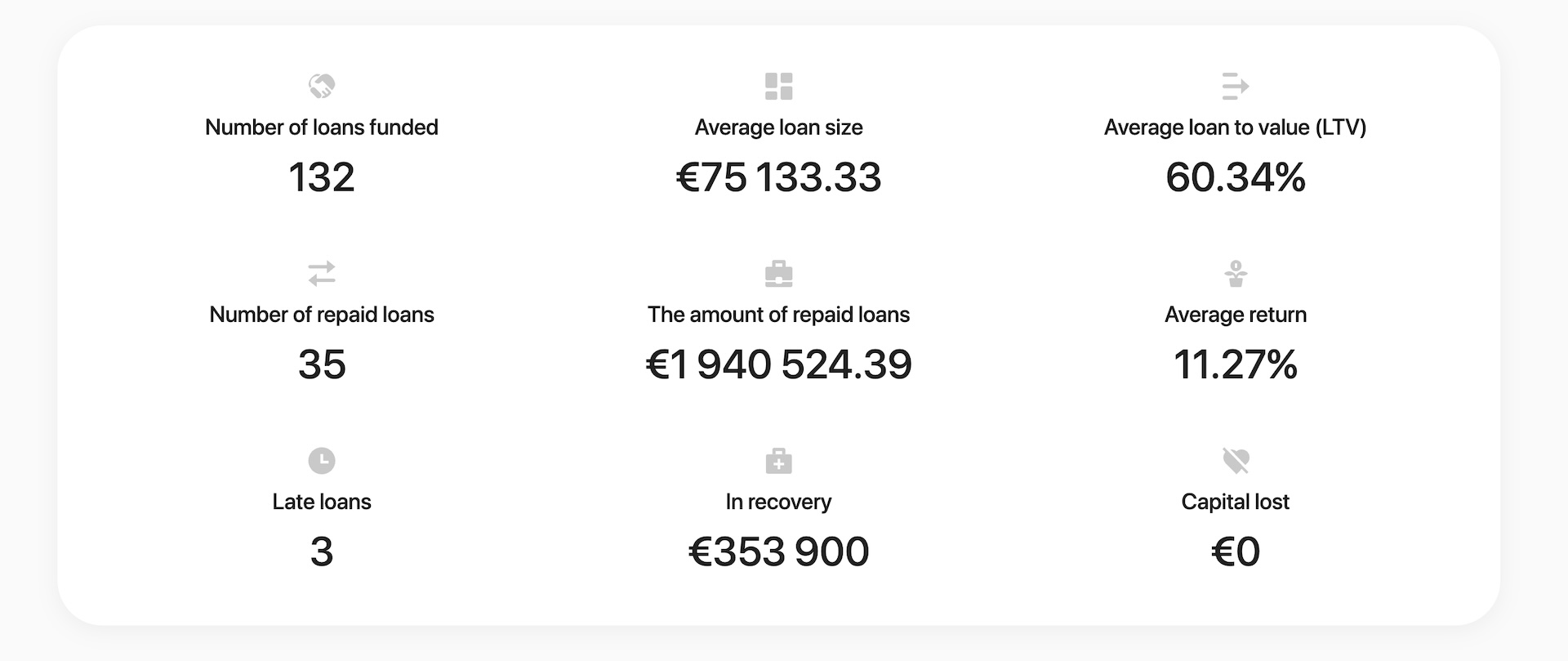

They currently have over 3000 investors, with nearly 2 million Euros already invested on the platform.

