Beyond Volatility: Unlocking Predictable Returns in Today's Economy

Discover how crowdlending platforms like Hive5 offer stable, transparent returns in an unpredictable financial landscape

Key Takeaways

Predictable Returns Without Market Volatility

Crowdlending offers fixed interest rates and guaranteed returns, providing stability that traditional stocks and bonds can't match in today's unpredictable markets.

Enhanced Security Through Buyback Obligations

Platforms like Hive5 protect your investment with buyback guarantees, repurchasing defaulted loans to safeguard your principal investment.

Accessible High-Yield Investing for Everyone

Start investing with as little as €10 and access returns averaging 14.94% annually, democratizing opportunities previously available only to large investors.

🌪️The Challenge of Modern Market Volatility

In an era defined by rapid change and often unsettling unpredictability, the financial markets stand as a stark example of this new normal. Traditional investment avenues, such as stocks and bonds, have seen increased fluctuations due to a confluence of global events, rapid technological shifts, and evolving economic policies. The daily headlines report on everything from geopolitical tensions and supply chain disruptions to interest rate hikes and inflation concerns, all contributing to an environment where stock market indices can swing dramatically. This heightened volatility leaves many investors anxious, constantly monitoring their portfolios and enduring the emotional rollercoaster of market downturns. The question then becomes, is there an oasis of stability amidst this storm? Is it possible to find an investment that offers not just growth, but predictable, reliable returns, especially when the very notion of 'stability' seems like a luxury?

This pervasive volatility highlights a critical need: the demand for investment avenues that offer a clearer, more consistent path to financial growth. While the allure of high-risk, high-reward ventures remains, a growing segment of investors is seeking alternatives that provide peace of mind through transparency and dependable income streams. It's in this context that crowdlending, particularly platforms like Hive5, emerges as a compelling solution, offering a refreshing counter-narrative to the prevailing market uncertainty. This shift towards predictable returns is not just a trend but a fundamental response to the challenges of modern finance, where clarity and reliability are increasingly valued.

🤝Crowdlending: A Stable Alternative for Modern Investors

Crowdlending, at its core, is a simple yet powerful concept: it allows individuals and institutions to directly lend money to borrowers, often businesses or consumers, in exchange for interest payments. Unlike equity investments, which are tied to the performance and valuation of a company, or bonds, which can be sensitive to interest rate changes and credit ratings, crowdlending platforms often deal with short-term, asset-backed loans that can offer a more stable return profile. The key differentiator is the direct nature of the investment and the often fixed interest rates, which provide a level of predictability rarely seen in public markets. This direct approach cuts out many of the intermediaries, leading to potentially higher returns for lenders and more accessible financing for borrowers.

🏆Hive5: Your Partner for Predictable Growth, Security, and Accessibility

Enter Hive5, a rapidly expanding investment marketplace that has carved out a significant niche by addressing the very pain points that volatile markets create. Hive5 connects a diverse range of investors—from private individuals and high-net-worth individuals to companies—with opportunities to invest in short-term consumer loans. What sets Hive5 apart, and why it's particularly relevant in today's economic climate, is its unwavering commitment to predictable and transparent returns. When the platform advertises a return of, say, 16%, that's precisely what investors are set to receive. There are no sudden downturns, no unexpected dips in value tied to broader market sentiment, and no guessing games about future performance. This assurance of a guaranteed percentage is a beacon of stability for those weary of financial uncertainty, offering a clear path to financial empowerment.

