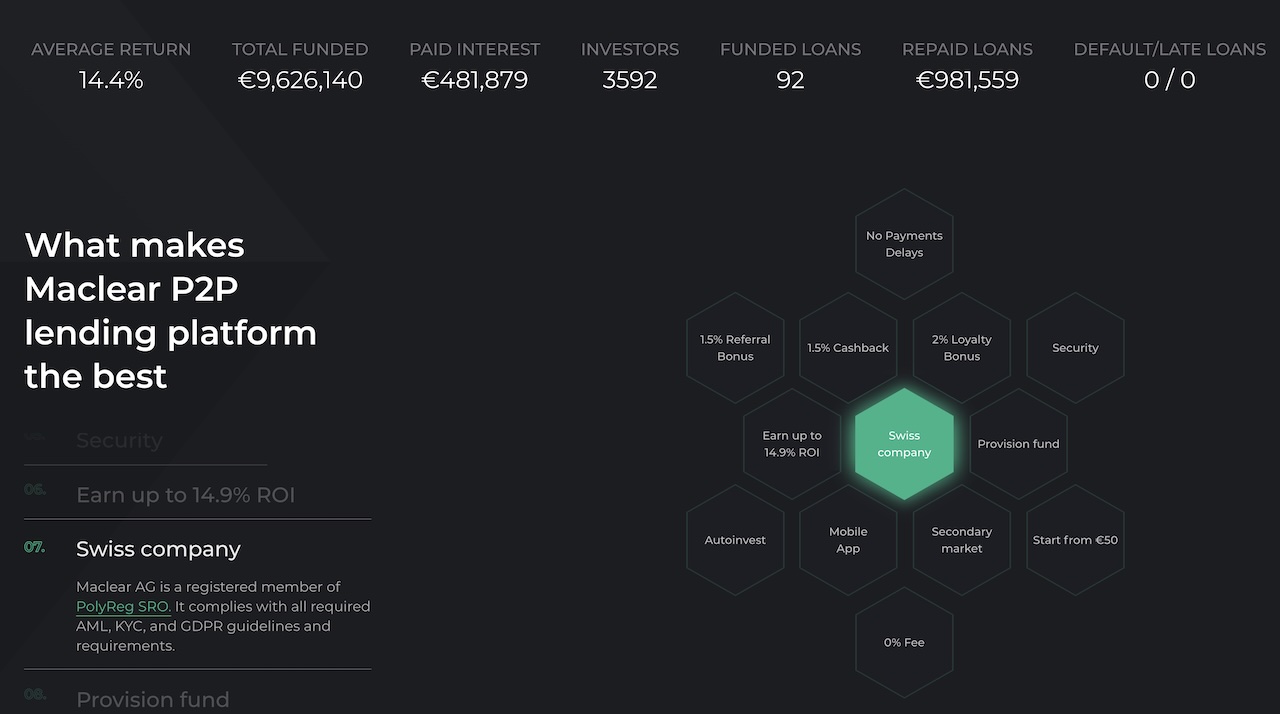

Maclear Review: a Safe P2P Lending Platform with High Returns

A comprehensive review of the Swiss crowdlending platform offering up to 14% annual returns

Quick Verdict

Maclear is a solid Swiss crowdlending platform that prioritizes investor safety through strong regulation, provision fund, and collateral requirements. While relatively new with limited projects, it offers attractive returns of up to 14% annually and is backed by an experienced team.

Try MaclearWhat is Maclear?

As for all crowdlending platforms, Maclear is a financial platform that allows investors to invest in projects, in exchange of payments of interests over time. Maclear is based in Wallisellen, Switzerland, and was officially founded in 2010 but started to offer investments in 2023.

They promise to offer high returns, while offering all the safety for investors by being a Swiss company and complying with all the required regulations to protect the investors money, which is of course something I'll verify in this review.

They are a therefore a relatively new platform, however they are for example members of PolyReg SRO, which means they respect all the required processes for AML checks of their clients.

What Returns Can You Expect?

Real returns based on my investing experience

Whereas the actual revenue you can expect on the platform completely depends on which projects you invest in, they claim that the usual returns are up to 14% annually.