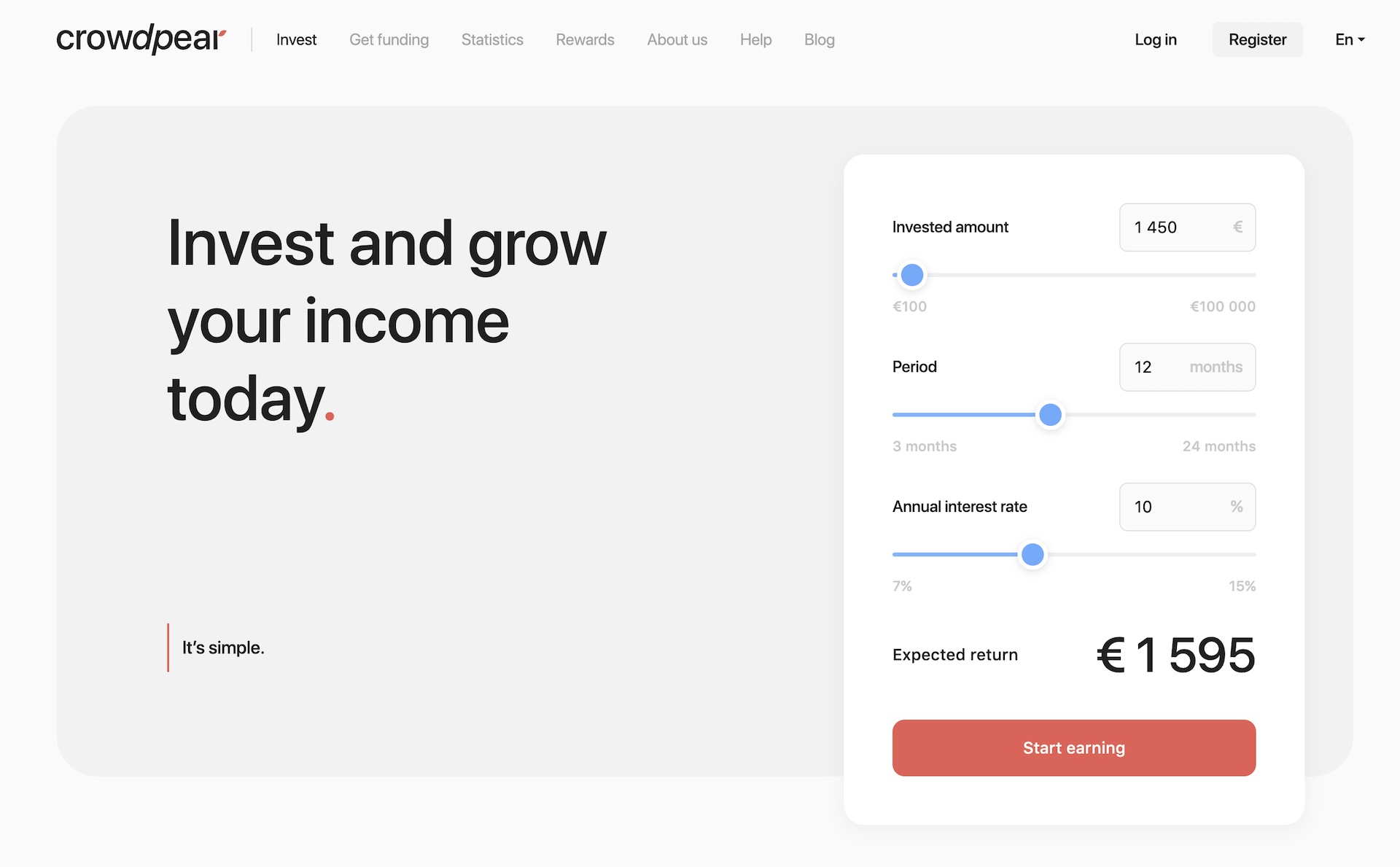

What Returns Can You Expect?

Real returns based on my investing experience

The returns you can expect on Crowdpear completely depend on which projects you invest in, which I will tell you more about when we'll see how to use the platform.

Currently, you can get up to 12% returns on the platform, and they advertise an average annual return of 11.27% for investors, which I will of course verify in this review and by investing on the platform.

Using the Crowdpear Platform

Crowdpear offers both primary and secondary markets for maximum flexibility

Primary Market

Browse new projects with details on annual returns, LTV ratios, and loan terms. Minimum €100 investment per project.