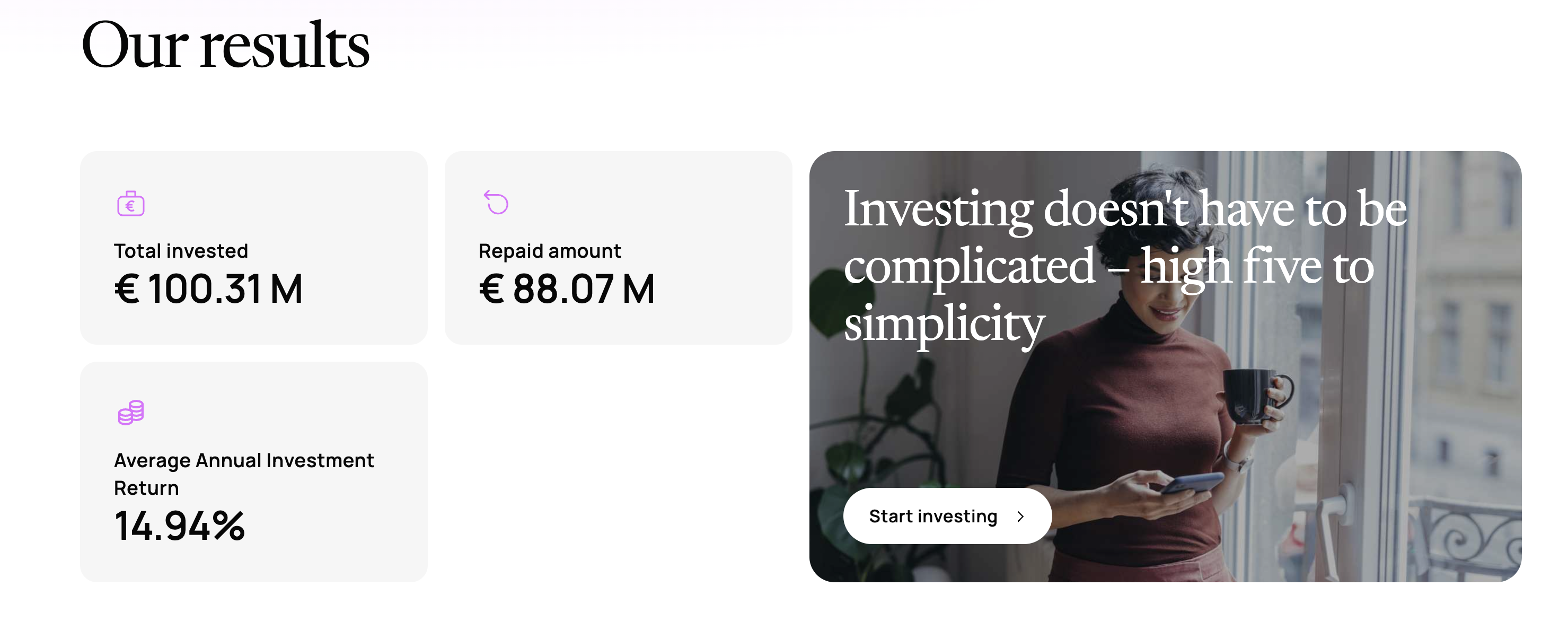

The data supporting Hive5's promise is compelling and speaks volumes about its reliability. The platform has already attracted over €100 million in total investments, a testament to its growing trust and efficacy within the investment community. More impressively, €88 million has been successfully repaid to investors, demonstrating a robust and efficient operational model. The average annual return for investors on Hive5 stands at an impressive 14.94%, consistently close to the advertised maximum, reinforcing the platform's commitment to delivering on its promises. These figures are not just statistics; they represent tangible returns for investors who have chosen a path less trodden but demonstrably more stable and rewarding.

🔐Security Features and Investment Control

Beyond the attractive returns, Hive5 integrates several key features designed to enhance investor security and convenience. A pivotal feature is the buyback obligation, which provides an added layer of security. This means that if a borrower defaults on a loan, Hive5 (or the loan originator) is obligated to repurchase the loan from the investor, safeguarding their principal investment. This mechanism significantly mitigates risk, offering a level of protection rarely found in other investment forms. For those seeking efficiency, auto-investment options allow investors to set predefined criteria and automatically allocate funds to suitable loans, streamlining the investment process and ensuring continuous deployment of capital. Furthermore, Hive5 offers full investor control through customizable strategies, allowing both novice and seasoned investors to tailor their portfolios to their risk appetite and financial goals, making it a versatile tool for diverse investment approaches.

🌟Accessibility and Transparency for All Investors

Another significant advantage of Hive5 is its accessibility. With a remarkably low entry point starting at just €10, the platform democratizes access to high-yield crowdlending opportunities. This low barrier to entry makes it an ideal choice for beginner investors looking to dip their toes into alternative investments without committing substantial capital, while also accommodating experienced investors seeking to diversify their existing portfolios. This inclusive approach ensures that a broad spectrum of individuals can benefit from the stable returns offered, fostering financial inclusion.

In an investment world often clouded by complex jargon and opaque structures, Hive5 champions transparency, simplicity, and strong support. Every loan opportunity is presented with clear details, enabling investors to make informed decisions. The user-friendly interface simplifies the entire process, from initial investment to tracking returns. Moreover, the company's commitment to strong customer support reinforces trust and confidence, fostering a thriving and loyal community of users. This dedication to clarity and assistance is crucial in building long-term relationships with investors, especially in a sector where trust is paramount and clear communication is essential.

Advantages

- ✓Predictable fixed returns averaging 14.94% annually

- ✓Low minimum investment of just €10 makes it accessible to all

- ✓Buyback obligation protects principal investment

- ✓Auto-investment options for hands-off portfolio management

- ✓Full transparency with clear loan details

- ✓Over €100 million in total investments demonstrates trust

- ✓€88 million successfully repaid to investors

Considerations

- •Returns are dependent on loan originator performance

- •Not protected by traditional deposit insurance schemes

- •Platform risk if the marketplace faces operational challenges

Conclusion

For investors who are looking to diversify beyond traditional financial instruments and prudently reduce their risk exposure in an unpredictable market, Hive5 offers a reliable, data-backed, and highly attractive alternative. It's a testament to the power of targeted, efficient financial innovation, providing a clear and predictable path to achieving financial goals without succumbing to the whims of market volatility. The future of investment is shifting, and platforms like Hive5 are leading the way by offering stability in an unstable world.

To explore how Hive5 can fit into your investment strategy and offer the predictability you seek, visit https://marcoschwartz.com/hive5 today. Discover a world where high returns meet unwavering stability, offering a refreshing perspective on how to grow your wealth in today's dynamic economy.

Ready to Achieve Predictable Returns?

Start your journey with Hive5 today and discover how crowdlending can provide stability in volatile markets.

Explore Hive5 Investment Opportunities