I checked the projects they already had on the platform when writing this review, and I could see yields at 13.5 - 13.8%, which is lower than what they advertise but definitely in the upper bracket of yields for similar platforms, so that's definitely some good news here.

They also have a loyalty bonus program where, you will get additional yields on your investments depending on how much money you invest. It goes from 0.5% additional yield from 5,000 Euros invested, and up to 2% additional yield after 75,000 Euros invested.

Investment Process & Platform Features

Maclear offers a streamlined investment experience with several key features

Low Entry Point

Start investing with just €50 per project, making it accessible for beginners

Loyalty Bonus Program

Earn up to 2% additional yield based on total investment amount

Support & Resources

Live chat and detailed FAQ section available for investor assistance

Note that autoinvest function and secondary market are not yet available but are in the platform's roadmap. A mobile application is also planned for future release.

Is Maclear Safe?

Key safety features and regulatory compliance

Swiss Regulation

Fully regulated under Swiss law and member of PolyReg SRO, complying with all AML and GDPR requirements

Provision Fund

Reserve fund with 2% of each funded project to cover investor payments in case of project issues

Collateral Required

All projects on the platform are backed by collateral for additional investor protection

Strict Due Diligence

Comprehensive project selection process analyzing financial details, compliance, and risk assessment

⚖️ Risks & Guarantees on Maclear

I first checked that the company is actually a real company registered in Switzerland, and it is indeed.

They are also fully regulated under Swiss law, and as I mentioned before they are a member of PolyReg SRO, and therefore comply with all the AML and GDPR requirement for a company in this field.

They also have a strict KYC process that we'll cover more in details when we will talk about how to open an account & start investing on the platform. It's worth to note here that they also partnered with a well-known identify verification company for this step.

Regulation aside, the main feature that they provide to guarantee the safety of the investors money is probably the provision fund. This is basically a reserve of money that is here to cover the payment of interests to investors, in case there would be some issue with some project on the platform.

This reserve of money is funded by them transferring 2% of each funded project on the platform directly to the fund. This fund is a great idea and something I already saw on similar platforms, so it's definitely something I like to see on Maclear.

Finally, they don't have yet the European crowdfunding license, but they are applying for it and according to the CEO of the company that I talked to, they should get it in early 2025 latest.

👥 The Company & The Team

As I mentioned earlier, Maclear is a company registered in Switzerland, and I could check in the official company registry of the country that it is indeed a real company that is currently active.