Secondary Market

Buy shares in already-running projects for immediate diversification and potentially quicker returns.

Detailed Project Pages

Access comprehensive information about borrowers, project purposes, and additional guarantees for informed decisions.

Note: Crowdpear does not currently have an auto-invest function, so you'll need to manually select and invest in projects.

Is Crowdpear Safe?

Key safety features and regulatory compliance

EU Regulated

Fully licensed European ECSP crowdfunding platform under EU law

Property Collateral

All real estate projects backed by property with ~70% LTV ratios

Experienced Team

Same team as PeerBerry with 15+ years banking experience

Strict Vetting

Rigorous project selection checking financials, collateral, and track record

🔒 Risks & Guarantees on Crowdpear

On Crowdpear, all real estate projects present on the platform are backed by property, that will be taken in case there is a problem with the project.

The LTVs (Loan To Value) on the platform are usually around 70%, meaning that the amount of the loan of a given project is always much than the value of the asset attached to the project. This means that in case of a problem with a project, the asset that will be sold to cover the loan will be more than enough to give the money back to investors & to cover all the legal costs associated with the sale. This is actually is bit too high for my own taste, and I would prefer to see projects with lower LTVs here so there is more room to get all your money back in case of a default.

What's really worth noting here is that Crowdpear actually has the European ECSP license - meaning it's a fully regulated crowdfunding platform under EU law.

They also do a very strict process of cherry-picking the best projects that they put on the platform, which we'll cover more in details when talking about the projects that are present on the platform.