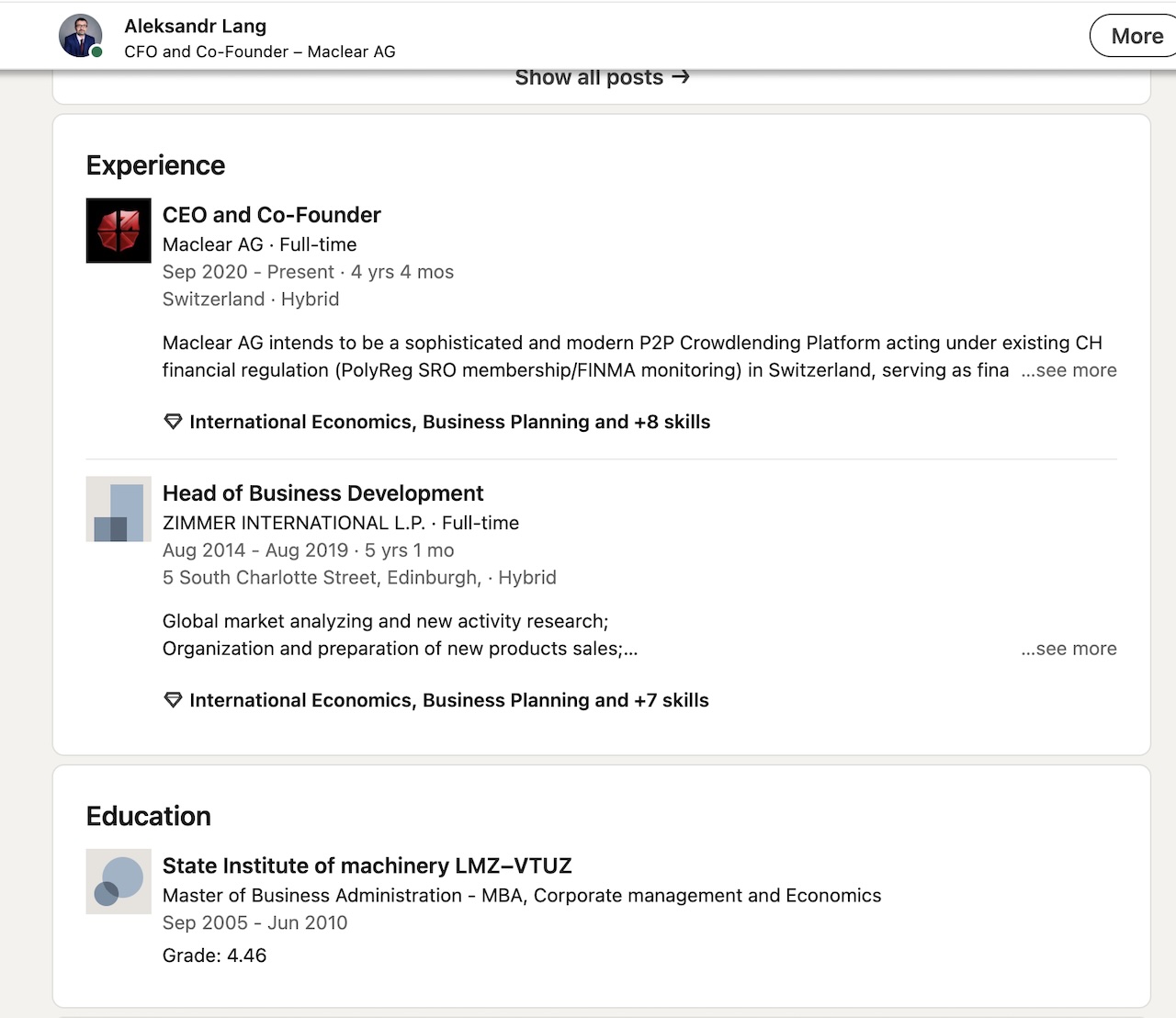

I also always like to check the team of the companies I invest with, especially their founders & current CEO. On Maclear, it was really easy to find information about who is working in the company, which is something I really appreciate on a platform.

I for example checked the profile of one co-founder of the company, Aleksandr Lang. He definitely has a strong experience in the field, having been the head of business development at a company for over 5 years.

At Maclear, he plays a critical role in project selection, leveraging his expertise in foreign trade and industrial projects.

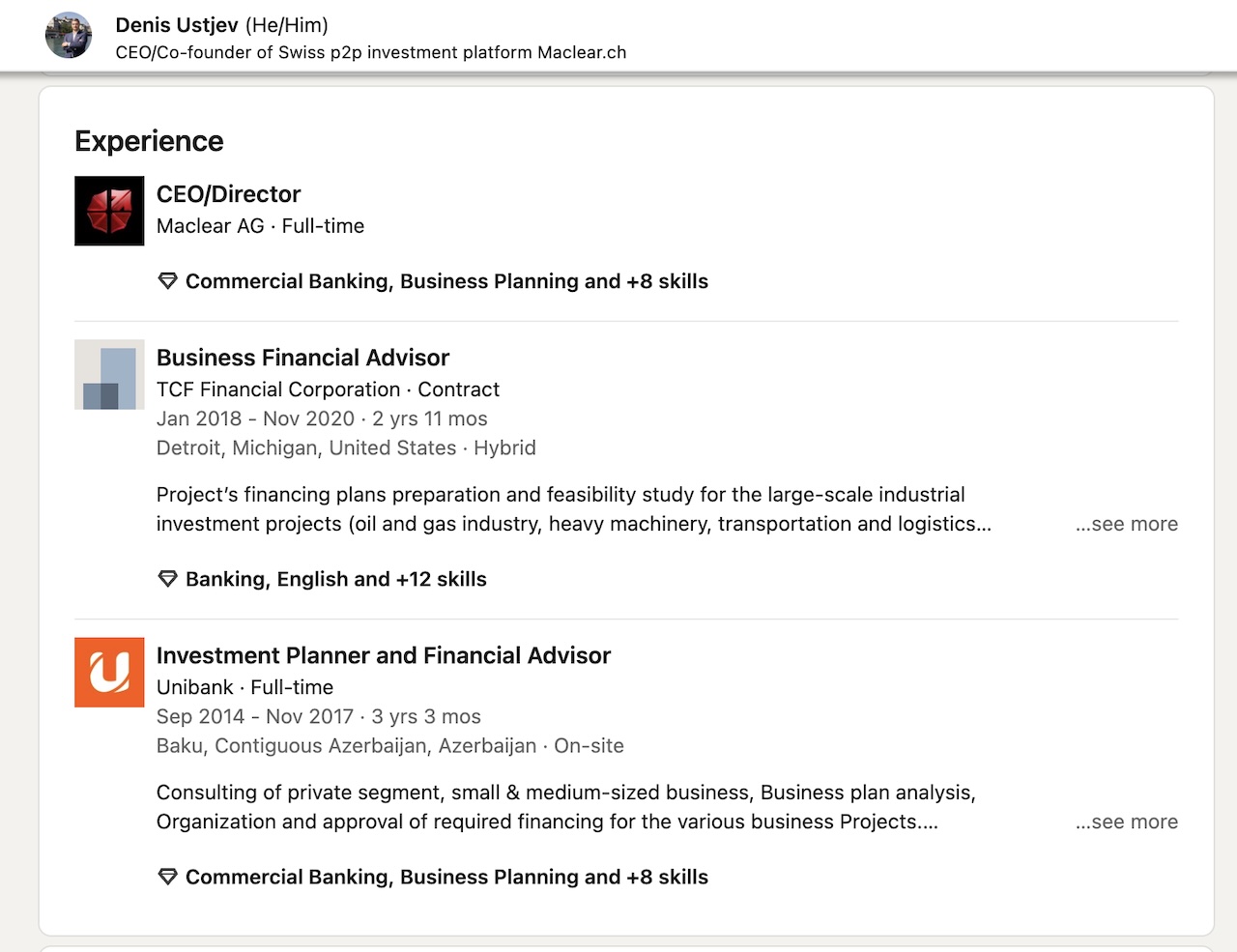

I also checked the profile of their other co-founder, Denis Ustjev:

He also has a strong experience in the financial sector, having worked as an investment planner & financial advisor for several years. He also brings valuable expertise from his extensive background in business consulting, capital investment, business loans management, and senior management roles in multinational companies. Finally, he also diverse experience across Estonia, Azerbaijan, and the United States, which I believe equipped him with practical financial knowledge in various cultural and geographical contexts.

Both Denis and Aleksandr also have a lot personal connections and networks, especially in Estonia, which really helps to evaluate projects for potential inclusion on the platform.

Finally, I also checked the profile of Igor Bannikov, the Chief AML/Compliance/Risk Officer, who oversees and approves potential borrowing projects, and Alexej Martin, the third director, that adds relevant banking experience as a relationship manager at MBaer Bank, CH, serving as a secondary AML/Compliance Officer.

Therefore, it's safe to say that the company is definitely ran by people with a strong experience in the field.