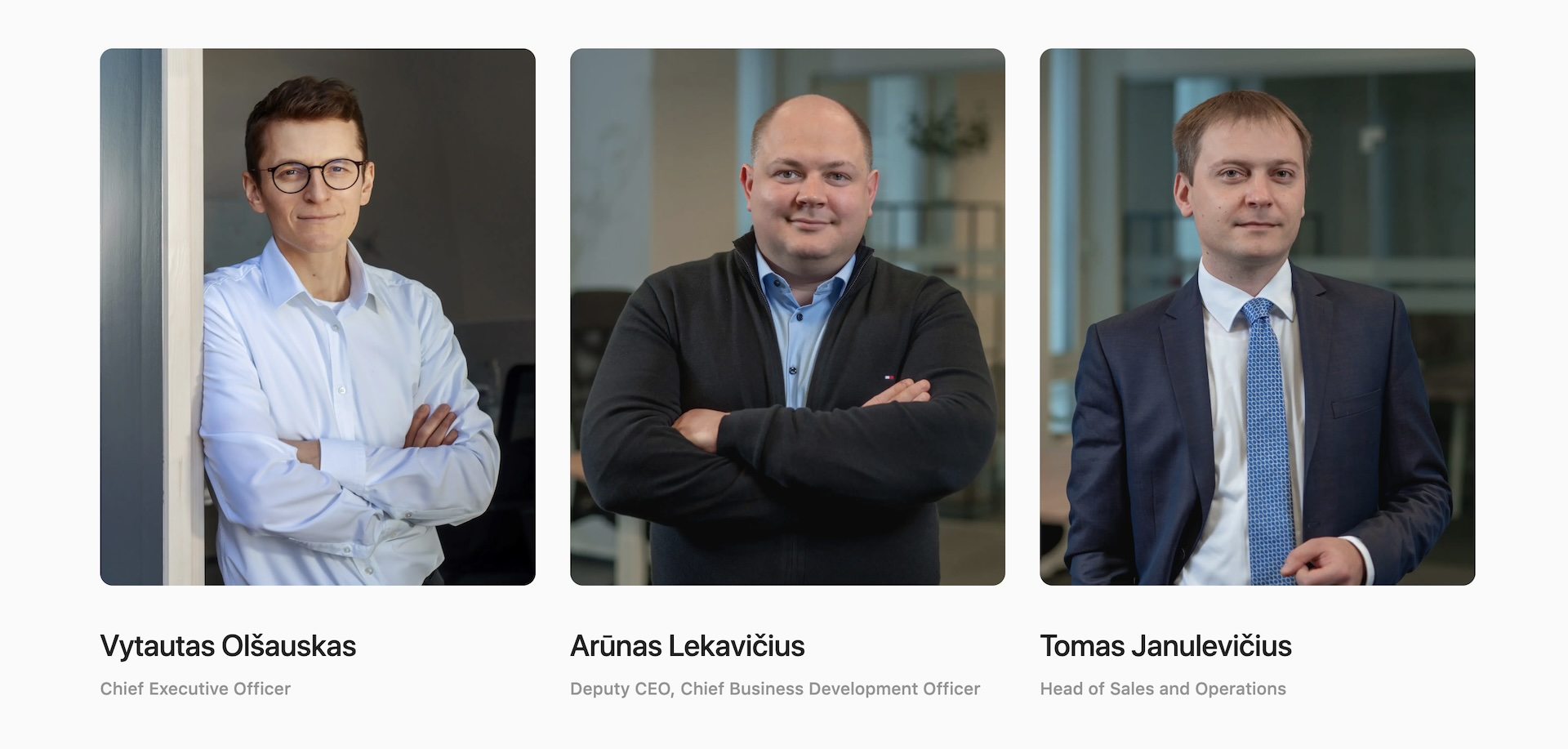

🏛️ The Company & The Team

As I mentioned earlier, the company is operating from Lithuania, and as for all platforms I add to my portfolio I checked if the company was officially registered in Lithuania, and it indeed.

They also are completely transparent about their team on their website, with a complete description of the role of each person in the team, which is also something I appreciate seeing on a platform.

I also check the profile of their CEO, Vytautas Olšauskas, and his LinkedIn page shows he has experience in the banking sector for over 15 years, having founded its own bank as well.

Their Chief Business Development Officier, Arunas Lekavicius, is also well known as he is actually the CEO of PeerBerry.

Overall, it's safe to say that the platform is in the hands of a team of experienced professionals, all with a link to PeerBerry that is a platform I trust for many years now.

📋 Project Originators

I also always have a close look at where the projects on the platform are coming from, as this is usually where a platform will start to have issues if anything bad happens like a financial crisis.

On Crowdpear, the projects are coming from borrowers that apply to a loan via the platform, and that are then approved after passing the strict checks from Crowdpear. For example, they check the financial data of the project, but also the proposed collateral, and the track record of the borrower in the field of real estate development projects.

Getting Started on Crowdpear

Open an Account & Get Verified

Quick registration process taking under 5 minutes including ID verification. Simple and straightforward setup to get you started.

Deposit Funds

Transfer money to your Crowdpear account via bank transfer. Your funds will be ready to invest once they arrive in your account.

Browse Available Projects

Check the primary market for new projects or the secondary market for existing investments. Review project details including returns, LTV, and loan terms. Minimum investment is €100 per project.

Start Investing

Select projects that match your investment criteria and allocate your funds. Monitor your portfolio and receive interest payments as projects progress.

Pros & Cons

✅ Pros

- ✓Fully regulated with European ECSP license

- ✓Backed by PeerBerry team with solid track record

- ✓Offers both real estate and business loans on same platform

- ✓Up to 12% annual returns available

- ✓All real estate projects backed by property collateral

- ✓Transparent team with experienced professionals

- ✓Quick and easy account setup (under 5 minutes)

- ✓Fast withdrawals (2 days)

- ✓Secondary market available for additional liquidity

- ✓Strict project vetting process

❌ Cons

- ✗No auto-invest function currently available

- ✗Limited projects on primary market

- ✗LTV ratios around 70% (higher than some competitors)

- ✗Relatively new platform (founded 2021)

- ✗Minimum investment of €100 per project

My Results with Crowdpear

I only invested in one real estate project so far on Crowdpear, and it should give me a return of 10.5% annually. It is of course too early to talk about long-term yields on the platform, but I can say that so far everything went smoothly and I will definitely invest more on the platform in the future.