📊 Projects on Maclear

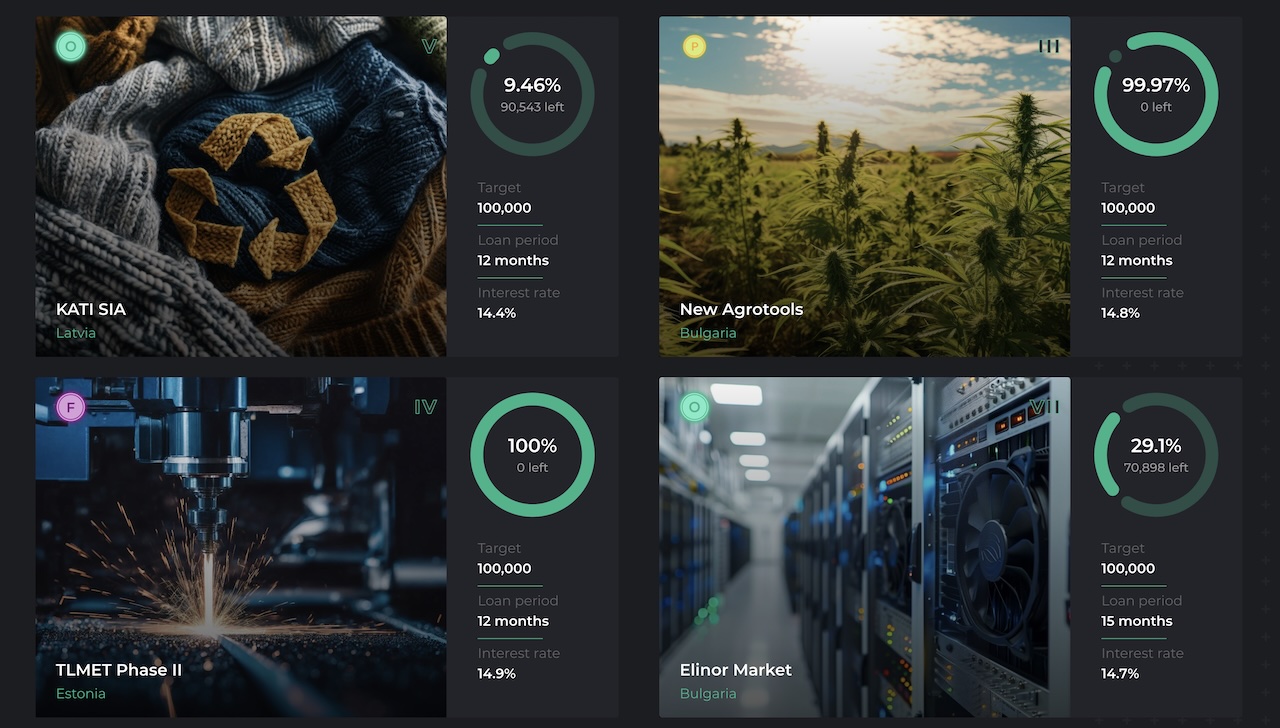

When I invest on a platform, I always have a very close look at where the projects that people can invest in are coming from, as most of the risks will come from here.

In the case of Maclear, there are various projects on the platform, and at the time of writing this article, there were two business loans available on the platform.

They use a very strict due diligence process to select all the projects that will be available to investors, analysing all the financial details of the companies that apply, as well as the project itself, in terms of compliance, due diligence, and risk assessment.

On top of that, there is also always a collateral attached to each project of the platform.

Therefore, all those points combined, along with the provision fund & regulations that I mentioned earlier, makes it much safer to invest on Maclear than on other similar crowdlending platforms.

Getting Started on Maclear

Open and Verify Your Account

Sign up on Maclear and complete the KYC verification process. This takes only about 5 minutes thanks to their automated identity verification partner.

Deposit Funds

Transfer money to your Maclear account via bank transfer. There are no deposit fees, making it easy to fund your account.

Browse Available Projects

Explore investment opportunities in the Primary Market tab. Review project details including yields (13.5-13.8%), collateral, and company information.

Start Investing

Select projects that match your investment goals and click 'Invest Now'. The minimum investment is €50 per project. Build your portfolio across multiple projects for diversification.

Pros & Cons

✅ Pros

- ✓Swiss-based company with strong regulatory compliance

- ✓Provision fund covering 2% of each funded project

- ✓All projects backed by collateral

- ✓Experienced management team with financial expertise

- ✓Strict due diligence process for project selection

- ✓Low minimum investment of €50

- ✓Fast KYC verification process (under 5 minutes)

- ✓No deposit fees

- ✓Loyalty bonus program offering up to 2% additional yield

- ✓Applying for European crowdfunding license

❌ Cons

- ✗Relatively new platform with limited track record

- ✗Limited number of projects available

- ✗No autoinvest function yet

- ✗No secondary market currently available

- ✗No mobile application yet

My Own Returns with Maclear

Having discovered the platform only in 2023 it's of course way too soon to speak about my own returns with the platform. However, I will definitely invest in more projects as they become available, and I will of course update this article accordingly.